【Low-sulfur Petroleum Coke & Needle Coke】Market Trend Forecast

【Low-sulfur Petroleum Coke & Needle Coke】Market Trend Forecast

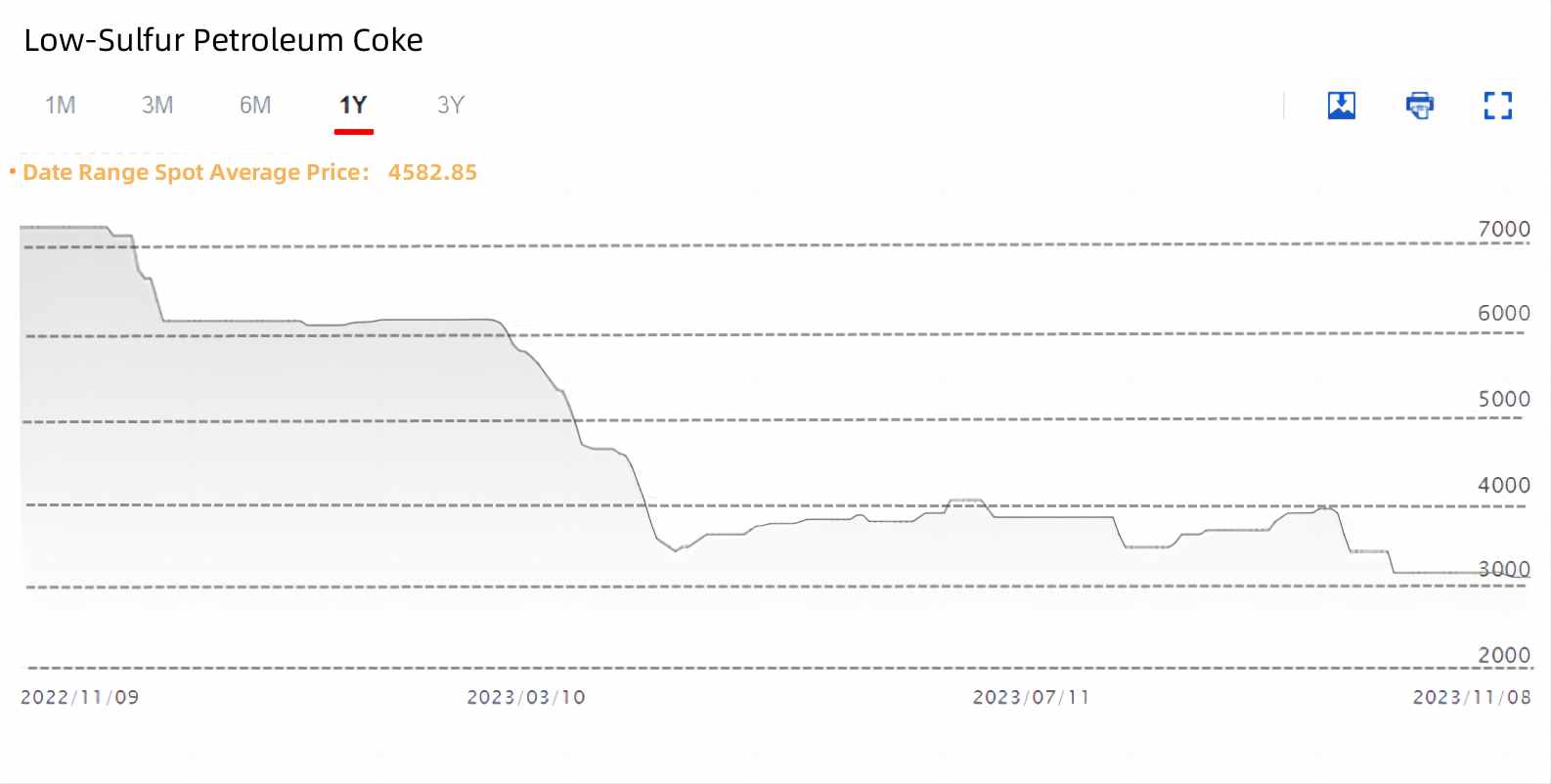

In October, the average price of low-sulfur petroleum coke was 3,094 RMB/ton, showing a 14.5% month-on-month decrease.

At the beginning of the month, China Petroleum's petroleum coke was unified under its sales subsidiary, leading to a general price reduction of 200-300 RMB/ton during the National Day holiday. Many manufacturers implemented pricing strategies, offering preferential deals to major customers. In the latter half of the month, low-sulfur coke prices stabilized at lower levels. To learn more about calcined petroleum coke products.

In early November, some manufacturers slightly reduced prices to maintain stability. With no apparent favorable factors in the fourth quarter and no improvement in downstream demand, the subsequent trend for petroleum coke prices may still see a slight downward trend.

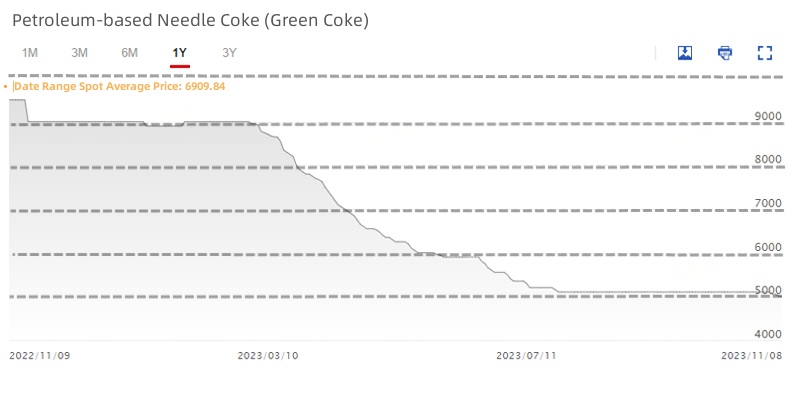

In October, the average price of oil-based needle coke (green coke) was 5,095 RMB/ton, showing a slight decrease month-on-month.

Despite some fluctuation and decline in oil slurry prices this month, manufacturers of needle coke, influenced by high-priced inventory from the previous period and sluggish downstream demand, maintained a low-profit margin. Manufacturers expressed a strong willingness to hold prices, adjusting production lines according to demand or switching to produce other petroleum coke products for inventory digestion.

In November, as the price of negative electrode materials gradually decreased, the demand for cost reduction in negative electrode factories increased. This led to a higher proportion of petroleum coke usage, further reducing downstream demand. In the short term, due to profit impacts, the price of oil-based needle coke may remain weak and stable, but there is still a risk of future declines. Follow us for the latest updates on the calcined petroleum coke market.

No related results found

0 Replies