【Needle Coke】Market Overview (September 12, 2024)

【Needle Coke】 Market Overview (September 12, 2024)

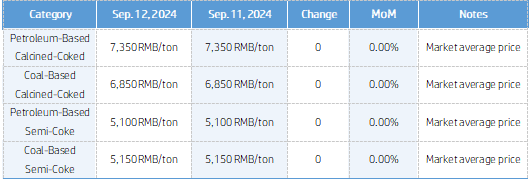

Market Average Price

On September 12, the needle coke market was temporarily stable, with the Chinese needle coke market price range of raw coke of 4900-5300 yuan/ton and calcined coke of 6500-8200 yuan/ton;The mainstream transaction price of imported petroleum-based needle coke is 500-1200 USD/ton for raw coke and 750-1250 USD/ton for calcined coke, while the mainstream transaction price of imported coal-based needle coke is 800-1000 USD/ton for calcined coke.

The average market price of domestic needle coke is 7,585 yuan/ton, which is the same as the previous working day.At present, the trading volume of needle coke in China is light, and the inventory level of some enterprises is high.According to market feedback, most negative electrode enterprises are currently experiencing a downward trend in production scheduling, and the release of coke demand is not as expected. Therefore, some needle coke enterprises have generally signed orders, and the inventory level of coke production has slightly increased, leading to a wait-and-see attitude towards the coke production market in the short term.

Market Prices

Upstream Market

Oil Slurry: Prices are stable, with some companies adjusting prices by 20-50 RMB/ton. The main range for high-sulfur oil slurry is 3,380-4,000 RMB/ton, and for low-sulfur oil slurry is 3,680-5,000 RMB/ton. International oil prices closed higher, providing positive signals, but downstream buyers remain cautious with a focus on just-in-time purchasing. The oil slurry market remains stable, with price adjustments depending on individual companies.

Coal Tar Pitch: The market is expected to remain stable with slight adjustments. The main production area's modified pitch is priced at 4,300-4,500 RMB/ton. New orders are being negotiated, with the market waiting to see how transactions develop. The overall price support for coal tar pitch is weak, with downstream buyers showing limited enthusiasm and a cautious outlook.

Downstream Market

Graphite Electrodes: Production is aimed at maintaining a balance between supply and sales. Despite some new orders, graphite electrode companies are cautious in accepting orders to maintain existing profit margins. The presence of low-priced resources in the market leads to price pressure from downstream buyers. The market remains stable with actual transactions pending improvement.

Anode Materials: Demand from downstream is weaker than expected, and orders for anode materials are declining. The market is still oversupplied, giving downstream battery manufacturers stronger bargaining power and leading to price pressure. Despite a slight increase in production costs, profits for anode material manufacturers remain under pressure, with a strong sense of market uncertainty.

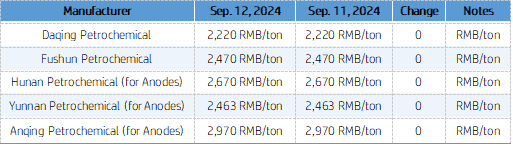

Petroleum Coke Prices

Market Forecast

Currently, the supply of semi-coke is ample, giving buyers the upper hand. The calcined-coked market remains stable, with good sales conditions for manufacturers. It is expected that in the short term, the needle coke market will maintain stability, with semi-coke prices ranging between 4,900-5,250 RMB/ton and Calcined-coked prices between 6,500-8,200 RMB/ton.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the needle coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies