【Petroleum Coke】 Steady Shipments with Market Average Price at 1,892 RMB/Ton

【Petroleum Coke】 Steady Shipments with Market Average Price at 1,892 RMB/Ton

Market Overview

As of June 3, the petroleum coke average market price was 1,892 RMB/ton, a slight decrease of 2 RMB/ton or 0.11% from the previous working day. Currently, the petroleum coke market is stable, with some PetroChina refineries implementing new June prices, and local refineries seeing steady shipments with slight price fluctuations of 10-60 RMB/ton. Graphitized Petroleum Coke: Low Sulfur, Low Nitrogen, with Absorption Rates Up to 98%.

For more information about our graphitized petroleum coke products and to discuss your specific needs, please contact us. Our team of experts is ready to assist you with detailed product information, technical support, and tailored solutions to meet your industrial requirements.

Current Market Dynamics

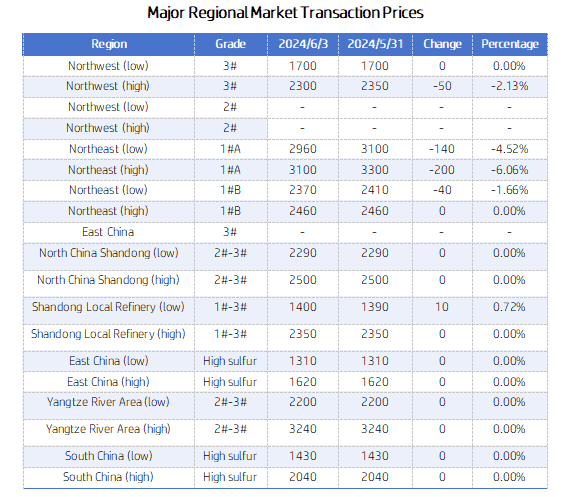

In Sinopec's refineries, shipments are steady with stable prices. Along the Yangtze River, the demand for anode-grade petroleum coke from Changling Petrochemical remains strong, with prices for some grades increasing by 50 RMB/ton. In East and South China, the market for medium to high sulfur petroleum coke is stable. However, in North China and Shandong, trading is somewhat weak, with Yanshan Petrochemical's coking unit beginning maintenance. In Northeast China, PetroChina's refineries in Daqing, Fushun, and Jinzhou have implemented new prices for June, with decreases ranging from 40-200 RMB/ton. Jilin Petrochemical plans maintenance for its coking unit starting in August, with prices rising by 20 RMB/ton. Liaohe Petrochemical is currently holding tenders, with increased purchasing enthusiasm from downstream buyers. In the Northwest, prices at Urumqi and Karamay Petrochemical have decreased by 50 RMB/ton. CNOOC's refineries continue to ship as per orders, maintaining stable prices.

In local refineries, the petroleum coke market remains steady with slight price fluctuations. Downstream demand persists, with some refinery prices increasing by 10-30 RMB/ton due to sustained demand. Tianhong Chemical's vanadium content has decreased to around 270 PPM, with prices rising by 60 RMB/ton. Other refineries have lowered prices by 20-50 RMB/ton to balance shipments.

Imported Coke

The market for anode-grade imported petroleum coke is stable, with carbon enterprises maintaining necessary purchases and traders fulfilling orders. The price of pellet coke remains stable. As silicon plants prepare to resume production, raw material purchases are starting, with slight price increases for Formosa Plastics coke.

Supply Situation

As of June 3, there are 17 ongoing regular maintenance activities in coking units nationwide. The daily production of petroleum coke is 83,551 tons, with a coking operation rate of 65.88%, down by 1.41% from the previous working day.

Demand Situation

Downstream aluminum carbon enterprises are mainly purchasing petroleum coke as needed. The demand for negative electrode materials has not increased as expected, but remains stable. The demand for high sulfur pellet coke from the silicon carbide industry and southern fuel market persists. The graphite electrode market lacks significant positive factors, with enterprises maintaining a balance between production and sales, purchasing petroleum coke as needed.

Market Outlook

Downstream carbon enterprises have general enthusiasm for receiving goods, mainly purchasing petroleum coke as needed. Therefore, in the short term, the market price of petroleum coke is expected to remain generally stable, with limited price increases of 10-50 RMB/ton for some grades. The price of pellet coke is expected to continue stable operation.

Feel free to reach out to us for further information about the petroleum coke market. Our team is dedicated to providing you with comprehensive insights and assistance tailored to your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies