【Calcined Petroleum Coke】Price Hiked by 100 Yuan! Market Prices Rise Across the Board ...

【Calcined Petroleum Coke】Price Hiked by 100 Yuan! Market Prices Rise Across the Board This Week, Downstream Stockpiling Intentions Strengthen

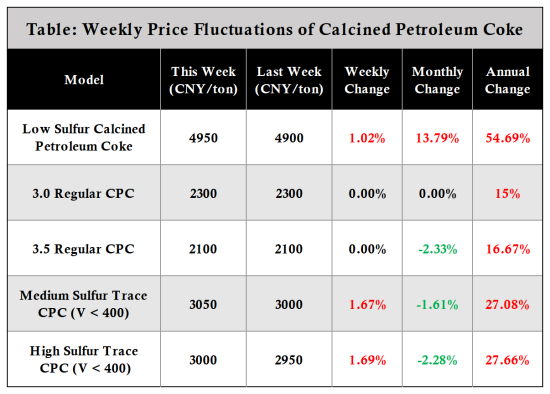

Weekly Price Trend Analysis of Calcined Petroleum Coke

This week (July 18–24, 2025), the domestic calcined petroleum coke (CPC) market witnessed moderate trading activity. Supported by favorable raw material prices, the prices of various grades of CPC increased across the board.

Low-Sulfur CPC: In Northeast China, the price of green petroleum coke was raised over the weekend. Due to low inventory levels, most low-sulfur CPC enterprises were firm on their prices and actively shipping. Some producers increased their quotations by 50–100 yuan/ton.

Medium-to-High Sulfur CPC: With the continuous upward push in green coke prices this week, cost support helped improve CPC shipments. Prices of medium-to-high sulfur CPC rose by 30–100 yuan/ton, although the increase lagged behind that of green coke.

As of July 24:

1. The average market price of low-sulfur CPC stood at 4,950 yuan/ton, up 50 yuan/ton from the same time last week, an increase of 1.02%.

2. The average market price of sulfur 3.0% standard CPC remained stable at 2,300 yuan/ton.

3. The average market price of sulfur 3.0%, vanadium <400PPM CPC rose to 3,050 yuan/ton, up 50 yuan/ton, or 1.67%.

4. The average market price of sulfur 3.5% standard CPC held steady at 2,100 yuan/ton.

5. The average market price of sulfur 3.5%, vanadium <400PPM CPC climbed to 3,000 yuan/ton, up 50 yuan/ton, an increase of 1.69%.

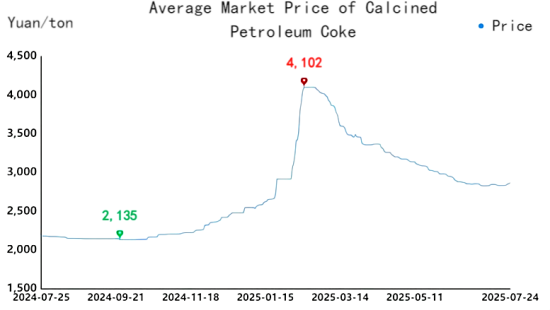

Average Market Price of Calcined Petroleum Coke

Low-Sulfur CPC

This week, the low-sulfur CPC market saw active sales. In the Northeast, green coke prices continued to rise, and producers with low inventories were firm in holding prices. Some increased quotations by 50–100 yuan/ton to match raw material costs.

Market Situation:

According to statistics, shipments of low-sulfur green petroleum coke in Northeast China were brisk this week. Favorable raw material factors prompted downstream buyers to increase stockpiling. CPC producers were generally firm in their pricing, although most remained cautious about the future market trend, maintaining current production and sales rhythms, and generally adopting a production-by-order strategy.

Price Situation:

As of Thursday, July 24:

1. Low-sulfur CPC (using Jinxi and Jinzhou green coke as raw material): Mainstream transaction prices were 4,700–5,100 yuan/ton;

2. Low-sulfur CPC (using Fushun green coke): Mainstream ex-factory transaction prices were 5,800–6,100 yuan/ton;

3. Low-sulfur CPC (using Liaohe and Binzhou CNOOC green coke): Mainstream transaction prices were 4,200–5,000 yuan/ton.

Medium-to-High Sulfur CPC

This week, the medium-to-high sulfur CPC market experienced improved trading. The continuous rise in green coke prices boosted the willingness of various grades of CPC producers to ship, and ex-factory prices were raised by 30–100 yuan/ton. However, the price hikes lagged behind green coke increases, and the producers' losses were not significantly alleviated.

Market Situation:

The medium-to-high sulfur CPC market was moderately strong this week. Raw material prices rose across the board, prompting CPC prices to follow. Most producers had low inventories, but the slower rise in CPC prices meant that many enterprises continued to face production losses and were reluctant to accept low-priced orders.

Price Situation:

As of Thursday, July 24:

1. Sulfur 3.0%, no requirement for trace elements: Mainstream ex-factory transaction prices were around 2,300 yuan/ton;

2. Sulfur 3.5%, no requirement for trace elements: Mainstream ex-factory transaction prices were 2,050–2,100 yuan/ton;

3. Sulfur 3.0%, only vanadium <600PPM required, no other trace element requirements: Mainstream ex-factory prices were 2,680–2,800 yuan/ton;

4. Sulfur 3.0%, only vanadium <500PPM required, no other trace element requirements: Mainstream ex-factory prices were 2,700–2,900 yuan/ton;

5. Sulfur 3.0%, only vanadium <400PPM required, no other trace element requirements: Mainstream ex-factory prices were 3,000–3,100 yuan/ton;

6. Sulfur 3.0%, high-end export (strict trace element requirements): Prices to be negotiated with enterprises.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies