【Coke Prices】Weak Demand for Petroleum Coke and Needle Coke in July: What's Next for August?

【Coke Prices】Weak Demand for Petroleum Coke and Needle Coke in July: What's Next for August?

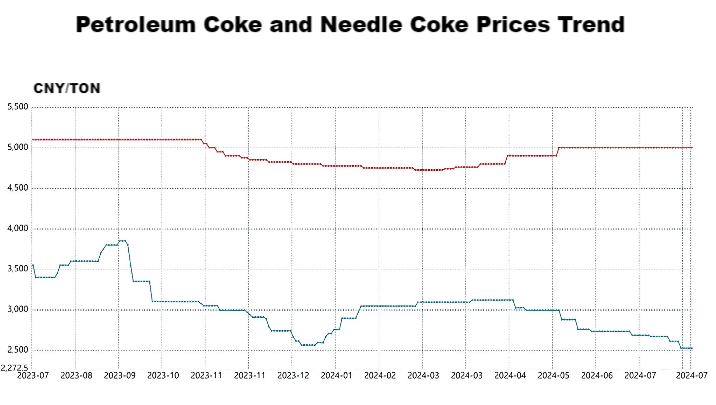

In July, the average price of low-sulfur petroleum coke was CNY 2,633/ton, down 3.9% month-on-month. Despite entering July, demand from anode, electrode, and other downstream sectors for low-sulfur petroleum coke remained weak. As petroleum coke is a by-product for some refineries, production continued even with sluggish sales, leading to high inventory levels and forcing refineries to lower prices. Although the terminal market has slightly recovered in August, downstream demand for petroleum coke products remains poor. Production has not significantly increased, so low-sulfur petroleum coke demand is expected to remain weak, with further price declines likely in August.

In July, the average price of oil-based needle coke was CNY 5,000/ton, unchanged from the previous month. Needle coke is mainly used in the production of lithium battery anode materials and high-power, ultra-high-power graphite electrodes. Due to reduced market activity, needle coke demand weakened, prompting refineries to manage inventory and reduce production, thus avoiding a price drop this month. However, as anode production remains low in August and many anode plants have sufficient needle coke inventory, demand for needle coke is still weak. To ensure sales, refineries are expected to slightly reduce needle coke prices, with a small decline anticipated in August.

Feel free to contact us anytime for more information about the carbon market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies