【Anode Materials】Power Demand Declines M-O-M, Anode Material Production Based on Sales

Graphitized Carburant: Mainly used in the metallurgical industry, especially in steelmaking and foundry processes, to increase the carbon content in molten steel. Juxing Carbon's graphitized carburant, made from petroleum-based coke and processed through high-temperature graphitization, offers high carbon content, low sulfur, low ash, high conductivity, and fast absorption. It's particularly effective in electric arc furnace (EAF) steelmaking, improving the quality of molten steel and reducing impurity levels.

【Anode Materials】Power Demand Declines Month-on-Month, Anode Material Production Based on Sales

In January, the production and installation of power batteries in China declined month-on-month, with a decrease in consumption demand in the power sector. After the Spring Festival, downstream demand is expected to return to normal. The anode material market is facing high raw material cost pressures, with production primarily determined by sales.

I. Power Battery Installation Declines Month-on-Month

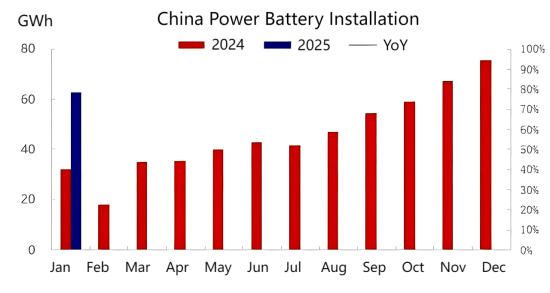

Figure 1: China Power Battery Installation

Source: Oilchem

In January, the total production of power and other batteries in China was 107.8 GWh, a 13.4% decrease month-on-month but a 63.2% increase year-on-year. Of this, power battery sales accounted for 62.9 GWh, or 78.3% of total sales, down 34.7% month-on-month but up 24.6% year-on-year. Sales of other batteries were 17.5 GWh, or 21.7% of the total, down 42.1% month-on-month but up 163.6% year-on-year. While power battery sales showed significant growth compared to last year, the month-on-month decline was mainly due to the surge in the December power market, followed by a normal seasonal adjustment.

II. New Energy Vehicle Sales Decline Month-on-Month

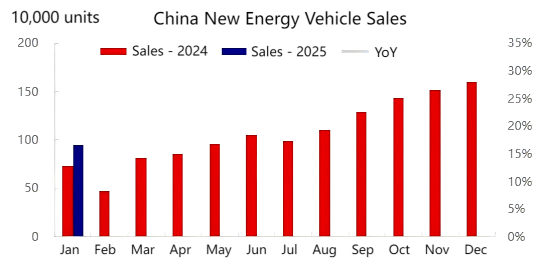

Figure 2: China New Energy Vehicle Sales

Source: Oilchem

In January, production and sales of new energy vehicles (NEVs) reached 1.015 million and 944,000 units, respectively, showing a year-on-year growth of 29% and 29.4%, but a month-on-month decrease of 33.7% and 40.8%. Sales of new vehicles accounted for 38.9% of total car sales. The month-on-month decline in January NEV sales was expected due to the impact of the Spring Festival. The implementation of the 2025 vehicle replacement subsidy policy is expected to further release the market potential of NEVs. The car market is expected to gradually recover after the holiday, with terminal demand for NEVs expected to remain positive.

III. Anode Material Production to Decrease in February

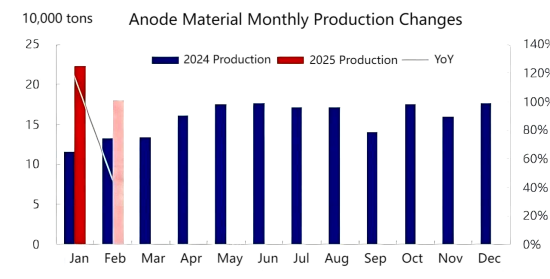

Figure 3: Anode Material Monthly Production Changes

Source: Oilchem

In January, the monthly production of anode materials reached 223,000 tons, a year-on-year increase of 27.86%. The production of anode materials is mainly determined by downstream demand. In February, the production schedules of leading lithium battery companies showed a decline, and the shorter production cycle in February was a key factor behind the reduced output. It is expected that February's production of anode materials will remain above 180,000 tons, showing a year-on-year increase of 45%, but a month-on-month decline of 19%.

IV. Slight Increase in Anode Material Prices

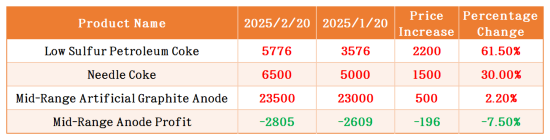

Table 1: February Anode Material Raw Material and Profit Changes

Source: Oilchem

Month-on-month in February, the prices of two major raw materials for anode material production saw sharp increases. The price of low-sulfur petroleum coke rose by 2,200 RMB/ton, a 61.52% increase, while the price of needle coke rose by 1,500 RMB/ton, a 30% increase. This led to an intensification of losses in anode material production, with the loss per ton widening from 2,609 RMB to 2,805 RMB. If this continues, anode material manufacturers will struggle to sustain operations, and there are strong calls for price increases. Currently, new small orders for anode materials have seen a slight price rise, and negotiations are ongoing between anode material manufacturers and major battery companies for a new round of order pricing. Downstream companies are facing the pressure of NEV price reductions, and the price transmission mechanism for anode materials is nearing a breaking point, with significant resistance to further price increases.

Conclusion

Overall, although the downstream demand for anode materials has declined month-on-month, this seasonal change is normal. Year-on-year terminal demand for NEVs is expected to improve, and energy storage demand is expected to maintain high growth. With both electric and energy storage driving forces, the demand for lithium batteries remains positive. Leading anode material companies have sufficient orders and will maintain high operating levels. Poor profits will accelerate the exit of smaller companies, and industry concentration in the anode material sector will further increase.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies