【Anode Materials】 Is a Recovery Imminent? Inventory Down, Demand Warming Up in October-November...

【Anode Materials】 Is a Recovery Imminent? Inventory Down, Demand Warming Up in October-November...

In the third quarter, the anode materials market experienced a downward trend in both production and sales, with the industry as a whole focusing on inventory reduction. As inventory levels gradually decrease, expectations for the anode market in October to November are starting to show signs of recovery.

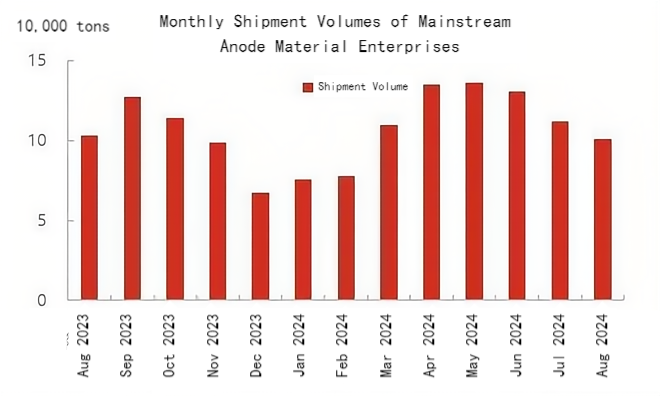

Monthly Shipment Volumes of Anode Materials Decreased from June to August

Mainstream Anode Material Enterprises' Shipment Volumes

(Source: Oilchem)

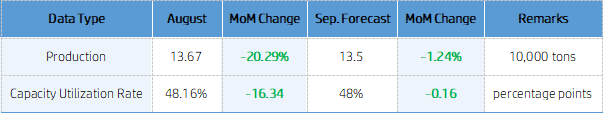

August Production and Capacity Utilization Rate of Anode Materials (Unit: 10,000 tons)

(Source: Oilchem)

From April to May 2024, anode material shipments saw a significant increase; however, this trend reversed starting in June. In the first eight months, the total shipment volume of major anode material companies reached 8.79 million tons. In August, these leading companies' shipment volume dropped to 1.01 million tons, a month-on-month decrease of 9.82%, and a year-on-year decrease of 2.32%. This change was mainly due to downstream battery manufacturers working to deplete existing inventory, which led to a reduction in new anode material orders. Currently, anode material production is being adjusted according to sales conditions. Graphitized Carburants are commonly used in the preparation of synthetic graphite anode materials. They improve conductivity, reduce costs, and enhance charge-discharge performance. Due to the decline in downstream orders, anode material production in August was 1.367 million tons, a sharp month-on-month decline of 20.29%.

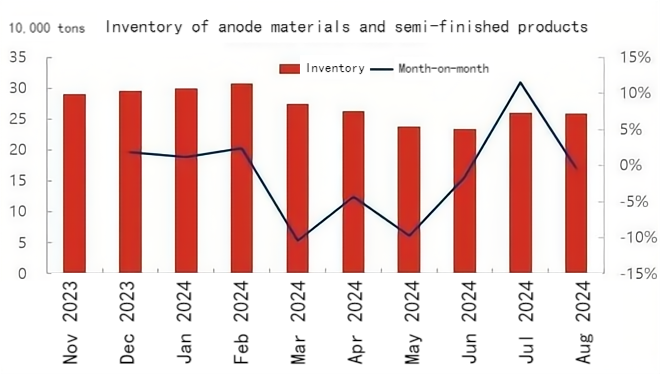

August Inventory of Anode Raw Materials and Semi-finished Products Decreased

Inventory of Anode Raw Materials and Semi-finished Products

(Source: Oilchem)

In August, the inventory of raw materials and semi-finished products of major enterprises reached 2.59 million tons, a slight month-on-month decrease of 0.38%, equivalent to 1.9 times the production volume. Since anode production lines need to maintain a high inventory level, typically holding 1.5 to 2 months' worth of stock, production scheduling by anode material manufacturers is usually in line with the production plans of end customers. In response to reduced downstream orders, anode material manufacturers quickly adjusted production loads to reasonably control inventory levels.

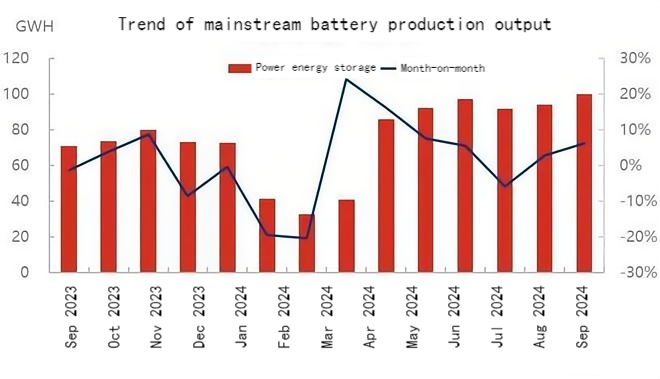

Increase in Downstream Battery Production

Mainstream Battery Factory Production Volumes

(Source: Oilchem)

In September, the production volume of major battery factories for power and energy storage batteries is expected to reach 100 GWh, a 6.3% increase from the previous month. At present, production at leading battery cell factories remains stable, and the output of major companies has seen some increase. Although there is inventory in both power and energy storage batteries, industry feedback shows that current inventory levels are still within a reasonable range. With inventory levels gradually decreasing and considering advance stockpiling for the fourth quarter, battery orders are expected to show a slight increase in October and November.

Overall Outlook

The operating rate of anode material production remains at 48%, and there has been some success in reducing inventory levels throughout the supply chain. Once this destocking process takes effect, orders for anode materials are likely to increase, and a slight recovery in the anode market is anticipated. In terms of demand this month:

Power Sector: In August, the inventory of new energy vehicles at both automakers and dealerships decreased, and preparations began for the "Golden September and Silver October" period, leading to an increase in demand for power battery cells, which also boosted demand for key raw materials.

Energy Storage Sector: In August, the number of awarded projects increased, driving up production in energy storage battery companies and intensifying the purchase of anode materials.

Consumer Sector: In August, due to the back-to-school season and home appliance subsidy policies in some regions, consumer demand increased slightly, which led to an incremental rise in demand for battery cells and key anode materials.

In September, market activity is expected to heat up further, and with the arrival of the "Golden September and Silver October" peak season, anode material production is expected to continue rising. It is estimated that in September, China’s anode material production will increase by 6% month-on-month and 6% year-on-year.

(Source: Oilchem)

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies