【Petroleum Coke】End of September Market Prices for 2023

【Petroleum Coke】End of September Market Prices for 2023

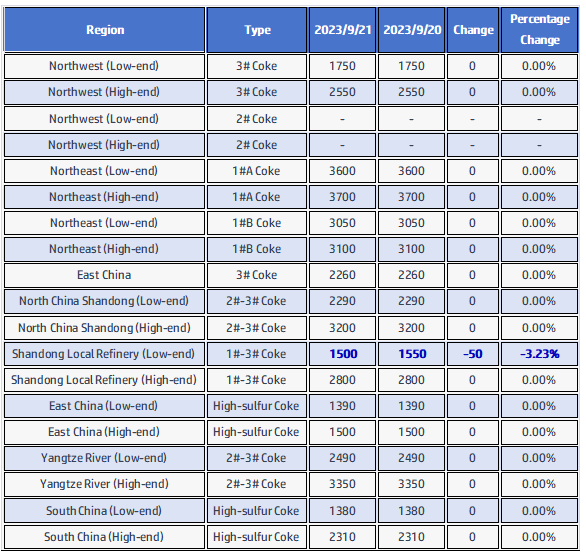

On September 21, 2023, the average market price of petroleum coke was 2,203 yuan/ton, down 4 yuan/ton, a decrease of 0.18%. In the main petroleum coke market in the northwest, some coke prices are under pressure, while local refinery coke prices vary, more hot news on the graphitized petroleum coke market. Here are the prevailing market prices in major regions:

01. Sinopec

Currently, various Sinopec refineries are stable in trade for petroleum coke, with good shipments of medium-sulfur petroleum coke in the Yangtze River region. In East and South China, medium and high-sulfur petroleum coke have good shipments, and downstream demand is high. In North China and Shandong, petroleum coke trades steadily, with refinery shipments leading. In the Northwest region, high-sulfur petroleum coke has good shipments. Sinopec's refineries in the Northeast are currently trading at stable prices, with most of them executing fixed-price sales. Yumen Petrochemical in the Northwest region has reduced the price of petroleum coke by 260 yuan/ton, but other refineries have good shipments and low inventories. Under China National Offshore Oil Corporation (CNOOC), refineries are mainly shipping based on orders.

02. Local Refineries

Currently, prices of petroleum coke from local refineries vary, and as refinery coke prices continue to decline, prices for some types of coke have bottomed out. Downstream enterprises have begun to enter the market for procurement, and refinery petroleum coke inventories have fallen to a low level. This is favorable for upward price movements, with some coke prices rising by 20-50 yuan/ton. As the National Day approaches, some refineries are starting to sign orders for the holiday period in advance. In addition, some petroleum coke prices remain high, so prices may continue to decline by 40-200 yuan/ton. Market fluctuations: Haiyou Petrochemical's coking unit started producing coke on September 20th, and the indicators are awaiting testing.

03. Imported Coke

Currently, the market for imported petroleum coke is still active, with ongoing downstream procurement demand. Trading companies are actively shipping, and port deliveries are proceeding at a good pace.

04. Supply Side

As of September 21, there have been 3 routine maintenance inspections of coking units nationwide. The daily production of petroleum coke in China is 92,710 tons, with a coking plant operating rate of 73.29%, an increase of 0.24% compared to the previous working day.

05. Demand Side

Overall, there has been an increase in demand for carbon used in aluminum production. Silicon metal demand is still present. The graphite electrode and carbon additive markets are trading moderately. The demand for petroleum coke in the anode market is positive, and the silicon carbide industry has increased production.

06. Future Forecast

As petroleum coke prices continue to decline, downstream enterprises are more active in procurement than in the previous period. Some are stockpiling before the holiday. It is expected that petroleum coke prices will remain stable tomorrow, with some minor fluctuations of around 50 yuan/ton. Follow us to explore the hot news of petroleum coke.

No related results found

0 Replies