【Steel】Why Was There No Adjustment to Steel Export Tax Rates This Time?

【Steel】Why Was There No Adjustment to Steel Export Tax Rates This Time?

On November 15, the Ministry of Finance and the State Administration of Taxation issued an announcement on adjusting export tax rebate policies:

1. Cancellation of export tax rebates for products such as aluminum, copper, and chemically modified animal, vegetable, or microbial oils and fats. Graphite electrode is a high-temperature resistant graphite conductive material that can conduct current and generate electricity, mainly used in steel production.

2. Reduction of export tax rebate rates for certain refined petroleum products, photovoltaic products, batteries, and some non-metallic mineral products from 13% to 9%.

3. The policy will take effect on December 1, 2024, and the applicable export tax rebate rates will be determined based on the export date indicated on the customs declaration form.

But why wasn't steel included in these adjustments?

Reasons Supporting Adjustments to Steel Export Taxes:

1. Steel Export Value Exceeds That of Aluminum and Copper:

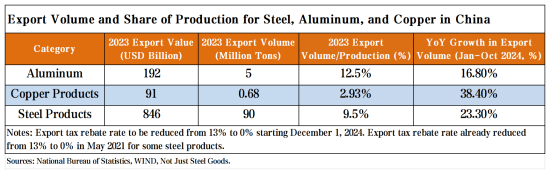

In 2023, China's steel exports reached $84.6 billion, significantly higher than aluminum's $19.2 billion and copper's $9.1 billion.

2. Higher Growth in Steel Export Volume:

1) From January to October 2024, steel export volumes increased by 23% year-on-year, surpassing aluminum's 17% and copper's 38%.

2) In 2023, steel exports accounted for 9.5% of production, compared to aluminum's 12.5% and copper's 2.9%.

3. Trade Disputes:

The number of trade disputes involving Chinese steel this year has already exceeded the total for 2021–2023. Adjusting steel export taxes would help mitigate international trade friction.

Additionally, during the Steel Export Work Meeting held by the China Iron and Steel Association (CISA) on October 11, the association reiterated its principle of “encouraging high-end, restricting low-end, and combating illegal” steel exports. Adjusting export taxes to impose duties on low-end products while subsidizing high-end products would align with this principle.

Reasons Against Adjusting Steel Export Tax Policies:

The primary reason is the severe financial difficulties of the steel industry.

In Q3 2024, the entire industry suffered cash flow losses, with listed steel companies recording their third-worst losses in history.

For instance, 37% of output incurred cash losses, and if this continues for another two quarters, cumulative losses could rival the 2015 downturn.

Imposing export taxes on steel under current conditions would exacerbate the industry’s challenges. If export tax rate adjustments were to proceed, they should be accompanied by production cuts; otherwise, such adjustments would be ill-advised.

Feel free to contact us anytime for more information about the EAF steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies