【Electric Furnace Steel】China Graphite Electrode Market Outlook for December

【Electric Furnace Steel】China Graphite Electrode Market Outlook for December

In November, under the dual pressure of environmental control policies and weak finished-steel margins, steel mill bidding slowed down. Meanwhile, raw material petroleum coke prices rose and then stabilized, and the high production cost of graphite electrodes remained difficult to ease in the short term. As we enter December, how will China's graphite electrode market evolve amid the game between costs and demand?

I. Graphite Electrode Prices Ran Steady with Mild Adjustments in November

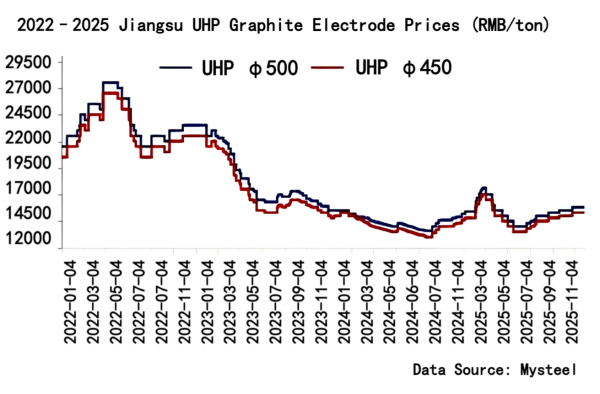

In November, the domestic graphite electrode market operated steadily with slight adjustments. As of November 30, the price of φ450 UHP graphite electrodes was 15,300 RMB/ton, and the price of φ500 UHP graphite electrodes was 15,800 RMB/ton. Transactions showed that low-priced resources moved upward, while suppliers' quotations remained relatively firm.

II. High Costs Support Suppliers' Firm Pricing

From the raw material perspective, both petroleum coke and coal tar pitch prices increased in November, keeping graphite electrode production costs on the stronger side. Based on theoretical calculations and taking the price of φ500 UHP electrodes as an example, although losses narrowed in November, graphite electrode prices were still at the break-even point. From the perspective of profit analysis, graphite electrode profits increased month-on-month by 67.69%, and the average profit in November was around -84 RMB/ton. Some companies with better cost control achieved slight profits. Suppliers continued to defend the price gains achieved earlier and maintained strong pricing intentions.

III. Export Orders Remain Acceptable, Providing Some Demand Support

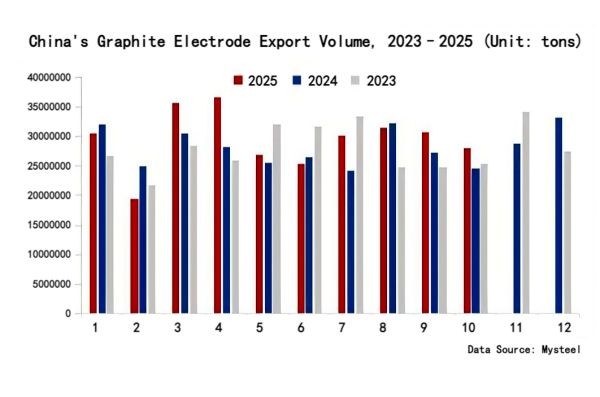

In terms of exports, China's graphite electrode export volume in October 2025 was 28,100 tons, down 8.23% month-on-month. Overseas demand also showed weakness. From November to mid-December, due to trade policy factors, export volumes may be released ahead of schedule, and December exports may decline after mid-month.

IV. Increased Steel Mill Maintenance Slows Down Bidding Pace

In November, many steel mills carried out year-end maintenance, and such maintenance continued into December. According to industry surveys, some steel mills still have maintenance plans for December. Graphite electrode procurement and bidding from steel mills have been delayed, reducing demand.

V. Summary and Outlook

In December, most graphite electrode suppliers are maintaining normal production to prepare for steel mill stocking before the Spring Festival, so production and supply remain relatively stable. On the demand side, both domestic and overseas markets face the risk of demand softening, and transaction performance may trend slightly weaker. Raw material prices remain high, and combined with profits hovering near break-even, suppliers' quotations are expected to remain firm. Overall, the domestic graphite electrode market is expected to operate with stable, mildly adjusted trends in December.

(Source: Mysteel)

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies