【Petroleum Coke】Prices Fluctuate Sharply – Refineries Rushing Shipments to Reduce Inventory?

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Prices Fluctuate Sharply – Refineries Rushing Shipments to Reduce Inventory?

Petroleum Coke Market Analysis

1.1 Petroleum Coke Market Analysis

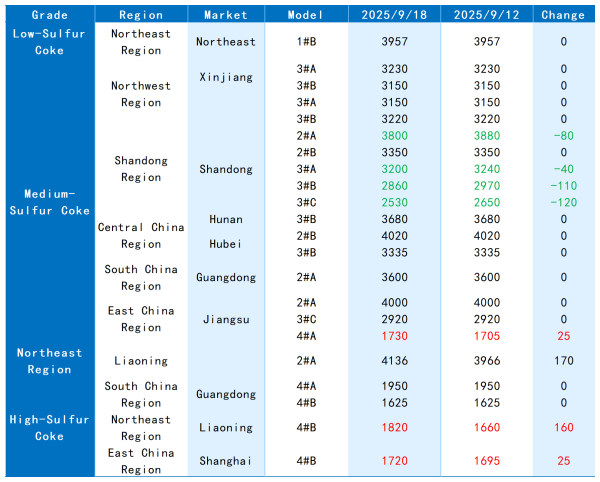

Market Analysis: This week, the petroleum coke market saw weaker trading performance, with both price increases and decreases appearing. Local refineries were actively shipping out goods, with transaction prices showing a steady-to-weak trend. As of this Thursday, in Northeast China, the price of 1# coke was 3,957 RMB/ton, unchanged from last week. In Shandong, coke prices mostly declined, with drops ranging from 40 to 120 RMB/ton. During the week, refineries actively pushed shipments, with low-sulfur coke remaining stable while high-sulfur coke quotations fell. In Central China, coke prices temporarily stabilized; in Hunan, 3#B was quoted at 3,680 RMB/ton, while in Hubei prices ranged from 3,335 to 4,020 RMB/ton, with good trading activity. In East China, the market saw smooth shipments, with Shanghai 4#B quoted at 1,720 RMB/ton, up 25 RMB/ton from last week, and most downstream players held a bullish mindset.

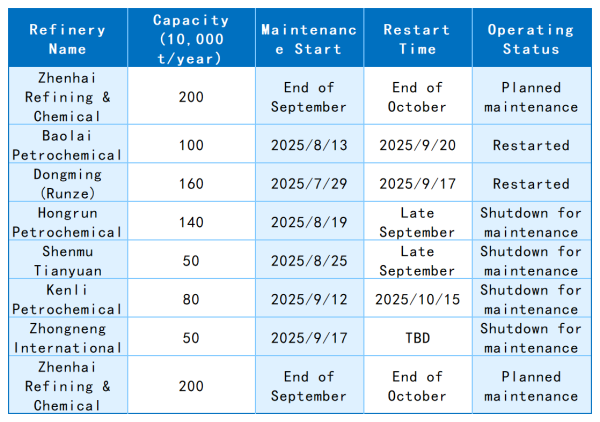

Supply Side: Currently, China's petroleum coke supply remains sufficient. Next week, Baolai Petrochemical will resume production, adding to output. Imported coke shipments from ports are proceeding smoothly, and port inventories are falling.

Demand Side: Downstream buying momentum has slowed somewhat. However, with the upcoming "Double Festival" holidays, some traders have already started stocking in advance, keeping overall supply and demand balanced.

Outlook: Overall, it is expected that mainstream petroleum coke prices in China will operate steadily to slightly stronger next week. However, close attention is still needed on refinery operating conditions and downstream demand follow-up.

1.2 Petroleum Coke Market Price Comparison

Unit: RMB/ton

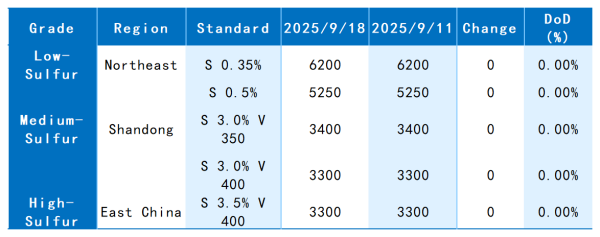

1.3 Calcined Petroleum Coke Market Price Comparison

Unit: RMB/ton

Operating Conditions of Domestic Facilities

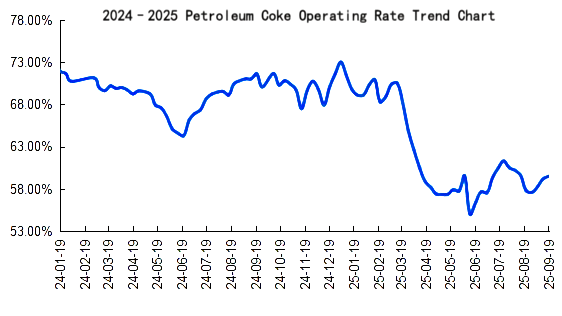

Delayed Coking Unit Operating Rate in China

This week, the operating rate of delayed coking units continued to edge up slightly. As of September 19, the operating rate of the petroleum coke market stood at 59.56%. This week, Dongming Petrochemical Runze Plant, Qingyuan Fangyu Petrochemical, and Tianjin Dongsheng Coking units resumed operations, while Kenli Petrochemical shut down for maintenance, leading to increased petroleum coke output.

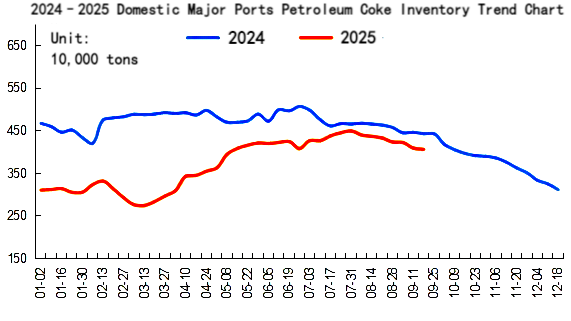

Domestic Petroleum Coke Port Inventory Analysis

This week, total petroleum coke port inventory was about 4.064 million tons, a decrease of 28,000 tons compared with last week. Currently, port spot shipments are stable. Newly arrived imported petroleum coke has not yet been fully warehoused, and inbound volume is smaller than outbound, resulting in declining inventories.

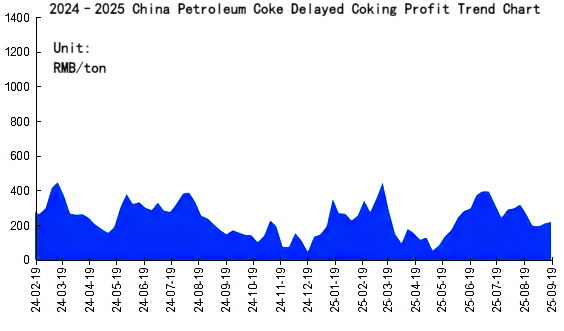

Petroleum Coke Delayed Coking Profit Trend in China

This week, China's petroleum coke delayed coking sample production remained decent, with costs decreasing while other coking by-product prices fluctuated, leading to a slight overall decline. The drop in coking costs was larger than the decline in coking product prices, so theoretical delayed coking profits rose slightly. Current profitability is about 222 RMB/ton, up 8 RMB/ton week-on-week (+3.74%), and up 77.52 RMB/ton year-on-year (+53.65%).

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies