【Calcined Petroleum Coke】Market Prices Stable, September 18th Quick Market Overview!

【Calcined Petroleum Coke】Market Prices Stable, September 18th Quick Market Overview!

Market Summary

As of September 18th, the average market price for calcined petroleum coke (cpc) is 2,148 CNY/ton, remaining stable compared to the previous working day. Currently, the calcined coke market is running steadily. The overall market for low-sulfur calcined coke remains weak, with insufficient support from downstream electrode enterprises, limiting price increases. The overall market for medium and high-sulfur calcined coke is seeing decent sales. Due to the recent impact of upstream petroleum coke prices, some calcined coke companies supplying to the aluminum industry have slightly lowered their quotes, while mainstream prices remain stable.

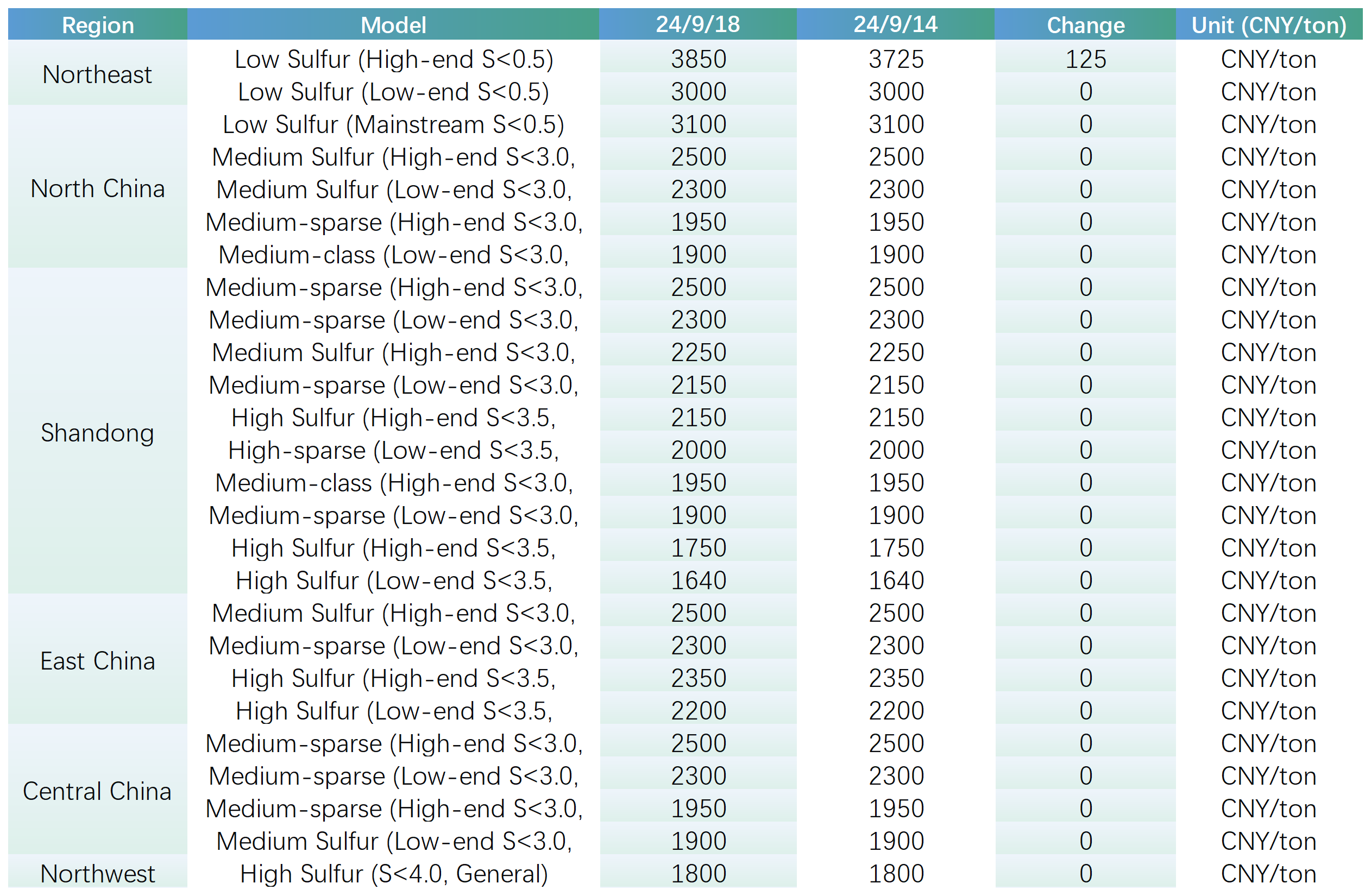

Major Regional Market Transaction Prices

Market Prices

Low-sulfur calcined coke (using Jinxi and Jinzhou petroleum coke as raw materials): mainstream transaction price 3,050-3,200 CNY/ton.

Low-sulfur calcined coke (using Fushun petroleum coke as raw material): ex-factory mainstream transaction price 3,500-3,850 CNY/ton.

Low-sulfur calcined coke (using Liaohe and Binzhou CNOOC petroleum coke as raw materials): mainstream transaction price around 2,850-3,050 CNY/ton.

Medium and high-sulfur calcined coke (S<3.0%, no trace element requirements): previous ex-factory mainstream contract price at 1,950 CNY/ton, current negotiation price at 1,900-1,950 CNY/ton.

Medium and high-sulfur calcined coke (S<3.5%, no trace element requirements): previous ex-factory mainstream contract price at 1,640-1,750 CNY/ton, current negotiation price at 1,640-1,750 CNY/ton.

Medium-sulfur calcined coke (S<3.0%, V<400): previous contract price at 2,400 CNY/ton, current negotiation price at 2,400 CNY/ton.

Supply Situation

Currently, the national daily supply of commercial calcined coke is 26,689 tons, with an operating rate of 62.71%. Compared to the previous working day, the supply has decreased by 0.08%.

Upstream Market

Petroleum coke: Sinopec refineries are maintaining stable prices and shipments, with post-holiday orders as the focus. In North China, medium and high-sulfur petroleum coke sales remain stable, with Shijiazhuang refinery supplying 4#A coke. In East China, shipments of medium and high-sulfur petroleum coke are stable, with refineries selling 4#B petroleum coke. Along the Yangtze River, Hunan Petrochemical mainly supplies anode materials, while Anqing Petrochemical is undergoing maintenance. Refineries such as Jiujiang and Jingmen focus on supplying carbon products. CNPC refineries continue stable shipments, with low-sulfur coke sales performing well in Northeast China. In Northwest China, prices are stable, with Lanzhou Petrochemical planning to restart operations in late September, and Xinjiang refineries primarily supplying coke to aluminum and silicon plants. In Southwest China, Yunnan Petrochemical focuses on medium-sulfur coke production, with downstream flows mainly directed to anode materials. CNOOC refineries are active in shipments, with CNOOC Asphalt raising prices by 20 CNY/ton this week. Follow Baichuan Yingfu for updates on prices from Zhoushan and Huizhou refineries.

Downstream Market

Graphite electrodes: Following the Mid-Autumn Festival, trading in the graphite electrode market remains slow. Downstream enterprises remain cautious with tenders, and the market continues to be dragged down by weak demand. The unstable pricing of raw materials further limits support for graphite electrode prices, which currently remain stable.

Electrolytic aluminum: News from Guangzhou’s Nansha District of relaxed housing purchase restrictions has boosted local real estate consumption sentiment. In addition, data from the National Bureau of Statistics shows an increase in retail sales of consumer goods and industrial production in August, indicating favorable consumer trends in China. Spot aluminum prices have increased.

Anode materials: Post-holiday, the anode materials market remains weak. Companies continue production based on sales, and competition is intense due to limited orders. Some enterprises report less than 50% production capacity, with no significant market boost in the short term, and output may continue to decline this week.

Market Forecast

It is expected that the mainstream prices of calcined coke for various grades will remain stable tomorrow. However, some enterprises may adjust prices slightly based on market trends and cost fluctuations.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies