【EAF】Survey and Statistics of Independent Eaf Production in China (October 25, 2024)

【EAF】Survey and Statistics of Independent Electric Arc Furnace Production in China (October 25, 2024)

This week, our network surveyed 87 independent electric arc furnace (EAF) steel mills in China (of which 76 produce construction steel) and found the following production conditions:

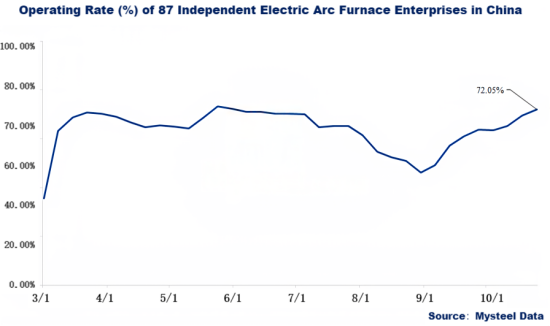

1. The average operating rate of the 87 independent EAF steel mills in China is 72.05%, an increase of 2.47 percentage points week-on-week and 0.51 percentage points year-on-year.The rates in East China, South China, Central China, and Northwest regions have slightly increased, while the other regions remain unchanged.

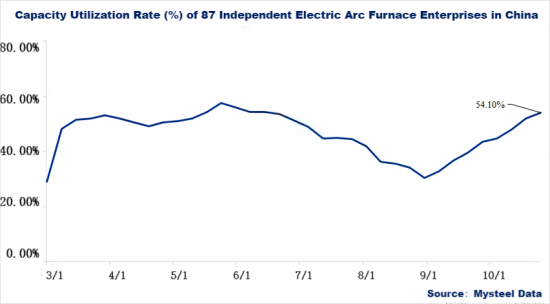

2. The average capacity utilization rate of these mills is 54.10%, up 2.22 percentage points from the previous week and 2.14 percentage points year-on-year. The Northeast region saw a slight decline, the North China region remained steady, and the other regions showed slight increases.

3. The average daily crude steel output of the 87 independent EAF steel mills increased by 4.27% week-on-week.

4. The weekly output of rebar from the 76 construction EAF steel mills increased by 9.07%, while the output of wire rod decreased by 2.93%.

5. The profitability status of the 76 construction EAF steel mills is as follows: 77.63% are barely profitable, 22.37% break even (partly due to production stoppages), and 0% are operating at a loss. The Market Price Situation of Graphite Electrodes as Conductive Materials in Electric Arc Furnace Smelting.

This week, the operating and capacity utilization rates of independent electric arc furnaces in China showed a slight increase. Production levels have maintained last week's restart levels, and with steel mills in a profitable state, overall operating and capacity utilization rates continue to rise slightly week-on-week. However, the positive impact of the "Golden September and Silver October" period has largely diminished, leading to expectations of a high-level retreat in the market. Overall production enthusiasm is slowing.

From a fundamental perspective, finished product prices have shown weak fluctuations this week, with the price differentials between rebar and scrap, as well as hot-rolled scrap, narrowing week-on-week. Nevertheless, the profitability level of steel mills remains acceptable, and the supply of finished products continues to trend upward. However, feedback from surveys indicates that the pace of end-demand digestion is slow, and speculative demand in the market is cautious. Thus, the fundamental contradictions are gradually accumulating, and the spot steel market still faces pressure and adjustment risks. Market expectations continue to diverge, with short-term adjustments likely in production saturation levels among steel mills.

Looking ahead to next week, profit-oriented behavior may lead electric arc furnace steel mills to maintain normal production levels, with limited adjustments to short-term production plans. Considering the overall market situation, it is expected that the operating and capacity utilization rates of independent electric arc furnace mills will fluctuate within a narrow range next week.

Feel free to contact us anytime for more information about the EAF steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies