【Calcined Petroleum Coke】Prices Surge! Low-Sulfur Coke Prices Break Through 8000 Yuan

【Calcined Petroleum Coke】Prices Surge! Low-Sulfur Coke Prices Break Through 8000 Yuan

On February 8, the average price of calcined petroleum coke in the market was 3421 yuan/ton, an increase of 186 yuan/ton compared to the previous working day, with a rise of 5.59%. Currently, influenced by the price of petroleum coke, the prices of low-sulfur calcined petroleum coke have generally risen sharply. However, the downstream electrode market has a low acceptance level, leading some electrode companies to delay their resumption plans, with overall procurement primarily driven by essential needs. The trading atmosphere for medium to high sulfur calcined petroleum coke is good, with raw material prices continuing to rise, providing certain support for calcined petroleum coke prices. Companies are inclined to raise their quotes, showing low willingness to accept low-priced orders.

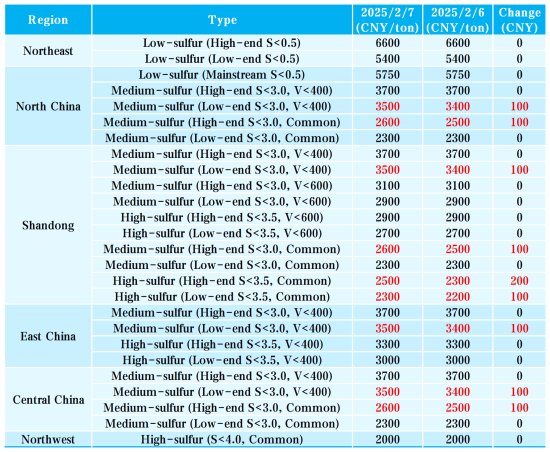

Main Regional Market Transaction Prices

Low-Sulfur Calcined Petroleum Coke:

o From Jinxi and Jinzhou petroleum coke: 7000-7200 yuan/ton

o From Fushun petroleum coke: 7800-8100 yuan/ton

o From Liaohe and Binzhou Zhonghai petroleum coke: around 7000-7300 yuan/ton

Medium to High Sulfur Calcined Petroleum Coke:

o 3.0% sulfur, no requirement for trace elements: previous mainstream contract price 2400-2600 yuan/ton, current negotiating price 2400-2600 yuan/ton

o 3.5% sulfur, no requirement for trace elements: previous mainstream contract price 2300-2500 yuan/ton, current negotiating price 2300-2500 yuan/ton

o 3.0% sulfur (Vanadium 400): previous contract price 3600-4000 yuan/ton, current negotiating price 3600-4000 yuan/ton

Supply Situation

Currently, China's commercial calcined petroleum coke daily supply is 27,334 tons, with an operating rate of 61.08%. The supply of calcined petroleum coke in the market has decreased compared to the previous working day.

Upstream Market Situation

Petroleum Coke: PetroChina's refineries are experiencing good sales, and downstream aluminum carbon products procurement is acceptable, with carbon coke sales being steady. In East China, Shanghai Petrochemical plans to stop operations for maintenance starting on the 13th, and Yangzi Petrochemical has a short-term shutdown plan of 10-15 days, with specific timing to be determined. Negative material companies are cautious about high-priced orders, but current raw material inventories are low. To maintain normal production schedules, some companies are increasing procurement of low-priced negative coke. PetroChina's refineries in Northeast China are seeing continuous price increases of 1000 yuan/ton, with low-sulfur coke in short supply and active downstream procurement. In Southwest China, Yunnan Petrochemical has raised prices by 480-1253 yuan/ton. Currently, CNOOC's refineries are focusing on fulfilling existing orders.

Downstream Market Situation

Graphite Electrodes: The price increase of low-sulfur petroleum coke has significantly impacted the graphite electrode market, causing some companies to delay their resumption plans and focus on processing semi-finished products and consuming inventories. Amid cost pressures, some companies are tentatively raising prices, but the downstream response remains unclear, leading to a cautious and watchful operation in the graphite electrode market.

Electrolytic Aluminum: The Shanghai Futures Exchange's main aluminum contract reached a high of 20,600 yuan/ton and a low of 20,515 yuan/ton, closing at 20,535 yuan/ton. Federal Reserve Governor Cookler indicated that the U.S. GDP growth rate is expected to be stable in the first quarter of 2025, resulting in positive market sentiment and continued increases in overseas aluminum prices.

Negative Materials: Feedback from the market indicates that the upward trend in petroleum coke prices provides some support for negative material prices. There are signs of potential price increases in the negative materials market; however, due to ongoing cost reduction efforts in the industry chain and strong bargaining power from downstream buyers, new contract prices for negative materials are still largely in negotiation stages, with specific prices yet to be clarified. Please stay tuned for the latest updates.

Market Outlook

It is expected that the prices of low-sulfur calcined petroleum coke will rebound after high-priced raw material replenishment, while medium to high sulfur calcined petroleum coke companies will maintain prices for sales, with price adjustments primarily driven by cost pressures.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies