【EAF Steel】 Production Cuts Nearing End, Scrap-Rebar Price Spread Widens

【EAF Steel】Production Cuts Nearing End, Scrap-Rebar Price Spread Widens

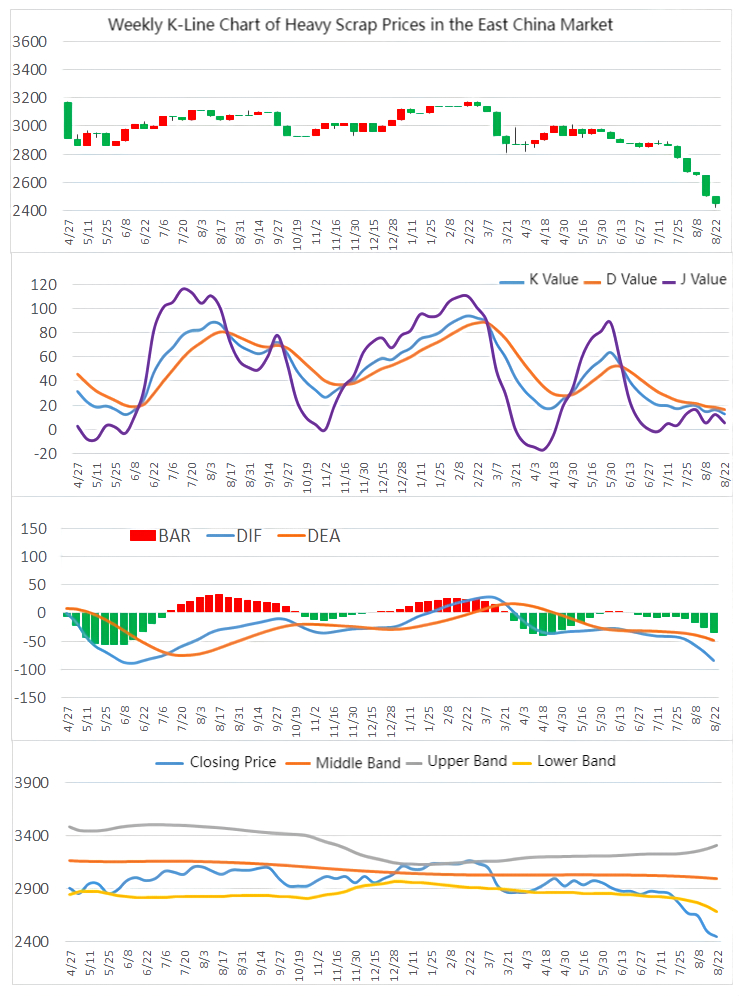

Supported by a futures market rebound, Chinese domestic construction steel prices saw a mild recovery this week, with market sentiment slightly improving, although overall transactions showed no significant signs of improvement. Both factory and social inventories continue to decline slowly. As of August 22, the average price of rebar in China reached 3,181 yuan per ton, up 66 yuan from the previous weekend.

In terms of raw materials, many electric arc furnace (EAF) steel mills remain idle this week. Graphite electrodes, as a key consumable in electric arc furnace steelmaking, directly influence the efficiency and cost of the steelmaking process through their quality and performance. The rise in scrap steel prices has significantly lagged behind that of steel, with the average purchase price for EAF steel mills increasing by 19 yuan from last week to 2,053 yuan per ton (excluding tax). However, most independent EAF steel mills in operation are still losing around 100 yuan per ton, with production generally maintained at under 8 hours per day.

As of August 22, the capacity utilization rate of 135 EAF steel mills in China was 36.13%, down 0.71% from the previous week, with daily EAF steel output at 226,100 tons, marking the 12th consecutive week of decline.

Although steel prices saw a slight rebound this week, it was mainly driven by market sentiment, with the fundamental issue of weak supply and demand in the steel market remaining unchanged. Amid a sluggish recovery in the real estate sector, delayed infrastructure investments, and increasing export pressures, the steel market is expected to remain in a weak bottoming-out phase in the short term. Blast furnace production cuts are also gradually intensifying.

It is anticipated that the domestic steel market may begin to stabilize and even show a small chance of short-term supply-demand mismatches by mid-September. This could lead to a dual increase in EAF steel production and profitability, with the short-cycle, low-inventory EAF process potentially gaining a slight advantage in a volatile market.

Feel free to contact us anytime for more information about the graphitized petroleum coke carburant (GPC) market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies