【Calcined Petroleum Coke】Prices Continue to Rise!

【Calcined Petroleum Coke】Prices Continue to Rise!

Market Overview

On October 23, the average market price for calcined petroleum coke was RMB 2,169/ton, remaining stable compared to the previous working day. Overall, the calcined petroleum coke market saw moderate trading activity. The low-sulfur calcined petroleum coke market remains stable, with downstream enterprises maintaining on-demand purchasing. Prices for mid- and high-sulfur calcined petroleum coke remain steady, focusing on fulfilling existing orders. However, prices for some specific-grade calcined petroleum coke continue to rise, and negotiations over next month's purchase prices with aluminum plants are ongoing.

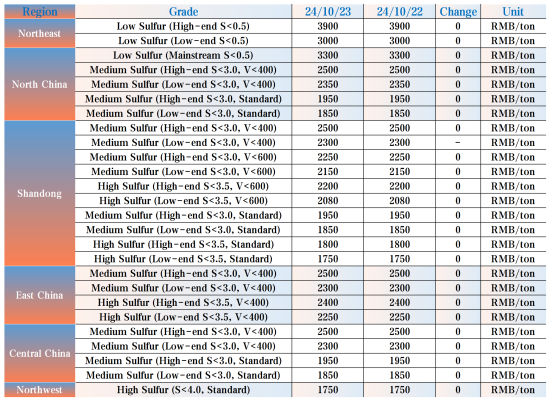

Transaction Prices in Major Regions

Current Prices:

1. Low-sulfur calcined petroleum coke (using Jinxi and Jinzhou petroleum coke as raw materials): mainstream transaction prices range from RMB 3,200 to 3,400/ton.

2. Low-sulfur calcined petroleum coke (using Fushun petroleum coke as raw material):ex-factory mainstream transaction prices range from RMB 3,700 to 3,900/ton.

3. Low-sulfur calcined petroleum coke (using Liaohe and Binzhou Zhonghai petroleum coke as raw materials): mainstream transaction prices range from around RMB 3,000 to 3,600/ton.

4. Mid-high sulfur calcined petroleum coke (3.0% sulfur, no specific requirements for trace elements): previous mainstream ex-factory contract price was RMB 1,900/ton, with current negotiation prices ranging from RMB 1,900 to 1,950/ton.

5. Mid-high sulfur calcined petroleum coke (3.5% sulfur, no specific requirements for trace elements): previous mainstream ex-factory contract price was RMB 1,700 to 1,800/ton, with current negotiation prices ranging from RMB 1,750 to 1,800/ton.

6. Mid-high sulfur calcined petroleum coke (3.0% sulfur, 400 ppm vanadium): previous contract price was RMB 2,400 to 2,500/ton, with current negotiation prices at RMB 2,400 to 2,500/ton ex-factory.

Supply

The current national daily supply of commercial calcined petroleum coke is 27,493 tons, with an operating rate of 62.78%, remaining stable compared to the previous working day.

Upstream Market

· Petroleum coke: Currently, CNPC refineries are witnessing active trading. Low-sulfur coke supply and demand in the Northeast region remains robust, with short-term prices expected to increase. Refineries in Northwest China report steady sales, with demand from the aluminum and silicon markets below expectations. CNOOC refineries are fulfilling orders as they come in, focusing on downstream carbon plant orders. Recent auctions saw stable prices for Taizhou Petrochemical, while CNOOC's asphalt price increased by RMB 70/ton, Huizhou Petrochemical by RMB 60/ton, and Zhoushan Petrochemical decreased by RMB 50/ton.

Downstream Markets

· Graphite electrodes: As the heating season approaches, some regions' production will be impacted by environmental policies. A few graphite electrode companies have plans to reduce baking production to comply with future restrictions. Companies with existing stock are focusing on inventory clearance, while some with low inventories plan to resume production to replenish stocks. The overall graphite electrode market remains stable, with no significant changes in production and sales rhythm.

· Electrolytic aluminum: The National Development and Reform Commission indicated that nearly half of the growth-promoting policies have been implemented, with more on the way. Coupled with China's Q3 GDP growth exceeding expectations, market confidence in the Chinese economy has risen, leading to increased spot aluminum prices.

· Anode materials: The anode materials market is stable, with continued upward price trends for low- and medium-sulfur petroleum coke. Prices for needle coke green coke and medium-temperature pitch remain stable. The slight increase in production costs for anode material companies, amid low anode material prices, means that profit margins remain thin and survival pressures persist.

Market Forecast

CNPC's low-sulfur petroleum coke prices in Northeast China are expected to continue rising in the short term, with mainstream low-sulfur calcined petroleum coke prices following the trend. Prices for mid- and high-sulfur calcined petroleum coke are likely to increase moderately, in line with market orders and raw material costs.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies