【EAF】Finished Steel Weakens, Capacity Utilization Drops to Pre-Chinese New Year Levels

【EAF】Finished Steel Weakens, Electric Arc Furnace Capacity Utilization Drops to Pre-Chinese New Year Levels

As of this week, the operating rate of 87 independent electric arc furnaces in China is 54.68%, down 6.78 percentage points from the previous week. The capacity utilization rate is 36.32%, down 5.63 percentage points from the previous week. In the week before the Chinese New Year, the operating rate of electric arc furnaces surveyed by our network was 40.85%, and the capacity utilization rate was 35.01%.Graphite Electrodes for Short Process Electric Furnace Steel, Specifications Reference. From the data, it can be seen that the current capacity utilization rate of electric arc furnaces has approached pre-Chinese New Year levels, reaching the lowest value for the same period in recent years. Why has the capacity utilization rate of electric arc furnaces dropped so quickly? Here’s a brief analysis.

1. Electric Arc Furnace Operations

According to this week’s data, 45.45% of independent electric arc furnace steel mills have stopped production. From the shutdown and maintenance plans for next week, the proportion of stoppages will reach 50%, setting a new high in recent years, indicating low production enthusiasm among electric arc furnace steel mills. Looking at the operating time, among the steel mills that are still in normal production, 70% have production times within 12 hours, with only a few mills choosing to produce during peak electricity periods. The average production time is 12.4 hours. Regionally, the capacity utilization rate in Central and East China is less than 20%, with low production loads, significantly lower than those in South and Southwest China.

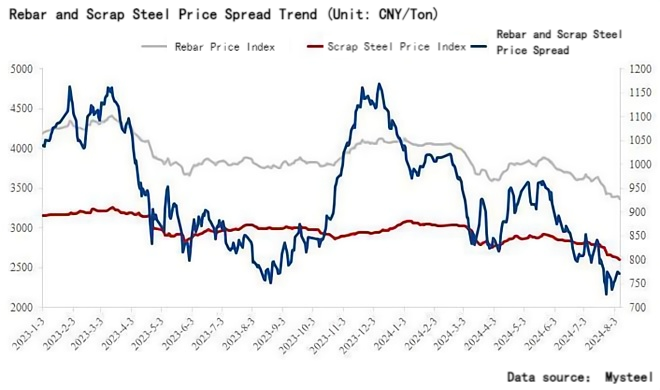

2. Finished Steel Prices Drop, Rebar-Scrap Price Spread Narrows Significantly

In July, the construction steel market was affected by the transition between old and new national standards and weak off-season demand, leading to a rapid decline in prices. In many places, the spot price of rebar fell below 3,000 yuan/ton, and the price difference between rebar and scrap continued to narrow. Moreover, the cost of molten iron was lower than the price of scrap steel in the earlier period, putting significant cost pressure on independent electric arc furnace steel mills, forcing them to choose to reduce or halt production to cope with the continuously declining market prices.

From the trend of finished steel, the performance in 2024 has been notably poor, especially in the second half of the year, with prices continuing to fall. As of the 7th, the absolute price index of rebar was 3,373.16 yuan/ton, down 253.53 yuan/ton month-on-month and down 449.87 yuan/ton year-on-year. On the raw materials side, as of the 7th, the absolute price of MySSpic scrap steel was 2,602.5 yuan/ton, down 212.9 yuan/ton month-on-month and down 384.3 yuan/ton year-on-year. The slower decline in raw material prices compared to finished steel has led to a continuous narrowing of the rebar-scrap price spread. As of the 7th, the spread was 770.66 yuan/ton, and on July 25th, the spread was 727.44 yuan/ton, the lowest value in nearly two years. Consequently, most steel mills have shown poor profitability. According to surveys, the average profit of independent electric arc furnace steel mills is -200 yuan/ton, with some regions experiencing losses of more than 300 yuan/ton.

3. Impact of the New and Old National Standards on Steel Mill Production Rhythm

Currently, the industry is in a transition phase between the old and new national standards for rebar. According to announcements from several steel mills, to adapt to market changes and ensure that products meet the new mandatory national standards, while also speeding up the digestion of old standard resources, many steel mills have adjusted production lines and conducted equipment maintenance. Recently, they have stopped producing old standard resources and plan to start producing new standard resources directly after resuming production in mid-to-late August. According to the new national standard, production costs for steel mills will increase to some extent. Therefore, with already poor profitability, if steel mills insist on directly producing new standard products, the company's profitability is bound to deteriorate further. Temporarily stopping production for maintenance is the best choice for flexible electric arc furnace steel mills, waiting for improvement in both finished steel and raw materials before resuming production.

In summary, the significant weakening of finished steel prices, continuous narrowing of the rebar-scrap price spread, deteriorating profitability, and the transition between old and new national standards, requiring the market to first digest old standard resources, have led to the electric arc furnace capacity utilization rate reaching new lows, approaching pre-Chinese New Year levels.

Feel free to contact us anytime for more information about the EAF steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies