【Ultra-High Power Graphite Electrode】Domestic Prices Expected to Remain Strong in November

【Ultra-High Power Graphite Electrode】Domestic Prices Expected to Remain Strong in November

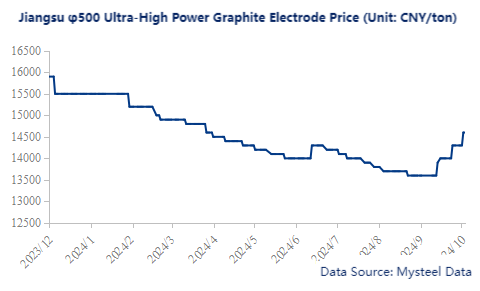

In October, Chinese domestic ultra-high power graphite electrode prices continued to rise, with two price increases within the month. Prices increased by over 800 CNY/ton, with some reaching 1,500 CNY/ton. Supply remained low, so what does November hold? Here is a brief market analysis:

1. Review – Continuous Price Increase

In October, ultra-high power graphite electrode prices rose steadily, with strong upward momentum. The first increase was 1,000 CNY/ton, with downstream transactions up 500-800 CNY/ton. By the end of the month, a second increase of 500 CNY/ton was observed, with significant market attention and optimism. For instance, the current market price of φ500 ultra-high power graphite electrodes in Jiangsu is 14,600 CNY/ton, up 1,000 CNY/ton from the previous month. Transaction levels were decent, but production was low, impacting supply.

2. Cost – Rising Raw Material Prices

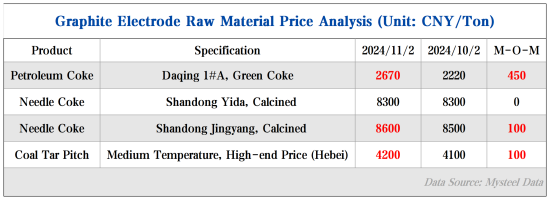

Petroleum Coke: Prices were stable to strong, with a month-on-month increase of 450 CNY/ton. Orders for low-sulfur coke, particularly for anode materials, were strong, supporting prices.

Coal Tar Pitch: Due to strict environmental controls and continued increases in tar prices, coal tar pitch supply was low, pushing costs higher.

Needle Coke: Prices remained steady but strong due to low production levels and a balanced supply-demand situation.

Overall, raw material prices showed an upward trend, creating cost pressures for domestic ultra-high power graphite electrode manufacturers. After prolonged losses, producers have now started to see positive margins, and as the year-end approaches, price increases have become essential to maintain operations.

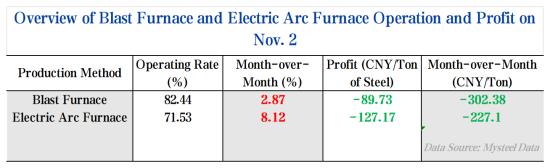

3. Demand – Steel Industry Returns to Losses

At the start of November, the comprehensive steel price index had dropped by 10.04 percentage points compared to early October. While blast furnace and electric arc furnace operations increased from the previous month, steel profits turned negative, with a significant drop in margins. This negatively affects the support for raw material prices and poses a challenge for ultra-high power graphite electrodes.

4. November Market Outlook – Strong Prices Supported by Costs

Demand: Losses in blast furnace and electric arc furnace steelmaking, along with expected production cuts due to environmental controls in the autumn-winter heating season, point to weak demand for raw materials.

Supply: Graphite electrode production remains low and could decrease further due to stricter environmental policies, potentially reaching annual lows.

Cost: High raw material prices and expectations for continued increases contribute to cost pressures.

Conclusion: In November, with both supply and demand weak and raw material costs high, ultra-high power graphite electrode prices are expected to remain strong.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies