In July, Ultra-high power graphite electrode market may operate with weak shocks

Mysteel monthly report: In July, Ultra-high power graphite electrode market may operate with weak shocks

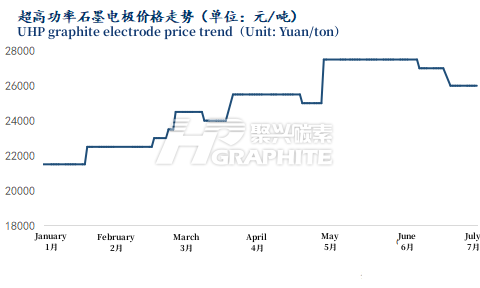

In June, UHP (ultra-high power) graphite electrode overall market price was in a weak operation, with a cumulative decline of 1500 yuan/ton. The transaction volume was low, the maintenance of blast furnaces and electric furnaces increased, and the profit inversion is obvious. It was difficult to stimulate the UHP graphite electrode market under high costs. What changes will happen in the domestic UHP graphite electrode market in July? The author elaborates from the following aspects respectively.

Ⅰ. Macro —— Strong stimulus drives steady economic growth

1. Strive to achieve social development goals

On June 23, President Xi Jinping clearly pointed out at the BRICS Business Forum that China will step up macro policy adjustment and take more effective measures to achieve the annual economic and social development targets.

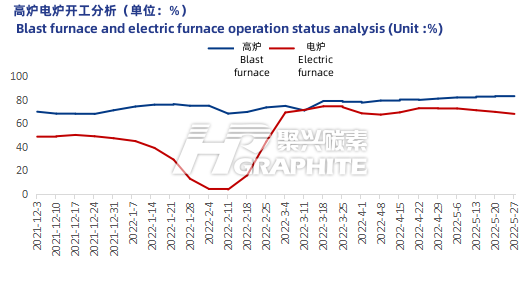

2. Blast furnaces and electric furnaces maintenance increased

According to incomplete statistics of Mysteel, in June 2022, many domestic steel plants issued maintenance plans. Wugang Group Co., Ltd. has the longest maintenance time. It plans to carry out annual maintenance of 7 # blast furnace for 150 days from July 2 to November 30, which is expected to affect the daily average molten iron production of about 7500 tons.

Ⅱ. Review —— Demand pressure, passive decline

In June, the overall steel market was depressed, and the steel composite price index fell by 419 points, and in some stages, there were even cliff falls. Not only did the finished materials fall in a mess, but the raw fuel market also weakened for a time. The price indexes of coal, iron ore and scrap steel all showed a downward trend. Under the sharp drop in steel cost, some varieties showed the biggest lows in recent years. Under the influence of the general situation, UHP graphite electrode market price was difficult to firm. From the trend in June, UHP graphite electrode price was forced to show two downward adjustments, with a cumulative reduction of 1500 yuan (reduction range). The transaction price of some UHP graphite electrodes used in refining has even returned to the level of May due to the low requirements for technical indicators. Early price increases were "all in vain". It can be seen that under economic pressure, it is difficult to escape the pressure of economic downturn. The UHP graphite electrode market also shows "have price but no buyers" phenomenon, which is passively adjusted.

Taking Jiangsu φ500 UHP graphite electrode as an example, as of July 2, the quotation was 26000 yuan/ton, with a monthly year-on-year decrease of 1500 yuan/ton. The small and medium-sized manufacturers stopped production, the large enterprises adjusted graphite electrode production pace, and some graphite electrode capacity was converted into anode materials and graphite products capacity. In order to cope with the current economic situation and downstream demand, graphite electrode enterprises are constantly adjusting their production.

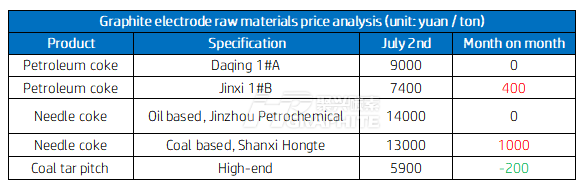

Ⅲ. Cost —— Petroleum Coke "rises" against the trend

In June, domestic low sulfur coke market overall performance fluctuated at a high level, becoming a variety that bucked the economic downturn. At the end of June, Jinxi low sulfur coke still showed an upward trend, with a year-on-year increase of 400 yuan/ton. Although some of the anode materials began to shift to the medium sulfur coke market, most consumption is still under future expectation, and the high-end market is still dominated by the demand for low sulfur coke, so its demand continues to be high, accounting for 30% of the conventional demand of low coke production, and the future demand is still growing.

In July, some low sulfur coke manufacturers still have maintenance plans, the market supply may continue to shrink, and the price trend is still strong.

Ⅳ. Demand —— Cliff type decline, entering a trough period

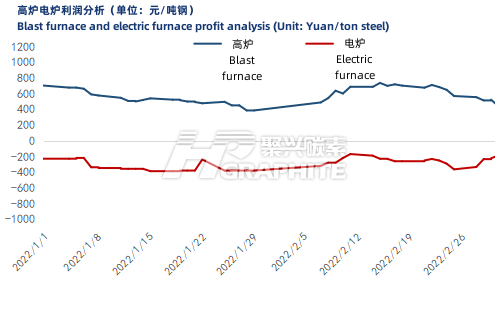

Looking at the mainstream steel market, the maintenance of blast furnaces and electric furnaces increased, significantly lower than the same period last year. Judging from the operation of domestic blast furnaces and electric furnaces, the operation of electric furnaces decreased significantly, blast furnace operation rate was 80.79%, with a year-on-year decrease of 2.89%. Electric furnace operation rate was 48.19%, with a year-on-year decrease of 18.11%. In terms of finished product profit, the profit of blast furnace decreased significantly, was 178.16 yuan/ton of steel, with a year-on-year decrease of 83.31 yuan/ton, and the loss of electric furnace was 462.61 yuan/ton, with a year-on-year increase of 11.72 yuan/ton.

In June, there was a rapid and sharp decline in the steel market, with nearly 90% enterprises losses. For the steel market in July, experts expect that with the re-establishment of economic growth expectations and the reasonable adjustment of epidemic control policies, various policies will be gradually strengthened, the contradiction between steel supply and demand is expected to be alleviated, and the steel price is expected to rebound.

Ⅴ. Market outlook in July —— focusing on "stability"

The epidemic has been gradually controlled, and economic activities recovery have accelerated, driving market demand to pick up; Policies such as helping enterprises to bail out, ensuring supply and stabilizing prices have gradually taken effect. With various measures to boost market demand, further smooth logistics and industrial chains to reduce manufacturing production costs, the steel market will accelerate its recovery. The demand side is improving, the supply side is weak, and the cost is supported. In July, the weak trend of the domestic UHP graphite electrode market will ease, and the market may transition from the game period to the repair period. For graphite electrode manufacturers, appropriate production reduction and conversion will help to stabilize the price. In the transaction step, it is very important not to bargain at a low price, pay attention to quality, establish public praise, and maintain long-term cooperative relations. Therefore, on the whole, although steel market demand is weak, and the cost of steel plants' raw material procurement is about to be reduced, however, driven by the cost, domestic UHP graphite electrode market may be dominated by weak consolidation in July. Follow us to learn more about the graphite electrode market reports.

No related results found

0 Replies