【Anode Materials】 May Market Price Analysis and Forecast

【Anode Materials】 May Market Price Analysis and Forecast

1. April Market Review

In April, the anode materials market experienced a simultaneous increase in supply and demand. The end-market consumption of new energy vehicles continued to grow, leading to higher demand for anode materials from downstream power battery manufacturers. This increase in demand boosted the operational rate of the anode materials market. However, the fundamental oversupply in the anode materials industry persisted, coupled with ongoing cost-cutting pressures from automakers, which transmitted down the supply chain. With downstream players holding significant bargaining power, anode material prices were pressured to decrease, although there were slight price increases for certain products. Graphitized petroleum coke(gpc) for anode materials has extensive applications and high demand.

2. May Market Forecast

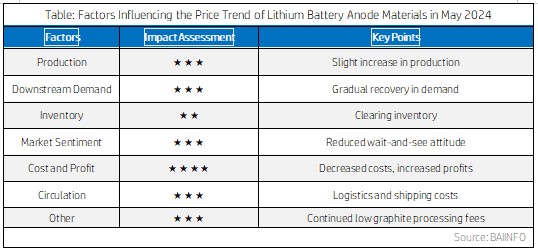

Preliminary forecasts suggest that the price of anode materials in May will remain stable, with little potential for significant increase.

1. On one hand, the overall operational status of the anode materials market has improved. Major manufacturers are running close to full capacity, and small to medium-sized enterprises are also seeing a recovery in operations. The overall production schedule for May is expected to increase by approximately 5%-10%, leading to higher shipment volumes and improved demand. In this context, small to medium-sized enterprises are considering price hikes. However, due to the oversupply in the market, there is still competition through low pricing, making it difficult for prices to rise.

2. On the other hand, downstream car manufacturers are continuously introducing promotional policies and subsidies, exerting stricter cost controls on complete vehicles. This has led to persistent price pressures on anode materials from downstream battery companies. By May, the actual transaction prices of mid to low-end anode materials were hovering around the cost line. Maintaining stable prices is already challenging, and any price increase will depend on future market conditions. It is expected that anode material manufacturers will continue to face a situation of "increased volume without increased profit."

In summary, while both production and sales volumes of anode materials are increasing, the actual transaction prices are close to the cost threshold. Although there is little room for further price decreases, the conditions for price increases are not yet sufficient. For more details on the P&S of anode companies this month, feel free to contact us.

No related results found

0 Replies