【Graphite Export】November Graphite Export Reaches Five-Year High Amid Regulatory Impact

【Graphite Export】November Graphite Export

Reaches Five-Year High Amid Regulatory Impact

01 Import and Export Data

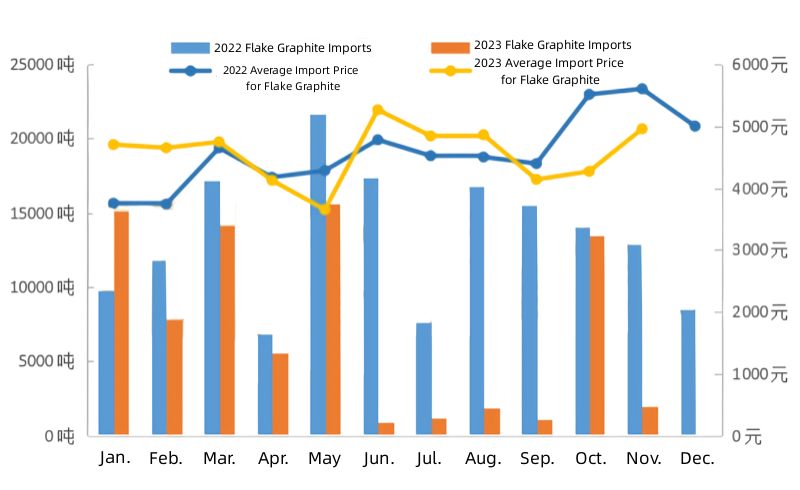

According to the latest customs data, China's import of flake graphite in November 2023 was 1,993 tons, marking an 84.52% year-on-year decrease and an 85.21% month-on-month decrease. The import unit price saw a slight increase. Specifically, 1,887 tons were imported from Madagascar, and 100 tons were imported from Mozambique. Overall, due to insufficient domestic demand and the unstable production pace of graphite mines in Africa, the import of graphite has significantly decreased compared to the same period last year, and the graphite carburant specifications for your reference.

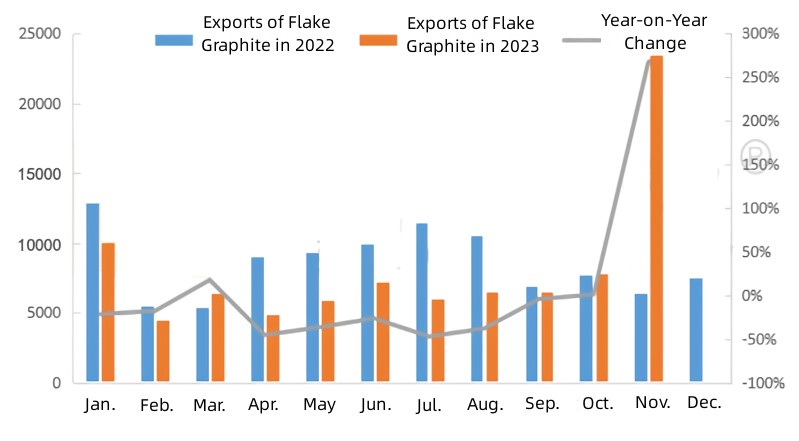

In November 2023, China exported 23,500 tons of natural flake graphite, reflecting a 267.83% year-on-year increase and a 202.89% month-on-month increase. Despite a year-on-year decreasing trend in most of the year, the announcement of export control measures for graphite items prompted overseas manufacturers to accelerate stocking, resulting in the highest monthly export volume in nearly five years in November. According to the latest information from the Ministry of Commerce, several eligible companies' export applications have been approved.

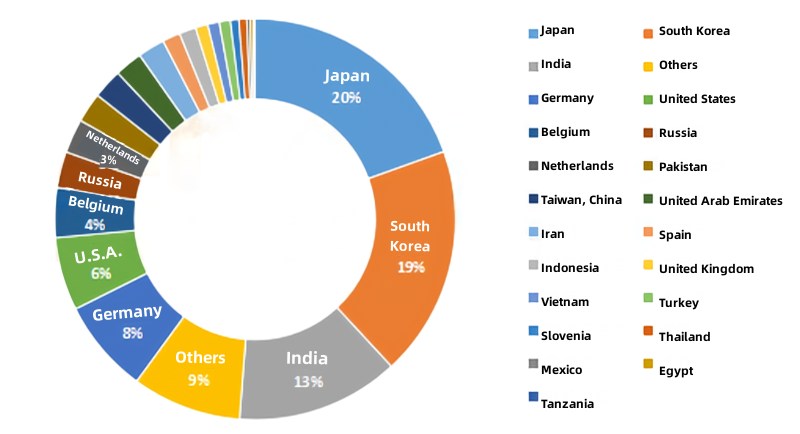

In terms of export structure, Asian countries like Japan, South Korea, and India, as well as European countries including Belgium, Germany, and the Netherlands, have a high dependence on Chinese graphite. Although the United States is gradually advancing graphite mining projects in North America, most projects are still in the financing stage, making it challenging to achieve large-scale production in the short term, maintaining significant demand for domestic graphite.

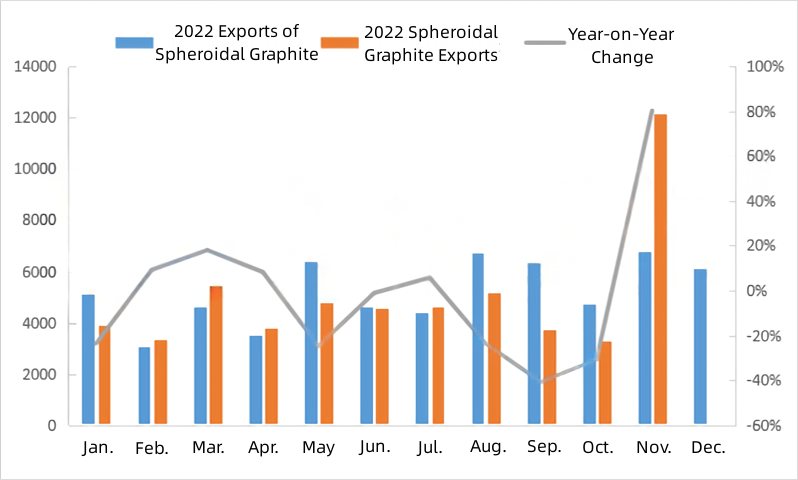

Spheroidized graphite exports in November reached 1.22 tons, marking an 80.28% year-on-year increase and a 273.55% month-on-month increase. The United States, Japan, and South Korea still dominate the major share, with significant increases in export volumes to Japan and South Korea and relatively stable changes in the United States.

Currently, overseas negative electrode material companies are deeply integrated into China's graphite deep processing industry chain. Influenced by graphite export control measures, Japanese and Korean negative electrode material companies have increased their purchases of spheroidized graphite to ensure supply chain stability.

02 Domestic Market Overview

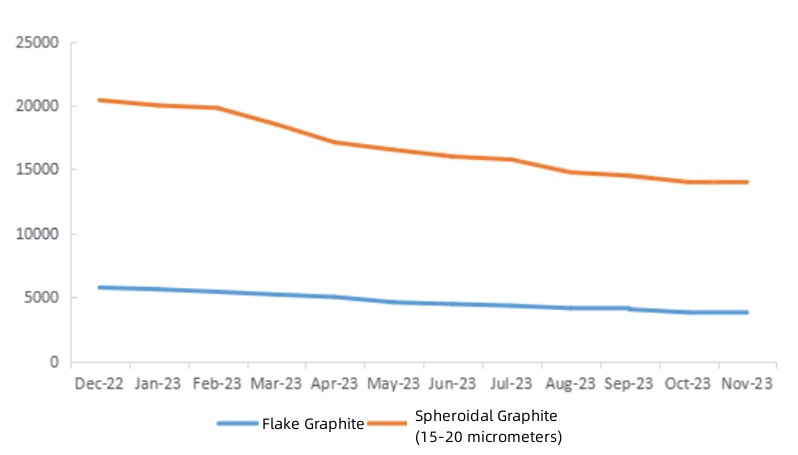

Currently, China’s domestic flake graphite market is somewhat sluggish. As of December, most flotation production lines in Luobei, Heilongjiang Province, have stopped working, and the production enthusiasm of in-production enterprises is not high. Due to temperature reasons, it is expected that most will gradually shut down before the end of December. Graphite processing enterprises in Jixi maintain normal production, while many small and medium-sized enterprises have already stopped production.

The overall supply of domestic flake graphite has decreased, but due to the flat downstream demand, spherical graphite and refractory material enterprises remain cautious in purchasing. Consequently, there is insufficient momentum for a significant rise in flake graphite prices. It is expected that the domestic graphite market will continue to move steadily forward. Contact us for more reports on graphite market.

No related results found

0 Replies