【EAF Steel】Production Continues to Decline, Plate Mills Begin Gaining Momentum

【EAF Steel】Production Continues to Decline, Plate Mills Begin Gaining Momentum

This week, Chinese domestic construction steel market experienced a trend of rising early in the week followed by a decline. Early on, driven by price hikes from some steel mills, domestic rebar prices increased slightly. Graphite electrodes are mainly used to melt scrap steel in the electric arc furnace (EAF) steelmaking process, and their prices have recently increased. However, downstream buyers remained cautious, and market demand gradually weakened due to colder weather. In the latter part of the week, steel prices saw a minor dip again. As of December 5, the average domestic rebar price was RMB 3,391/ton, up RMB 33 from last Friday.

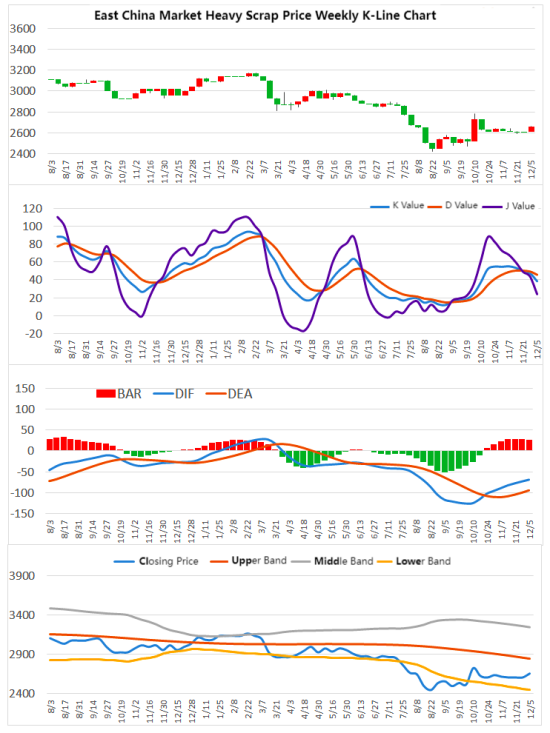

Raw Materials: This week, scrap steel prices increased slightly as mills intensified their stock replenishment efforts. The average purchasing price of scrap for electric furnaces rose by RMB 13 to RMB 2,277/ton (excluding tax). Both deliveries and inventories increased slightly.

Electric arc furnace (EAF) steelmakers recorded their fourth consecutive week of losses, though the extent of losses narrowed. A few EAF mills in northern China resumed operations, and an automotive sheet continuous casting production line in Hebei successfully completed hot trials. As of December 5, the capacity utilization rate for 135 EAF steelmakers nationwide was 51.94%, down 1.56% from last week, with EAF steel production at 325,000 tons/day, marking six consecutive weeks of decline.

Since economic targets for 2024 have largely been achieved, significant stimulus policies are unlikely to emerge from the December "Two Sessions" meetings. Furthermore, earlier policies to boost real estate and infrastructure will require time to take effect. It is anticipated that the domestic steel market in December will exhibit a dual weakness in supply and demand, with EAF steel being more severely impacted. Meanwhile, in the raw materials market, seasonal supply reductions and winter stockpiling are expected to result in prices outperforming steel, further squeezing EAF steelmakers' profits and output.

Feel free to contact us anytime for more information about the EAF steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies