【Anode Materials】Analysis of China's Anode Materials Supply Pattern in 2025

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】Analysis of China's Anode Materials Supply Pattern in 2025

Recently, petroleum coke prices have continued to rise, while anode material prices remain at a low level. Under thin production margins, anode producers have strong expectations for price increases, but the supply structure continues to restrict the price upside of anode materials.

1. Artificial Graphite Remains the Mainstream Product

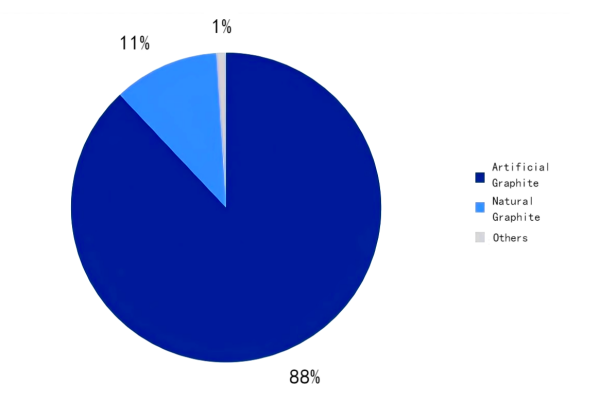

Figure 1 Proportion of Different Anode Material Technologies in China, 2025

Data Source: Oilchem

The primary production processes for anode materials include artificial graphite, natural graphite, and other types — mainly mesocarbon microbeads, silicon-based anodes, and hard carbon anodes.

Artificial graphite anodes feature mature technology, long cycle life, high safety, and relatively low cost, making them suitable for both power batteries and energy storage batteries.

With the rapid growth of energy storage battery orders this year, demand for artificial graphite anodes has increased. Their market share has reached 88%, up 1% from 2024.

Natural graphite uses flake graphite, spherical graphite, and other natural graphite as raw materials. It features lower energy consumption during production and good low-temperature performance, but its rate capability is weaker, prone to deformation, and performance is inferior to artificial graphite. With low processing margins, its market share continues to decline — currently at 11%, down 1% from 2024.

Silicon-based anodes mainly include silicon-carbon and silicon-oxide types. Due to high cost and expansion issues, commercial application remains limited, and most capacity expansion has only begun in recent years. Over the next decade, artificial graphite and natural graphite will remain the mainstream products in the anode market, while silicon-based anodes will gradually increase in application and commercial progress will accelerate

2. High Industry Concentration — CR6 Capacity Share Reaches 54%

Table 1 Domestic Anode Material Enterprises' Capacity Share

The anode materials industry has a high degree of concentration, presenting a clear "polarized competition" landscape. The top six companies account for 53.2% of total capacity.

Leading companies in the market include BTR, Shanshan, Shida Technology, Sinosteel Electric (Xingcheng), and Putailai. Their market shares remain relatively stable, and several companies are growing faster than the industry average.

The overall trend indicates that industry concentration continues to rise. Despite fierce competition, leading players are achieving rapid growth through enhanced R&D innovation and "differentiated" product strategies.

3. Anode Material Capacity to Grow 26% in 2025

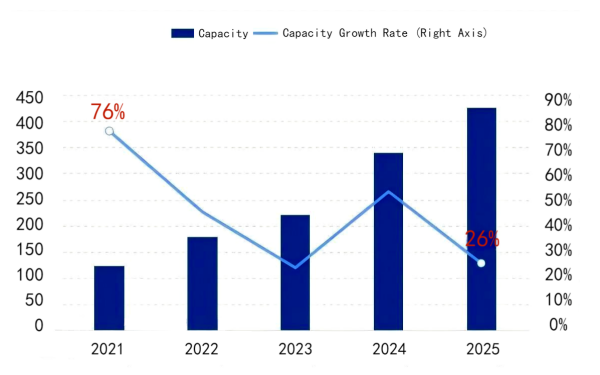

Figure 2 China's Anode Material Capacity Trend, 2021–2025 (10,000 tons)

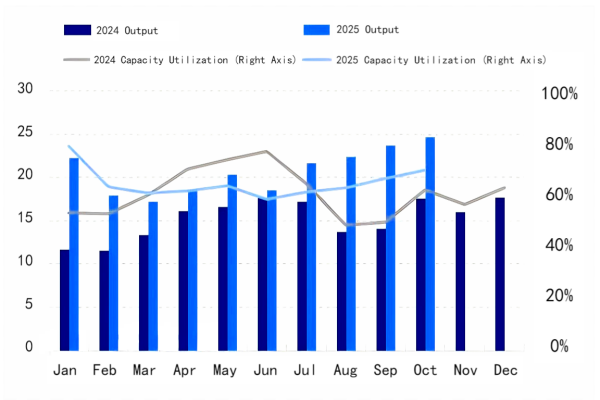

Figure 3 China's Anode Material Output and Capacity Utilization Comparison (10,000 tons)

Data Source: Oilchem

In 2025, total capacity is expected to reach 4.27 million tons, with a capacity growth rate of 26%.

Expansion is primarily driven by leading anode manufacturers building complete integrated processing chains and expanding market share. Small and mid-sized enterprises have limited expansion, and overall capacity growth is clearly slowing.

Annual output is expected to reach 2.52 million tons, and the pressure of capacity digestion will remain significant in 2025.

Leading enterprises are reducing costs and increasing efficiency by building their own graphitization lines, while small and mid-sized companies continue to face intense low-price competition. Utilization remains high among top players, but many second-tier and below companies operate below the industry average — some are forced to cut production or exit the market, accelerating the industry reshuffle.

From a competitive perspective, orders continue shifting toward financially strong and technologically advanced leaders. With overall capacity still excessive, many small manufacturers continue low-price strategies to secure orders — survival pressure remains high.

Although upstream raw material costs have risen continuously in recent days, major producers have not yet implemented price increases. With the tug-of-war between cost pressure and market competition, the overall upside space for anode material prices remains limited.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies