With Cost support, graphite electrode prices up

With Cost support, graphite electrode prices up

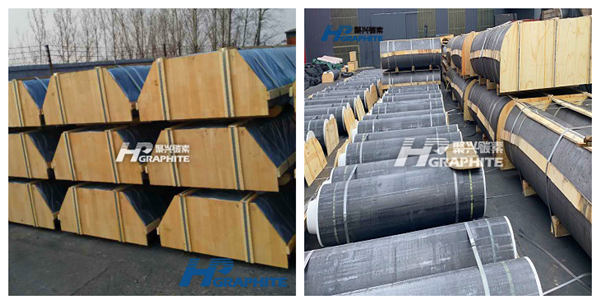

At present, China’s graphite electrode price has increased by 1500-2000 yuan/ton. As of May 5, 2022, China’s graphite electrode diameter of 300-600mm mainstream prices: regular power was 22500-25000 yuan/ton; High power was 24000-27000 yuan/ton; Ultra-high power was 25500-29500 yuan/ton; Ultra-high power diameter of 700mm was 31000-33000 yuan/ton.

Graphite electrode price increase is still mainly affected by raw materials price rise. Under the continuous high pressure of graphite electrode cost, graphite electrode enterprises profits are limited, enterprises production is cautious. Some small and medium-sized graphite electrode enterprises control production individually. The overall operation of graphite electrode market is insufficient, enterprises quotation is relatively strong. Under cost pressure, graphite electrode price continues to rise with the price of raw materials. The specific analysis is as follows:

1. High cost pressure drives up graphite electrode price

Supported by the anode material market demand, the prices of graphite electrode upstream low sulfur petroleum coke and other raw materials continued to rise. The price inflation far in excess of graphite electrode market price growth. Based on the price of low sulfur petroleum coke, needle coke and coal tar pitch in current graphite electrode upstream market, theoretically, current graphite electrode market comprehensive cost is about 23000 yuan/ton. Overall graphite electrode market profit margin is insufficient, graphite electrode prices have room to push up.

In addition, the cost pressure of graphite electrode enterprises with incomplete processes is more obvious. Affected by anode material market, some graphite electrode processing enterprises turn to do anode material graphitization and graphite crucible under the influence of profits, resulting in graphitization and baking processing resources shortage in the graphite electrode market. At present, graphite electrode graphitization price is about 5000-5300 yuan/ton, and individual prices are 5600 yuan/ton.

2. Insufficient operation of graphite electrode market, enterprise strong quotation

It is understood that the overall operation of the graphite electrode market is still insufficient. On the one hand, some regions’ epidemic control is still relatively strict, raw materials transportation is more difficult, and enterprises consume inventory raw materials for production; In some regions are controlled by region, and enterprises production is also limited; On the other hand, due to the high price of graphite electrode upstream raw materials and the characteristics of long production cycle and lagging capacity release of graphite electrode, some graphite electrode enterprises have a certain concern and control production to reduce risks.

By the end of March, graphite electrode market operating rate was about 50%. In April, affected by epidemic control and other factors, the increase of market output was limited. Up to now, some graphite electrode enterprises in Hebei, Shanxi and other regions have not started the molding process, and it is understood that under high costs influence, some graphite electrode enterprises have continued to suspend part of the production process.

3. Graphite electrode enterprises are optimistic about market demand

In terms of long-process steel plants: At present, some long-process steel plants have increased production and increased the procurement of UHP graphite electrodes with small and medium specifications. However, as the terminal steel market is still weak, most steel plants purchase on demand.

In terms of EAF steel plants: In the first quarter, the profits of EAF steel plants continued to be low, and recently the epidemic control in some regions limits production and steel plants were in a low-level operation state. In the first quarter, EAF steel plants mainly consumes the early inventory. It is expected that epidemic impact will be weakened in May and steel plants have the demand to replenish inventory.

In terms of non-steel: Yellow phosphorus, metal silicon and other products have a stable demand of graphite electrodes, due to the large specifications RP graphite electrode production is insufficient, the market demand is better, some specifications graphite electrodes supply is tight.

In terms of export: At present, although the EU anti-dumping, shortage of land transportation and shipping resources and other factors are still limited to China's graphite electrode export, the EU delay in levying anti-dumping duties on China's graphite electrode is good for graphite electrode export, some overseas enterprises and traders have a certain stock demand.

Future forecast: At present, the supply and demand of graphite electrode market are both weak. Under the pressure of insufficient construction and high cost, most graphite electrode enterprises push up prices. However, the downstream demand has not improved significantly, graphite electrode price increase is limited, therefore, in general, graphite electrode price is mainly implemented according to the current gradually rising price. Under the expectation that the cost and demand for graphite electrode are both increasing, graphite electrode price may still rise. For more professional analysis of graphite electrode market, please contact us.

No related results found

0 Replies