【Calcined Petroleum Coke】Market Prices Surge

【Calcined Petroleum Coke】Market Prices Surge

Market Overview

As of February 11, the average price of calcined petroleum coke rose to 3811 CNY/ton, up by 262 CNY/ton, an increase of 7.38% from the previous working day. Currently, the prices of low-sulfur calcined petroleum coke remain stable, but downstream companies are less accepting of the current prices, with overall procurement primarily based on rigid demand. For medium-high sulfur calcined coke, favorable raw material prices have led to price increases, but the market remains volatile with frequent price changes. Downstream demand remains cautious, leading to fewer actual transactions, and most calcined petroleum coke companies have paused quoting or delivery.

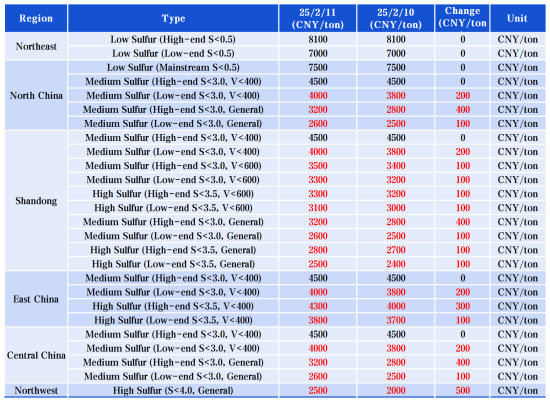

Key Regional Market Prices

1. Low Sulfur Calcined Coke

(Jinxi, Jinzhou petroleum coke as raw material) Market price: 7000-7300 CNY/ton

(Fushun petroleum coke as raw material) Ex-factory price: 7800-8100 CNY/ton

(Liaohe, Binzhou Zhonghai petroleum coke as raw material) Market price: 7000-7500 CNY/ton

2. Medium-High Sulfur Calcined Coke

(S<3.0%, trace elements not required) Previous price: 2500-2800 CNY/ton; current price: 2600-3200 CNY/ton

(S<3.5%, trace elements not required) Previous price: 2400-2700 CNY/ton; current price: 2500-2800 CNY/ton

(S<3.0%, V<400) Previous price: 3800-4500 CNY/ton; current price: 4000-4500 CNY/ton

Supply and Demand

Current national daily supply of commercial calcined petroleum coke is 26,834 tons, with an operating rate of 59.96%, stable compared to the previous working day.

Upstream Market

Sinopec refineries are actively selling, with price increases across various regions:

Jiangsu region (anode-grade coke) increased by 500-600 CNY/ton

General coke up by 400-600 CNY/ton

East China up by 50-500 CNY/ton

Other regions have seen increases ranging from 50 to 700 CNY/ton.

Downstream Market:

Graphite Electrodes:With petroleum coke prices continuing to rise, the price of needle coke and calcined coke has increased, putting upward pressure on graphite electrode production costs. The market for graphite electrodes is relatively steady, with companies looking for price increases.

Aluminum: Policies to stimulate consumption and address structural issues have led to a rise in spot aluminum prices.

Anode Materials: While downstream demand for anode materials remains stable, rising raw material costs are pushing anode material companies to increase prices, though new orders are still being negotiated.

Market Outlook

The price of low-sulfur calcined coke will continue to be driven by raw material costs, and with low-sulfur petroleum coke prices fluctuating, medium-high sulfur calcined coke companies are likely to adjust prices upwards under cost pressures.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies