【Petroleum Coke 2025 Review】Sharp Price Swings, Market Expected to Remain Strong

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke 2025 Review】Sharp Price Swings, Market Expected to Remain Strong

I. 2025 Market Overview

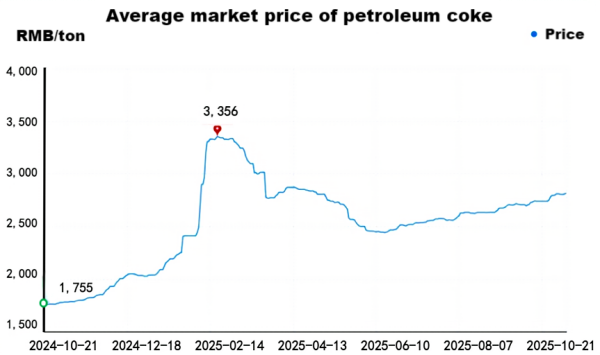

The petroleum coke market in 2025 experienced dramatic fluctuations. Changes in supply and demand led to sharp rises and falls in prices, forming an "N-shaped" trend — rising first, then falling, followed by a rebound.

In the early stage, supply was lower than demand, pushing prices upward. Later, as port arrivals increased and prices fell, the combined impact of earlier price hikes and anticipated tariff increases triggered a surge in petroleum coke imports, reversing supply-demand conditions and dragging prices down. In the second half of the year, demand gradually recovered, coupled with more refinery shutdowns for maintenance, leading to a steady rebound in coke prices.

Overall supply in 2025 showed mixed performance. On one hand, domestic refinery shutdowns and maintenance increased, resulting in a 6.25% decrease in total output compared to the same period in 2024 (January–September). On the other hand, due to tariff and market influences, port inventories remained relatively high. From January to September, total imports reached 11.9537 million tons, up 12.83% year-on-year.

Downstream demand performed well — carbon products, as a traditional downstream sector, provided a firm base for petroleum coke demand, while anode materials maintained increasing orders from the start of the year. Coal supply remained ample with persistently weak prices, offering limited support to the coke market. Demand for high-sulfur fuel-grade coke weakened. Affected by tariffs, pellet coke costs increased, pushing prices upward. The key market influences are as follows:

No new delayed coking units were added in 2025, while domestic refinery shutdowns increased. By October, there had been 50 instances of maintenance, reducing total output year-on-year. Besides routine maintenance, some major refineries cut production due to constraints in producing marine fuel or raw material shortages, tightening low-sulfur coke supply. Meanwhile, due to Sinopec's raw material adjustments, part of the high-sulfur coke production shifted to medium-sulfur coke, creating an uneven change in production levels. Local refineries reduced output due to poor profits and limited raw materials.

Port inventories remained low early in the year, reaching an annual low in March before continuously accumulating. Meanwhile, some overseas low-sulfur coke supplies faced maintenance or shipping delays, keeping domestic port inventories low. Combined with decreased domestic supply and active downstream restocking, overseas low-sulfur sponge coke tender prices rose sharply, quickly followed by domestic prices.

Rapid price hikes led to the release of high-priced port inventories. After downstream restocking ended, buyers were unable to absorb high prices, leading to cautious sentiment and reduced purchasing enthusiasm, causing prices to fall. Meanwhile, the reduced supply of high-sulfur coke pushed prices upward again.

From Q3 onward, some domestic low-sulfur refineries underwent maintenance. Supported by active restocking from anode and steel-related carbon enterprises, prices rose first, followed by mid- and high-sulfur and imported coke. Some local refiners adjusted prices periodically based on product quality or shipment pace, but average prices remained higher than in Q2, with upside limited by downstream affordability.

Throughout Q1, both China and the U.S. issued multiple industrial and trade policies. Stimulated by earlier price hikes and tariff expectations, imports of U.S. mid- and high-sulfur shot coke surged in Q2, sharply increasing port inventories. Coupled with weak coal markets and sluggish demand from non-carbon downstream sectors, high-sulfur shot coke sales were pressured. In Q3, silicon producers restocked intermittently, depleting inventories. Positive sentiment from tariff news boosted U.S. coke trading activity and accelerated spot price increases.

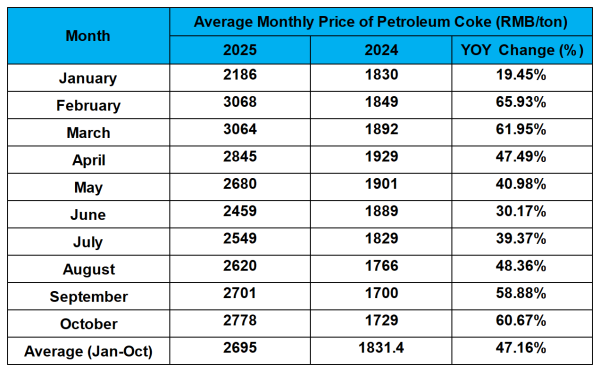

II. 2025 Price Analysis

Main petroleum coke price ranges in 2025:

Low-sulfur coke (≤1.0% S): 2,920–6,000 RMB/ton

Medium-sulfur coke (~3.0% S, V ≤ 400): 2,150–3,760 RMB/ton

High-sulfur coke (~3.5% S, V > 400): 1,350–2,973 RMB/ton

Very high-sulfur coke (~5.0% S, V > 600): 1,103–2,530 RMB/ton

Sponge Coke

1. Low-Sulfur Petroleum Coke:

In 2025, low-sulfur petroleum coke prices fluctuated significantly, showing a pattern of "sharp rise – steady decline – mild rebound." Prices increased 710–950 RMB/ton compared with early-year levels. Market dynamics were marked by strong supply-demand competition — early refinery maintenance reduced supply, while low port inventories and strong restocking from anode and carbon sectors drove prices to yearly highs. By March, as port arrivals rose and production recovered, the supply-side advantage faded. With restocking complete, prices entered a downward trend, bottoming mid-year before rebounding slightly as downstream demand recovered.

Specifically, in January–February, refinery maintenance and limited imported low-sulfur supply created a tight market. Strong pre- and post-holiday restocking pushed prices up sharply. By March, restocking ended and high prices dampened buying interest, leading to inventory buildup and falling prices. In early April, maintenance at Jinxi Petrochemical and Daqing Petrochemical temporarily supported prices, but weak demand and abundant imports pushed prices down again. In H2, as downstream inventories depleted and new procurement plans emerged (notably from Fushun Petrochemical maintenance), anode and carbon manufacturers resumed restocking. With stable demand and reduced supply, prices entered a mild upward phase.

Supply-wise, six domestic refineries conducted maintenance in 2025, involving 8.3 million tons/year of capacity. Imported low-sulfur micro coke from Brazil and Argentina increased starting in April, driving up port inventories. Overall, low-sulfur supply was tight early in the year but eased later.

2. Medium- and High-Sulfur Petroleum Coke:

The 2025 market showed a "rise–fall–steady rebound" pattern, with price fluctuations of 150–890 RMB/ton. Early in the year, poor refinery margins and raw material shortages caused some Shandong refineries to halt or reduce production, shrinking supply. Meanwhile, anode and negative electrode manufacturers stocked up ahead of the Spring Festival, causing prices to spike. By mid-February, as the rally outpaced demand, buyer enthusiasm fell, pulling prices down. From April to May, sentiment stayed weak, keeping prices under pressure. By late June, rising low-sulfur prices lifted local refinery sentiment, and increased buying supported a mild price recovery. In Q3, frequent shutdowns cut supply further. Import price inversion and overseas refinery maintenance constrained imported coke, supporting domestic markets.

Downstream, anode and negative electrode firms purchased steadily in line with production schedules. Despite limited room for price hikes due to buyer constraints, local refinery prices continued mild upward movement.

3. Shot Coke:

Demand from the glass and silicon carbide sectors remained stable, while other high-sulfur fuel applications weakened under low coal prices. Imports of shot coke were heavily affected by tariffs — prices spiked in April–May due to tariff hikes but fell sharply afterward as imports surged and glass factories built up inventories. As stocks were drawn down, prices recovered in Q3, though slowly due to higher domestic production. In Q4, tariffs and shipping cost increases accelerated the rebound.

III. 2025 Supply Analysis

Total petroleum coke supply (domestic + imports) in 2025 decreased compared with 2024.

China's petroleum coke production totaled 30.263 million tons, down 5.75% year-on-year, with external sales of 25.4296 million tons.

Beyond regular maintenance, several factors affected output:

CNPC Dagang Petrochemical reduced production in February to produce marine fuel.

CNOOC Zhoushan Petrochemical faced price pressure and reduced output in April.

Sinopec refineries in East and North China adjusted feedstock, converting high-sulfur output to medium-sulfur.

Local refineries cut production due to poor profits and raw material shortages.

Weifang Fumei switched to needle coke in February.

In October, macro factors caused further feedstock tightness and output cuts.

According to customs data, January–September 2025 imports reached 11.9537 million tons, up 12.83% year-on-year.

In Q1, strong domestic demand and tight supply drove rapid imports. In Q2, large volumes of U.S. mid- and high-sulfur shot and sponge coke arrived due to tariff timing, causing inventories to surge. In Q3, imports dropped sharply as earlier arrivals saturated the market and margins inverted. In Q4, refinery maintenance in Russia's Daneco and Formosa Petrochemical (Taiwan) further reduced imported availability, while tariff concerns curbed new U.S. imports.

IV. 2025 Demand Analysis

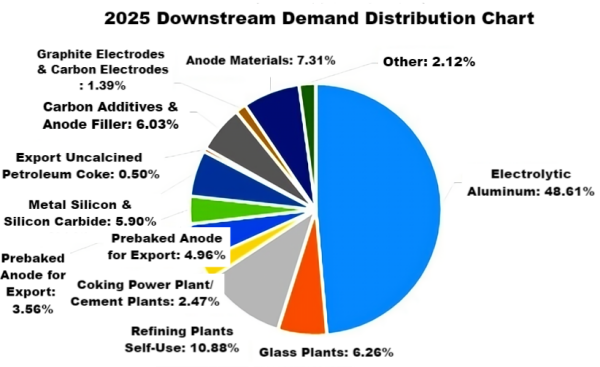

In 2025, carbon-related demand increased slightly, while non-carbon demand declined, reducing total consumption.

Sponge Coke Market

Total downstream demand reached 45.59 million tons, down 3.80% year-on-year.

Electrolytic aluminum prices held between 19,530–21,020 RMB/ton, peaking in September. Output remained high, with resumption of operations in Qinghai, Guangxi, Gansu, Xinjiang, and Guizhou.

Aluminum-related carbon materials remained the main demand source. Calcined coke transactions were steady, while low operating rates in the anode graphitization sector limited petroleum coke purchases. Prebaked anode production remained active, ensuring steady demand.

In H1, negative electrode producers adjusted output in line with sales, keeping load rates low. By August–September, large firms maintained high utilization rates, while smaller ones improved slightly during the seasonal upturn — becoming a key driver of price recovery.

Graphite electrode production stayed stable, with major producers maintaining balanced output and sales, limiting petroleum coke demand growth.

Metal silicon output increased in Q3, particularly in Northwest China, slightly lifting petroleum coke demand. Silicon carbide producers remained cautious, with many in Ningxia and Gansu cutting or halting operations, thus limiting demand.

Shot Coke Market

Fuel demand in southern China remained weak, with the coal market lacking bullish drivers. Silicon carbide faced weak demand and high inventory pressure, keeping consumption subdued. High-sulfur shot coke sales were average, focused on inventory digestion. Early September saw mild improvement in glass production, slightly lifting demand.

V. 2025 Local Refinery Coking Profit

In 2025, international crude oil prices were volatile, market sentiment unstable, and terminal demand lukewarm. Buyers remained cautious, with refineries mostly taking a wait-and-see attitude on fuel oil, while residue oil prices declined.

Gasoline demand was weak, prompting risk aversion and price drops; diesel prices also fell as buyers prioritized destocking. Other coking by-products saw occasional increases but generally trended downward.

By October 2025, local refinery coking profits averaged 127 RMB/ton, down 31.24% year-on-year.

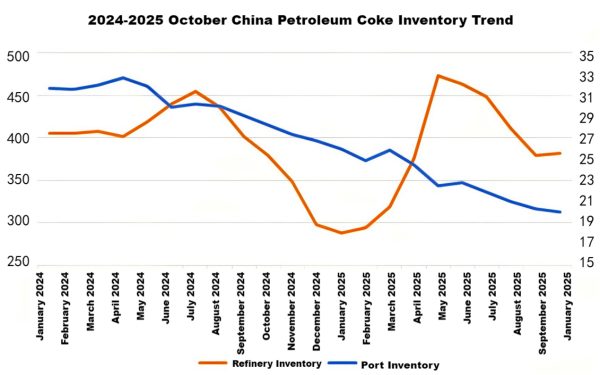

VI. 2025 Inventory Analysis

Petroleum coke prices fluctuated throughout 2025, following the "rise–fall–rebound" pattern. Refineries flexibly adjusted prices to ensure smooth sales, keeping inventories at medium to low levels.

From January to October, port inventories showed a "narrow fluctuation – rise – decline" pattern.

In January–February, active downstream demand kept turnover high. From March, as prices fell and shipments slowed, inventories accumulated. Q2 saw a surge in U.S. high-sulfur coke imports (up 67% YoY), while weak demand and inverted costs led traders to hold stocks, pushing inventories to highs. In Q3, demand recovery in sponge coke and anode sectors, along with higher silicon plant operations during the hydropower season, accelerated destocking — port inventories fell significantly.

VII. 2025 H2 Market Outlook

Supply:

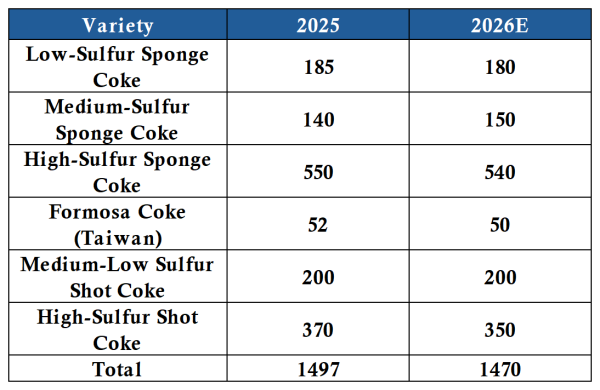

2026 petroleum coke total supply is expected at 31.82 million tons.

Major refineries' low-sulfur coke output will remain steady, with some maintenance plans in place. Medium-sulfur coke output will expand as Sinopec's East and North China refineries continue shifting from high- to medium-sulfur grades and increasing anode-grade production. Local refinery output will remain volatile due to profit pressure. One 2 million tons/year coking unit is expected to start by end-2025, and two additional 3.7 million tons/year delayed coking units in 2026 will further increase supply.

Imports:

2026 petroleum coke imports are expected at 14.8 million tons, down 1.3% year-on-year.

Steady demand from aluminum and anode sectors will support low-to-medium sulfur sponge coke imports, though cautious sentiment amid Sino-U.S. trade tensions and rising domestic capacity will limit import growth. High-sulfur shot coke imports may decline due to weak demand and tariff concerns.

Demand:

Downstream demand is expected to increase by 2.64% in 2026.

New carbon and anode capacities will sustain petroleum coke consumption growth. Demand from graphite electrodes, carbon electrodes, and metal silicon will edge up, while silicon carbide and glass sectors may weaken. Southern fuel markets will likely maintain weak stability.

Overall Outlook:

The 2026 petroleum coke market is expected to remain strong overall. Medium- and low-sulfur coke will continue to benefit from firm downstream demand and may rise further. High-sulfur coke prices are also expected to increase modestly, supported by domestic production cuts and external supply constraints.

Main Price Ranges:

Low-sulfur coke (~0.5% S): 3,850–4,500 RMB/ton

Medium-sulfur coke (≤3.0% S): 1,300–4,000 RMB/ton

High-sulfur coke (~5.0% S, regular grade): 900–3,000 RMB/ton

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies