【Petroleum Coke】Market Driven Upward: 3.28% Year-on-Year Increase in Early 2025 Imports

Calcined petroleum coke is a vital material in modern manufacturing, particularly in the aluminum and steel industries. Its high carbon content, low sulfur levels, and minimal impurities make it an ideal choice for various applications.

【Petroleum Coke】Market Driven Upward: 3.28% Year-on-Year Increase in Early 2025 Imports

Since Q4 2024, China's petroleum coke market has been on an upward trend, with strong buying interest from downstream enterprises and active trading. Port spot petroleum coke prices have risen accordingly. Driven by domestic market conditions, overseas petroleum coke orders have increased, leading to a 3.28% year-on-year growth in January-February imports.

1. Active Overseas Orders: Monthly Import Growth Exceeds 3%

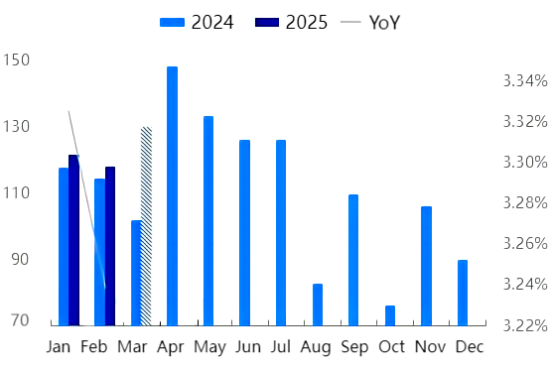

Figure 1: Monthly Petroleum Coke Import Volume Chart (2024-2025) (10,000 tons)

(Source: Customs Data)

According to China Customs data, China's January-February 2025 petroleum coke imports totaled 2.3941 million tons, up 76,100 tons year-on-year, an increase of 3.28%.

January imports: 1.2142 million tons, up 34.91% MoM and 3.33% YoY. February imports: 1.1799 million tons, down 2.82% MoM, but still showing a 3.24% YoY increase.

The positive trading sentiment at the end of 2024 led to higher overseas orders, significantly boosting early 2025 imports. As domestic prices continued rising, traders increased overseas purchases, and March imports are expected to remain high at around 1.3 million tons, with Q1 total imports forecast to grow by over 10% YoY.

2. Changes in Import Structure: Medium-Sulfur Coke Share Increases by 12%

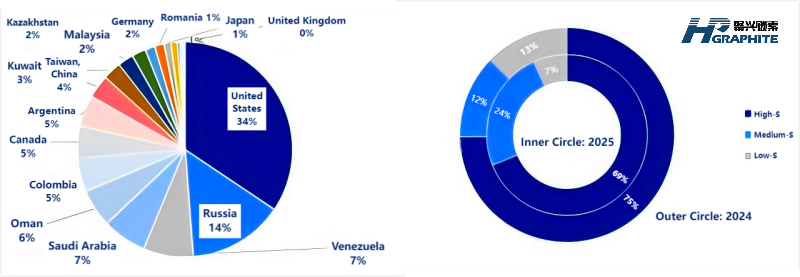

Figure 2: Distribution of Petroleum Coke Import Sources (Jan-Feb 2025)

Figure 3: Specification Structure of Imported Petroleum Coke (Jan-Feb 2025)

(Source: Oilchem)

Customs data indicates that high-sulfur petroleum coke remains the dominant import category, accounting for 69% of total imports, though down 6 percentage points year-on-year.

High-sulfur coke imports: 1.6489 million tons, down 82,300 tons (4.75% YoY). Major sources: U.S., Russia, Venezuela, Saudi Arabia, and Oman, primarily supplying high-sulfur coke. Oman made a breakthrough in 1-2M 2025, reaching zero-to-positive import volumes, mainly pellet coke used in blending by carbon enterprises in Shandong and Henan. Medium-sulfur petroleum coke imports surged to 582,300 tons, up 99.66% YoY, now making up 24% of total imports. Key sources: BP (Europe) 40,000 tons, as well as concentrated imports from Russia, Kuwait, and the U.S.. Downstream demand is strong, supporting higher medium-sulfur coke sales, with prices rising accordingly.

Low-sulfur petroleum coke imports fell by 6 percentage points, totaling 162,900 tons. Key reasons: Indonesia's refinery supply disruptions, reducing exports to just 10,000 tons, a 75% YoY decline. Small increases from Azerbaijan and Argentina, but with no recorded Brazilian imports, total low-sulfur coke imports fell by 44.82%.

3. Strong Demand Drives Down Port Inventory

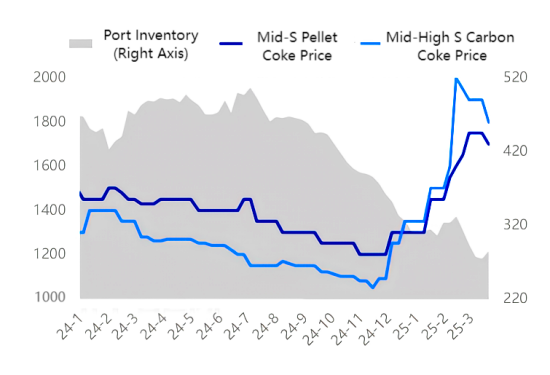

Figure 4: Comparison of Petroleum Coke Port Inventory and Import Coke Prices (CNY/ton, 10,000 tons)

(Source: Oilchem)

Supported by steady downstream demand, spot petroleum coke prices at ports rose 30-48% compared to late 2024. Early 2025: Port inventories remained around 3 million tons, briefly rising to 3.2 million tons due to logistics slowdowns before and after the Spring Festival. Early February: Improved market sales drove inventories down to 2.7 million tons.

By early March, trading slowed slightly, and some import prices adjusted downward, causing port inventory to rise slightly to 2.8 million tons due to concentrated imports and some domestic stockpiling.

Market Outlook

Late March-April: End-users expected to resume purchases as production ramps up. Domestic refineries to enter maintenance season, tightening supply. Spot petroleum coke prices may rise by another 100-200 CNY/ton. Port inventories may decline to around 2.6 million tons.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies