【Petroleum Coke】Inventory Rises Again, When Will the Market Turnaround Occur?

【Petroleum Coke】Inventory Rises Again, When Will the Market Turnaround Occur?

In November, the overall trading in the domestic petroleum coke market was weak, with refineries actively shipping to reduce inventory. However, downstream cautious purchasing slowed down, leading to a continuous decline in petroleum coke transaction prices. As December begins, the market once again enters a consolidation phase, with petroleum coke spot inventory remaining high. Continue to check the specifcations of graphitized petroleum coke. With frequent fluctuations in raw material adjustment indicators, the question arises: What trend will petroleum coke prices take?

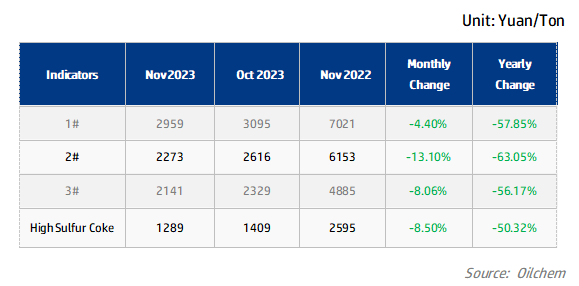

Petroleum Coke Monthly Average Price Statistics for Various Indicators

According to analysis of petroleum coke market price statistics, the prices of domestic petroleum coke in November showed a downward trend. The downstream enterprises exhibited low enthusiasm for procurement, leading to consecutive price declines at refineries, with a monthly decrease ranging from 4.4% to 13.1%. The year-on-year price drop exceeded 50%.

Low-sulfur coke faced pressure, and prices experienced a wide-ranging pullback due to reduced demand in the carbon and graphite electrode sectors. Orders for negative electrode products declined, negatively impacting energy storage coke shipments. Refineries actively reduced prices to boost sales, with petroleum coke prices falling by 200-400 yuan/ton.

In the middle-sulfur petroleum coke market, which competes for supply in the negative electrode and pre-baked anode sectors, some refinery prices followed the downward trend as downstream cautious purchasing slowed. The decline in orders for negative electrode products negatively affected energy storage coke shipments. Prices for middle-sulfur coke dropped by around 300 yuan/ton due to adjustments in refining indicators and increased inventory.

The high-sulfur petroleum coke market exhibited a clear contrast. Supported by silicon and fuel demand, and with some refineries increasing self-use, high-sulfur pellet coke and fuel-grade petroleum coke experienced good shipments, resulting in a slight rebound in transaction prices after the drop. However, ordinary high-sulfur coke, facing continued increases in supply and slower shipments of petroleum coke, saw refineries actively lowering prices, leading to a continuous and fluctuating decline. By the end of the month, transaction prices for some high-sulfur coke in Shandong had fallen below 1000 yuan/ton.

Source: Oilchem

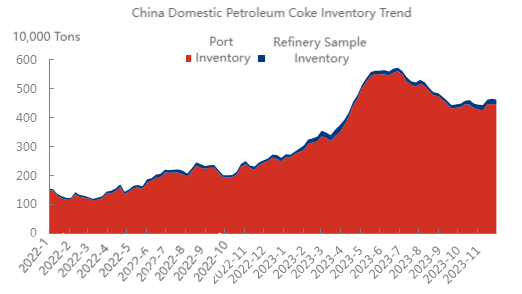

In November, imported petroleum coke continued to arrive at ports. However, due to the continuous fluctuation and decline in domestic petroleum coke prices, the clear cost disparity with imported high-cost petroleum coke became apparent. Slow discharging and some domestic petroleum coke being stored at ports contributed to a renewed increase in spot inventory to around 4.5 million tons. The imported sponge coke market continued to have poor trading, with northern ports being impacted by domestic resources, resulting in overall weak trading and high and fluctuating petroleum coke inventory.

The domestic petroleum coke market experienced sluggish trading, with obvious increases in inventory at local refineries. Downstream carbon enterprises exhibited weak purchasing activity, lacking strong support for petroleum coke shipments. While refinery shipments slightly recovered after the end of November's price decline, the inventory of sample refineries remained at around 180,000 tons.

Future Predictions:

In December, with domestic overhauls of refineries gradually resuming production, the supply of petroleum coke is expected to continue to increase. Low-sulfur coke market at the end of November had good signing of contracts. It is expected that early December will mainly see transactions based on the execution of contract prices. Due to the slowdown in purchasing demand from downstream enterprises, some refineries' coke prices are expected to stabilize after a narrow upward trend. With the slowing down of purchasing by some small and medium-sized carbon enterprises due to the continuous narrowing of production profit margins, there is insufficient positive support for petroleum coke shipments. Overall, in December, the petroleum coke market is expected to maintain a weak and fluctuating trend, with cautious trading by traders, a small amount of replenishment by production enterprises, and insufficient support from the demand side. There is still an expectation of downward pressure on petroleum coke prices, but the overall adjustment range may narrow.

No related results found

0 Replies