【Petroleum Coke】Prices Continue to Rise!

【Petroleum Coke】Prices Continue to Rise!

Market Overview

On October 15, the average market price of petroleum coke was RMB 1,718/ton, up RMB 5/ton from the previous trading day, a 0.29% increase. The market is mainly supported by positive factors, with steady demand from the aluminum sector. Prices at some major refineries increased by RMB 10-300/ton, while local refineries maintained stable shipments with slight price fluctuations.

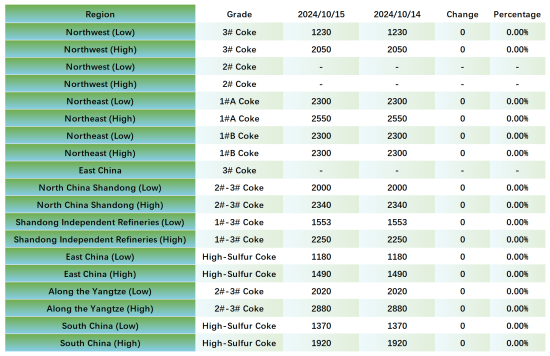

Key Regional Market Transaction Prices

Currently, prices at some Sinopec refineries have increased, while the anode-grade market remains stable with minimal price changes. Refineries generally maintain stable shipments. With low-sulfur coke prices continuing to rise, the trading atmosphere in the medium- and high-sulfur coke market remains favorable. Specific adjustments include price increases of RMB 20-50/ton at Jiujiang Petrochemical and Hunan Petrochemical in the Yangtze River region, and RMB 30/ton at Jingmen Petrochemical. In East China, Jinling Petrochemical raised prices by RMB 20/ton, Gaoqiao Petrochemical by RMB 10/ton, while other refineries kept prices stable. In Shandong, Qilu Petrochemical increased prices by RMB 30/ton, with Qingdao Refining and Qingdao Petrochemical each up by RMB 20/ton, and Jinan Refinery's carbon coke rising by RMB 20/ton. In North China, Yanshan Petrochemical increased prices by RMB 20/ton, and Shijiazhuang Refinery raised prices for low-emission coke by RMB 80/ton. In South China, Guangzhou Petrochemical adjusted some specifications by RMB 10-30/ton. PetroChina refineries maintained stable prices, with good sales of low-sulfur coke in Northeast China, where low inventory levels and reduced imports have increased demand for domestic low-sulfur coke. In the Northwest, sales of aluminum-grade and silicon-grade coke remain steady, with downstream purchases mainly driven by immediate needs. CNOOC refineries are currently conducting tenders, with active purchases from anode and aluminum sectors, and Zhoushan Petrochemical has increased prices by RMB 300/ton, with other refineries' final prices yet to be announced but expected to rise.

Local Refineries

Currently, local refinery sales are moderate, with slight price fluctuations. Downstream demand for petroleum coke remains steady, supported by immediate purchases. Some refineries with better quality indicators have raised prices by RMB 10-200/ton, while refineries producing high-sulfur coke are facing increasing pressure to sell, leading to price reductions of RMB 30/ton to facilitate sales. Recent changes in the market include a sulfur content reduction to 1.68% at Haike Ruilin Petroleum Coke and to 2.81% at Shandong Huifeng Petrochemical.

Imports

Demand from the anode material and carbon sectors remains stable, with a decrease in the supply of low-sulfur sponge coke. Low-sulfur sponge coke shipments at ports are satisfactory, as are those of shot coke.

Supply Side

As of October 15, there were 11 scheduled maintenance events at coking units across the country. The national daily output of petroleum coke stood at 88,565 tons, with a coking utilization rate of 69.84%, unchanged from the previous trading day.

Demand Side

In the downstream aluminum carbon market, purchases are being made as needed. Anode material companies continue to produce based on sales, maintaining a wait-and-see approach with stable demand for petroleum coke. The silicon carbide industry and southern fuel markets maintain demand for high-sulfur shot coke. However, demand from graphite electrode producers remains limited, leading to a stable market outlook for petroleum coke purchases.

Market Outlook

Domestic petroleum coke supply remains ample, and although there is downstream demand, the support is limited. It expects that petroleum coke prices will remain steady in short term with some potential for price reductions in high-sulfur regular-grade petroleum coke by RMB 10-50/ton. Shot coke prices are expected to remain stable in the near term.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies