【Petroleum Coke】Market Trading Holds Steady

【Petroleum Coke】Market Trading Holds Steady

Market Overview

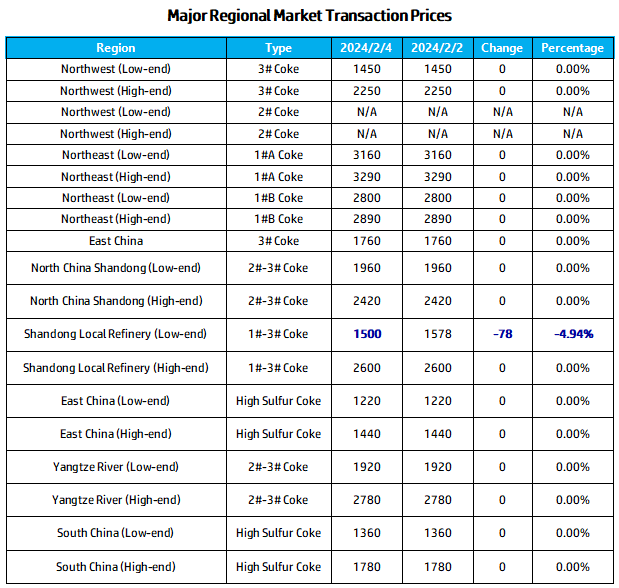

On February 4th, the average price of petroleum coke in the market was 1840 yuan/ton, an increase of 3 yuan/ton compared to the previous working day, with a decrease of 0.16%. Currently, the main refineries' trading remains stable, and local refineries' shipments are relatively stable, with some fluctuation in coke prices, and reference to the current situation of graphitized petroleum coke market.

Sinopec: The petroleum coke shipments from Sinopec's main refineries are acceptable, and the petroleum coke inventory of refineries remains low; in the East China region, the shipments of high-sulfur petroleum coke are acceptable, with Shanghai Petrochemical, Gaoqiao Petrochemical, and Yangzi Petrochemical delivering based on 4#B petroleum coke, while Zhenhai Refining & Chemical delivers based on shot coke; in the Northwest region, the shipments from Tahe Petrochemical are smooth, and downstream pickup enthusiasm is high.

PetroChina: In the Northeast region under PetroChina, the bid prices for petroleum coke have declined, while other refineries continue to stabilize prices for shipments; in the Northwest region, the shipments of petroleum coke from refineries are performing well, mostly maintaining a balance between production and sales.

CNOOC: Refineries under CNOOC continue to deliver according to orders, with good downstream pickup performance. Overall, refinery shipments are under low pressure.

Local Refineries: Currently, the overall shipments of local refinery petroleum coke are relatively stable, with market prices fluctuating. Approaching the Spring Festival, the slowing down of logistics transportation has led refineries to deliver based on holiday orders, causing some coke prices to continue to decline by 20-170 yuan/ton. However, as some refinery coke prices have fallen to a low level, shipments have gradually improved, and coke prices have rebounded by 30-100 yuan/ton. Some refineries also experienced fluctuations of 50 yuan/ton due to changes in their own indicators. Currently, the market is fluctuating: Dongming Petrochemical's old plant's petroleum coke sulfur content has decreased to around 1.84-2.1%, Shangneng Petrochemical's petroleum coke sulfur content has decreased to around 5.0%, and Xintai Petrochemical North's sulfur content has increased to around 4.8%.

Imported Coke: In terms of imported coke, the delivery speed of port petroleum coke is stable. Combined with the recent end of downstream enterprise stocking before the holiday, traders mainly focus on delivering volumes based on previous contracts.

Supply Aspect

As of February 4th, there were 9 regular overhauls of coking units nationwide, with a daily production of 87,158 tons of petroleum coke, and a coking operating rate of 68.73%, an increase of 0.17% compared to the previous working day.

Demand Aspect

Downstream carbon enterprises' demand for petroleum coke used in aluminum is limited, belonging to rigid demand procurement; the shipments of negative electrode materials enterprises have decreased, leading to a weak willingness to purchase raw materials and strong wait-and-see sentiment in the market; the graphite electrode market's on-site transaction range is sluggish, and the overall market is running steadily; the silicon carbide industry and the southern fuel market still have demand for high-sulfur shot coke.

Future Predictions

The petroleum coke market is mainly stable in trading. Currently, downstream enterprises mostly maintain rigid demand procurement, with limited support for the petroleum coke market. Refineries mostly ship according to orders, and it is expected that the petroleum coke market prices will generally continue to stabilize in the short term, with some fluctuations in coke prices ranging from 10 to 50 yuan/ton. The demand for shot coke downstream is stable, and it is expected that the coke price will remain stable in the transition. Contact us to learn more about the market news of petroleum coke.

No related results found

0 Replies