【Steel】21 Steel Mills Halt Production! Construction Steel Shortages and Stockouts; ...

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel】21 Steel Mills Halt Production! Construction Steel Shortages and Stockouts; 25 Steel Mills Raise Prices!

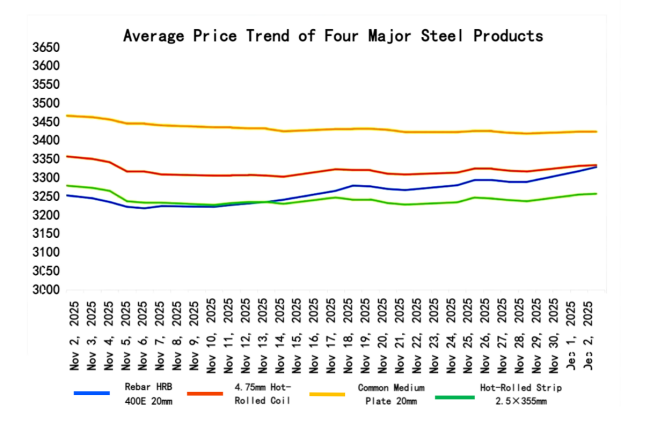

Steel Price Indicator: Up

On December 2, the ferrous futures market turned fully bullish. Both coke and coking coal continued yesterday's upward trend. Coke rose by more than 2%, and coking coal increased by nearly 2%, though both showed narrower gains than yesterday. In the spot market, prices mainly stabilized with mild increases, with construction steel up by 10–30 yuan/ton. A total of 25 steel mills collectively increased construction steel ex-factory prices by 10–50 yuan/ton. Due to shortages of certain construction steel specifications in the Yunnan–Guizhou region, Shuangyou and Qujing Hengté raised prices for rebar, wire rod, and coil by 50 yuan/ton.

Steel Price Trend on December 2

Futures closing prices on December 2:

Rebar closed at 3,133 (+11), hot-rolled coil at 3,325 (+10), iron ore at 800.5 (+4), coke at 1,629.5 (+39), and coking coal at 1,096.5 (+20). Coke recorded the largest increase at 2.45%, while coking coal rose 1.86%. Both coke and coking coal continued to climb, driven by supply-side disruptions.

Spot market:

Construction steel prices rose in 21 out of 31 markets, with gains of 10–30 yuan/ton. The average price reached 3,330 yuan/ton, up 10 yuan/ton from yesterday but with narrower momentum. Hot-rolled coil, strip steel, and medium plate remained mostly stable, with increases of 10–20 yuan/ton. Their average prices showed only slight increases of 1–2 yuan/ton.

According to incomplete statistics, around 25 steel mills adjusted construction steel ex-factory prices today.

Northwest region:

Shangang, Bayi, Kunyu, Minxin, Hegang, Xinan Special Steel, and Kunlun increased construction steel prices by 10 yuan/ton.

North China region:

Jinzhou, Donghua, Jinnan, Changzhi, Meijin, and Inner Mongolia Yaxin raised ex-factory prices for certain construction steel items by 10–30 yuan/ton.

East China region:

Shangang, Yongfeng, Shiheng, Changjiang, and Magang increased prices for some construction steel categories by 20–30 yuan/ton.

Southwest region:

Kungang, Yukun, Desheng, Chenggang, and Xianfu increased rebar, wire rod, and coil prices by 30 yuan/ton; Shuangyou and Qujing Hengté raised prices for rebar, wire rod, and coil by 50 yuan/ton.

Why Did Steel Prices Continue to Rise on December 2?

Steel prices on December 2 continued yesterday's upward trend, showing stable to moderately higher movement. The reasons include the following:

1. Fundamentals

Frequent production halts and maintenance at steel mills

From late November to now, steel mills have consistently announced production stoppages and maintenance plans. According to incomplete statistics, aside from seven Baowu Group mills scheduled for shutdowns, an additional 14 steel mills have issued maintenance plans, with the longest lasting up to 45 days.

Shortages of some rebar specifications in certain regions

According to research, mainstream steel mills in Yunnan and Guizhou are experiencing various degrees of specification shortages and stockouts.

In Guizhou, wire rod is almost entirely out of stock.

In Yunnan, 8mm coil is severely short.

Rebar specifications 14, 16, 20, and 22mm are seriously short or out of stock in Yunnan.

In Guizhou, large-diameter rebar (28, 32mm) is also in severe shortage or stockout.

Both mill inventories and social inventories in these two regions continue to decline, and shortages are unlikely to ease in the short term.

Coking coal supply disruptions boosting raw material prices

According to an announcement by the Henan Bureau of the National Mine Safety Supervision Administration, major safety hazards were found during an on-site inspection of Xinzhang Coal Mine under Henan Shenhuo Coal & Power Co. Ltd., which was still operating despite risks. The mine was ordered to suspend production for rectification for two days.

Additionally, Gaotouyao Ruiguang Coal Industry Co. Ltd. (capacity 1.8 million tons) in Ordos, Inner Mongolia, has been included in the list of mines to be closed in 2025. The mine applied to forgo subsidies, will handle worker resettlement and debt resolution independently, and must fulfill ecological restoration responsibilities.

Overall, due to safety inspections in major producing regions, mining constraints, and the implementation of Shanxi's new environmental rules, domestic coking coal mine operating rates remain restricted. Supply stays tight. Although Mongolian coal imports remain stable, they cannot fully compensate for the domestic shortage.

2. Macro Factors

Higher expectations of a Fed rate cut in December

Bank of America stated on Monday that due to a weakening labor market and recent hints from policymakers about possible easing, it now expects the Federal Reserve to cut rates by 25 basis points in December. Previously, it expected the Fed to hold rates unchanged this month.

U. S. manufacturing contracts for the ninth straight month in November

According to the ISM report released on December 1, U.S. manufacturing activity contracted for the ninth consecutive month due to tariff policy and fiscal uncertainty. The November PMI fell to 48.2 from 48.7 in October, below the market expectation of 49.

Local government bond issuance exceeds 10 trillion yuan for the first time

According to data, as of December 2, total local government bond issuance reached about 10.1 trillion yuan. Based on data from the PBoC and the Ministry of Finance, this marks the first time issuance has exceeded 10 trillion yuan in a single year.

Steel Prices Expected to Show Stable-to-Firm Fluctuations

The current market rally is mainly driven by:

concentrated maintenance across steel mills and shortages in certain rebar specifications,

coupled with raw material cost increases due to coking coal supply concerns.

On the macro level, the surge in special bond issuance boosts expectations of future demand improvement.

From actual data, however, spot price increases have clearly narrowed on December 2, suggesting that demand is struggling to digest higher prices. Transactions have not significantly increased. Without new positive catalysts, further steel price increases will lose momentum.

Forecast:

Tomorrow's market will likely remain stable overall, with certain regions or products possibly seeing small increases of 10–20 yuan/ton.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies