【GE】Japan Slaps 95% Tariff—How Can China's Graphite Electrode Industry Break the Deadlock?

【Graphite Electrode】Japan Slaps 95% Tariff—How Can China's Graphite Electrode Industry Break the Deadlock?

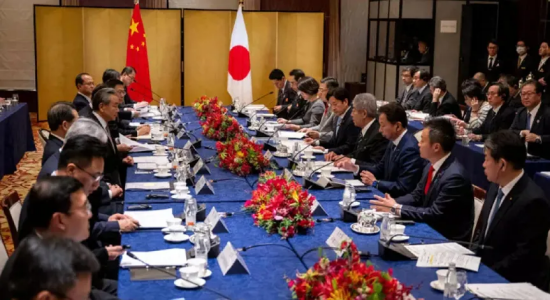

On March 12, Japan's Ministry of Finance approved a proposal to impose anti-dumping duties on graphite electrodes imported from China. A tariff of 95.2% will be levied on the import price for a period of four months starting March 29.

Background of the Tariff Imposition

In February 2024, Japanese domestic graphite electrode manufacturers such as SEC Carbon and Nippon Carbon jointly filed a complaint to the Japanese government, claiming that a large influx of low-priced graphite electrodes from China had flooded the Japanese market. The price of Chinese graphite electrodes was approximately 35% lower than that of domestic Japanese products, while maintaining comparable quality. This caused substantial harm to Japan's domestic graphite electrode industry. Despite Japan's certain technological and industrial advantages in the graphite electrode sector, local companies found it hard to compete with the low-cost products from China. As a result, they urged the government to protect local industry through measures like tariffs.

In April 2024, the Japanese government launched an anti-dumping investigation into graphite electrodes from China. Nearly a year later, on February 28, 2025, preliminary findings confirmed that Chinese graphite electrodes were being dumped and had caused material damage to the domestic industry. Based on this, on March 12, the Ministry of Finance approved the imposition of 95.2% anti-dumping duties on Chinese graphite electrodes, effective March 29 for a period of four months.

Minimal Impact on China

According to analysis provided by ICCSINO, although the anti-dumping duty may temporarily shield Japanese domestic companies from the shock of low prices and reduce the volume of Chinese graphite electrodes sold in Japan, the long-term impact on Chinese producers is relatively limited.

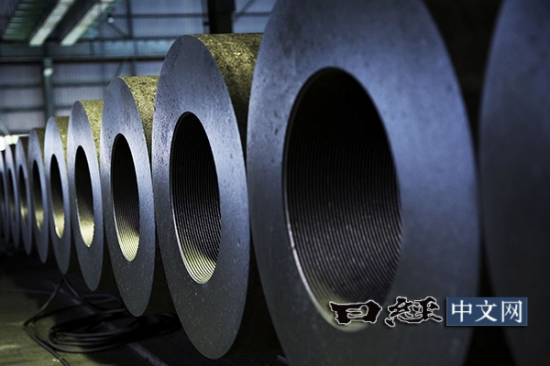

First, China is the world's largest graphite electrode producer, accounting for nearly 60% of global production. It holds a broad sales network and market share worldwide.

Data shows that in 2024, the top five destinations for Chinese graphite electrode exports were Russia (9.53%), the UAE (7.73%), South Korea (6.13%), Iran (5.84%), and Malaysia (5.01%), together accounting for 34.24% of total exports.

Second, China's reliance on the Japanese market for graphite electrode exports is low. In 2024, China exported only 13,300 tons of graphite electrodes to Japan, which accounted for just 3.94% of total exports and 1.6% of its annual production.

Moreover, China has a complete graphite electrode industry chain, from raw materials to finished products, with a cost competitiveness that few other countries can match. With China's broad distribution and strong competitiveness in the global market, even in the face of Japan's anti-dumping duties, the overall impact on the Chinese graphite electrode industry remains minimal.

In Conclusion

Although Japan's short-term imposition of anti-dumping duties on Chinese graphite electrodes may affect the export volume and sales of certain enterprises, in the long run, this move will likely push China's graphite electrode industry to further optimize and upgrade its structure, and to actively explore broader international markets. With its production capacity, complete industrial chain, and technological innovation, China's graphite electrode sector will continue to maintain its leading position in the global market.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies