【Petroleum Coke】Dual-Drive of Supply and Demand, Market Celebrates a Positive Start

【Petroleum Coke】Dual-Drive of Supply and Demand, Market Celebrates a Positive Start

The petroleum coke market continues its upward trajectory from Q4, with active trading sentiment. In January, domestic supply and demand provided mutual support, with stable refinery and port shipments. Transaction prices rose cumulatively by 100-300 yuan/ton. As the Spring Festival approaches and long-distance logistics become challenging, how will the petroleum coke market evolve?

1. A Positive Start: Petroleum Coke Prices Surge 7.01%

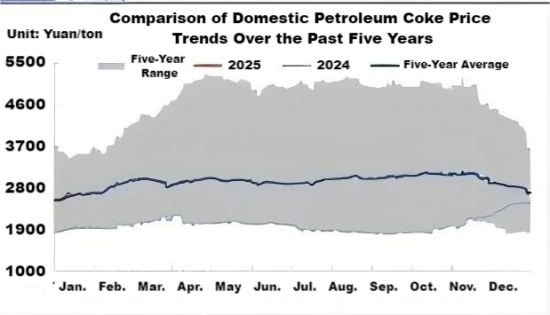

Figure 1: Comparison of Domestic Petroleum Coke Price Trends Over the Past Five Years

After New Year's Day, some downstream companies resumed purchasing, stabilizing refinery sales and increasing transaction volumes. Pre-Spring Festival stocking by long-distance producers and active participation by large carbon enterprises drove petroleum coke prices upward. As of mid-January, the market price reached 2,644 yuan/ton, a 7.01% increase from late December and a 37.19% rise year-on-year. Historically, Q1 trends show petroleum coke prices generally climbing. This trend is expected to continue into February, with a potential slight slowdown late in the month, followed by a resurgence in March as downstream demand recovers.

2. Refinery Operations Decline, Domestic Supply Tightens

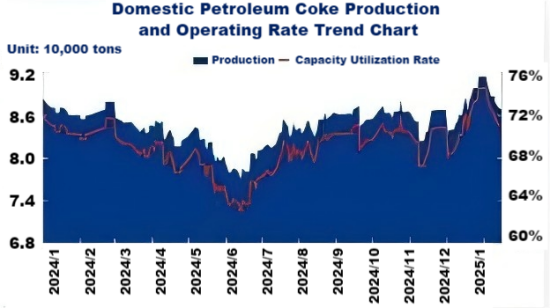

Figure 2: Domestic Petroleum Coke Production and Operating Rate Trend Chart

The average operating rate of domestic delayed coking units in early January was around 72%, down 0.4 percentage points year-on-year. Maintenance and production cuts have resulted in a daily loss of 18,000 tons of petroleum coke. January output is estimated at 2.6 million tons, down 3.7% YoY and 8.6% MoM. Supply is expected to further decline in February and March, with monthly output at 2.5-2.55 million tons due to tight raw material availability and reduced refinery loads.

3. Downstream Capacity Expansion Drives Steady Growth in Consumption

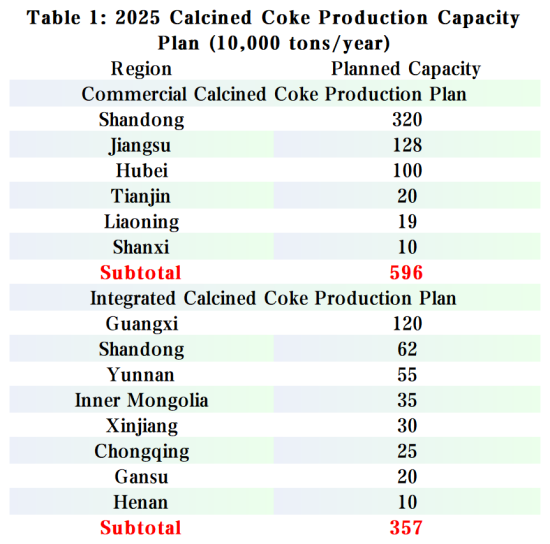

In 2025, approximately 5.96 million tons of commercial calcined petroleum coke capacity is planned for commissioning, mainly in Shandong, Jiangsu, and Hubei provinces. Additionally, 3.57 million tons of supporting calcined petroleum coke capacity, including 2.15 million tons for electrolytic aluminum, are expected to launch in regions like Guangxi, Inner Mongolia, Yunnan, and Xinjiang. Q1 consumption is forecast to grow slightly to 13 million tons, with annual consumption reaching 46 million tons.

Conclusion:

As the Spring Festival approaches, downstream stocking enthusiasm boosts transaction activity and prices. Traditional carbon markets maintain positive purchasing sentiment, while the anode material sector adopts a sales-driven procurement approach. Market dynamics are expected to stabilize in late January, with petroleum coke prices fluctuating between 2,400-2,500 yuan/ton.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies