【Anode Materials】Raw Material Prices Surge, Accelerating Industry Reshuffling

【Anode Materials】Raw Material Prices Surge, Accelerating Industry Reshuffling

Recently, the low-sulfur petroleum coke market has experienced frequent price surges, with prices reaching up to 5,500 RMB/ton, surpassing needle coke prices. Anode materials primarily use petroleum coke and needle coke, and with the significant rise in key materials, the anode materials market has entered a loss-making phase. Needle coke is a key material for producing graphite electrodes, known for its high strength and conductivity. With the growth of electric arc furnace steelmaking and the new energy industry, the needle coke market has broad prospects, especially driven by the demand for high-power graphite electrodes.

1. Surge in Petroleum Coke and Needle Coke Prices

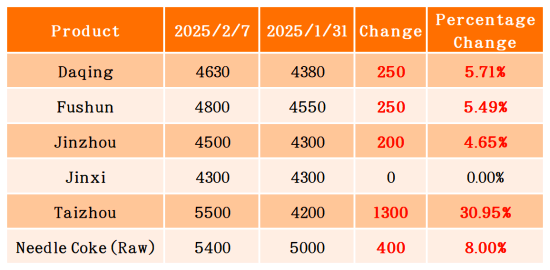

Table 1: Price Changes in Petroleum Coke and Needle Coke

Source:Oilchem

Since February, petroleum coke prices have surged by 200-1,300 RMB/ton. Sinopec has significantly increased its petroleum coke prices, leading to strong downstream demand and smooth shipments with no pressure on inventory. CNOOC has also implemented the latest tender pricing, further boosting market enthusiasm. The low-sulfur coke market has shown strong trading momentum, with prices rising sharply, supported by downstream demand. Needle coke prices for oil-based coke have risen by 400-500 RMB/ton, with actual deals still under negotiation. Due to changes in consumption tax deduction rates, needle coke production costs have increased and will be passed on to the product price.

2. Anode Material Enterprises Face Production Losses

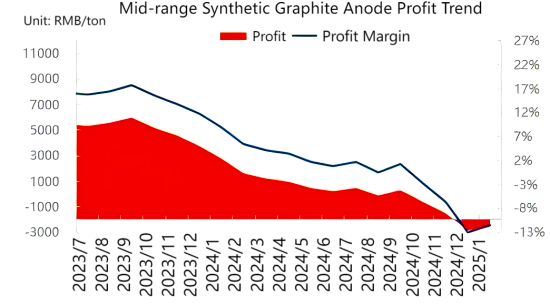

Figure 1: Production Profit of Chinese Synthetic Graphite Anodes

Source:Oilchem

In January, the profit of mid-range synthetic graphite anode sample enterprises was -2,609.92 RMB/ton, an 8.69% increase from the previous month. The gross profit margin was -11.35%, a 1.6 percentage point increase. The production cost of mid-range synthetic graphite anodes was 25,609 RMB/ton. The overall anode material profit remains negative, and the continuous rise in raw material prices has placed significant pressure on anode material production. Anode enterprises are actively negotiating price increases with downstream battery manufacturers. If the price increase does not materialize as expected, some anode enterprises will accelerate their clearance of stock, intensifying industry reshuffling.

3. Low Inventory of Raw Materials and Semi-finished Products, Yet Demand Remains

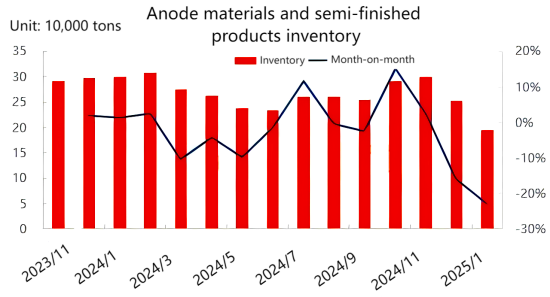

Figure 2: Raw Material and Semi-finished Product Inventory of Anode Materials

Source:Oilchem

Mainstream anode material enterprises have 194,000 tons of raw material and semi-finished product inventory, down 23% month-on-month. Anode enterprises have been operating near full capacity during the Spring Festival, consuming raw materials and semi-finished products rapidly. Downstream battery cell factories have a significant number of orders, leading to high operating rates at anode manufacturers.

Faced with the current surge in raw material prices, it is becoming increasingly difficult for anode enterprises to operate. On one hand, if anode enterprises continue to operate at a loss, it will harm the long-term sustainable development of the industry, and market share will shift. On the other hand, as anode enterprises push for price increases, battery cell factories are still focused on cost-cutting, and even with price concessions, the price increase is likely to be limited. It remains uncertain whether these increases will offset the losses caused by rising raw material prices. Anode enterprises may first deplete their existing inventories, slow down purchasing and order delivery, and consider using needle coke and natural graphite. They could also focus on developing other materials such as silicon anodes and hard carbon anodes to enhance product performance and drive price increases through high-performance products.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies