【Calcined Petroleum Coke】Prices Down 19.44%! Market Fell in May, Remain Under Pressure in June

【Calcined Petroleum Coke】Prices Down 19.44%! Market Fell in May, Likely to Remain Under Pressure in June

May Calcined Petroleum Coke Price Trend Analysis

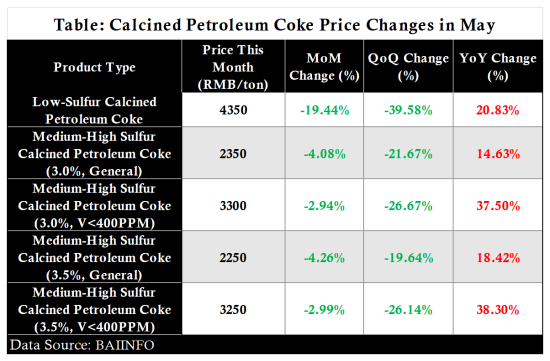

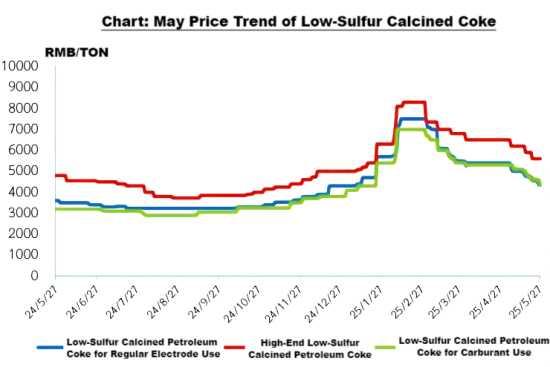

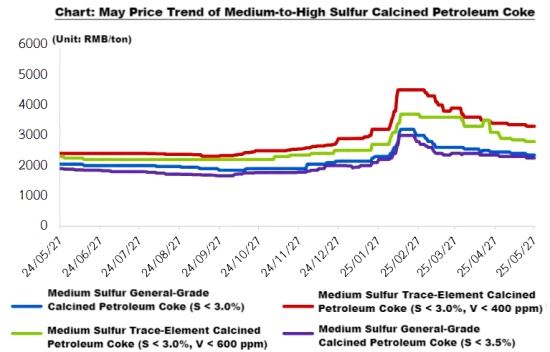

From May 1 to May 27, 2025, the domestic calcined petroleum coke market saw lackluster trading and a prevailing downward trend in prices. Throughout the month, raw material prices declined and demand remained sluggish. Prices for low-sulfur calcined petroleum coke dropped by 400–1,100 RMB/ton, while prices for medium- and high-sulfur calcined petroleum coke generally decreased by 50–150 RMB/ton.

As of May 27, the average market price for low-sulfur calcined petroleum coke was 4,350 RMB/ton, down 1,050 RMB/ton from the same period last month, representing a decline of 19.44%.

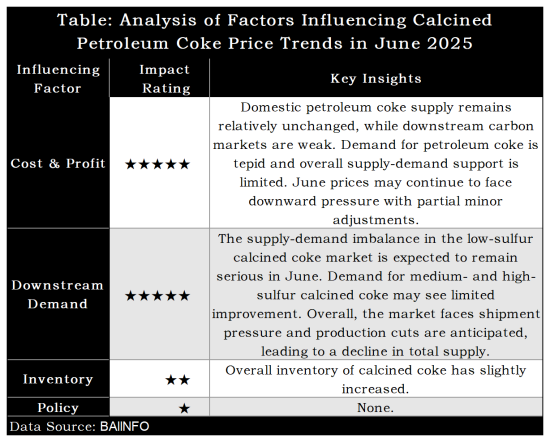

June Calcined Petroleum Coke Price Forecast

Raw Material Side

Domestic petroleum coke supply remains relatively stable. The downstream carbon market is weak, and demand for petroleum coke is flat. With limited support on both the supply and demand sides, petroleum coke prices are expected to continue a weak trend in June, with some coke prices experiencing slight adjustments.

Supply and Demand Side

In June, the supply-demand imbalance in the low-sulfur calcined petroleum coke market is expected to remain significant. Demand improvement for medium- and high-sulfur calcined petroleum coke is likely to be limited. The overall market faces sales pressure, and production cuts by manufacturers are anticipated, leading to a decrease in overall supply.

Overall Outlook

Low-Sulfur Calcined Petroleum Coke:

Recently, low-sulfur petroleum coke prices have continued to decline. With weak support from the green coke market, prices are expected to continue to fall by the end of this month or next month. The demand side for calcined petroleum coke remains poor. Prices for low-sulfur calcined petroleum coke are likely to lack upward momentum in June, with some enterprises under pressure to reduce prices by 100–200 RMB/ton.

Medium- and High-Sulfur Calcined Petroleum Coke:

By the end of the month, trading for medium- and high-sulfur calcined petroleum coke remains under pressure. Downstream demand improvement is limited, and raw petroleum coke prices remain weak and stable. In June, the monthly contract prices for medium- and high-sulfur calcined petroleum coke are expected to fall slightly compared to this month's prices, with spot market prices fluctuating by 50–100 RMB/ton.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies