【Petroleum Coke】Refineries Actively Ship to Boost Volumes; Calcined Petroleum Coke...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Refineries Actively Ship to Boost Volumes; Calcined Petroleum Coke Market Operates Steadily

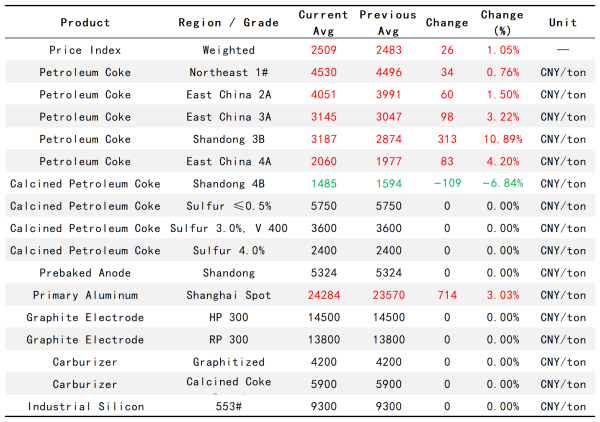

Weekly Overview of the Petroleum Coke Market

Petroleum coke market trading activity shifted from strong to weak, with refineries focusing on active shipments to boost sales volumes.

During this period (January 9, 2026 – January 15, 2026, same below), petroleum coke prices rose first and then declined. The weekly average price of Northeast China 1# coke increased to RMB 4,530/ton, up RMB 34/ton, a rise of 0.76%; East China 2A rose to RMB 4,051/ton, up RMB 60/ton, an increase of 1.50%; Shandong 3B climbed to RMB 3,187/ton, up RMB 313/ton, a sharp increase of 10.89%; East China 4A rose to RMB 2,060/ton, up RMB 83/ton, an increase of 4.20%; while Shandong 4B fell to RMB 1,485/ton, down RMB 109/ton, a decrease of 6.84%.

During this period, market trading activity shifted from strong to weak. Prices rose significantly in the early stage and retreated later. Prices at major state-owned refineries were mainly stable with slight increases, ranging from RMB 20–200/ton. After prices at independent refineries reached high levels, shipment pace slowed, and prices were lowered to promote sales, with declines of RMB 10–190/ton.

It is expected that petroleum coke output will decline in the next period, imported coke will continue to enter inventories, and port inventories will increase slightly. Key points to monitor include:

Supply side: Zhejiang Petrochemical suspended operations for coke cleaning, leading to a reduction in domestic petroleum coke output.

Demand side: Rigid downstream demand combined with some enterprises gradually conducting pre-holiday stockpiling, resulting in an overall upward trend in demand.

Weekly Overview of the Calcined Petroleum Coke Market

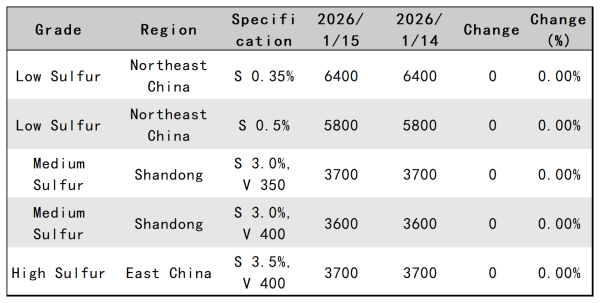

Mainstream calcined petroleum coke prices by major regions in China

Unit: RMB/ton

During this period (January 9–January 15, 2026), calcined petroleum coke prices remained stable. Mainstream petroleum coke feedstock prices showed a rebound trend, while downstream purchasing sentiment slowed, keeping calcined petroleum coke prices temporarily stable. Prices in the independent refinery market rose first and then fell, with overall market prices remaining stable and downstream purchasing sentiment easing. In Shandong, calcined petroleum coke producers actively shipped to boost volumes, with prices remaining generally stable, though enterprises maintained strong price support intentions. Downstream purchasing enthusiasm was average; demand in the prebaked anode market declined slightly, while operating rates in the anode material market remained stable, continuing to support the mid- and high-sulfur markets.

Low-sulfur calcining margins: During this period, profits for low-sulfur calcined petroleum coke declined. High-quality low-sulfur calcined petroleum coke recorded a margin of RMB -148/ton, while ordinary-grade low-sulfur calcined petroleum coke showed a margin of RMB -1/ton. This week, low-sulfur green coke prices rose slightly and have not yet been transmitted to the calcined petroleum coke sector, resulting in higher calcining costs and reduced profits. However, most downstream users hold raw material inventories, so actual profits are expected to be higher than theoretical levels and remain in a profitable state.

Mid-sulfur calcining margins: During this period, the profit margin for general-grade mid-sulfur calcined petroleum coke at independent refineries was RMB -332/ton, a decrease of 7%. Raw material prices rebounded slightly and then retreated, but remained higher than the previous period, increasing cost pressure on enterprises. With calcined petroleum coke prices holding steady, enterprise profit margins were compressed, and profitability for mid- and high-sulfur calcining enterprises continued to decline.

It is expected that calcined petroleum coke prices will edge up slightly in the next period, with market supply remaining generally stable. Key points to monitor include:

Supply side: No calcining units are scheduled to start up or shut down; low-sulfur calcining enterprises are meeting rigid downstream stocking demand, and operating rates are expected to remain stable.

Demand side: Environmental restrictions and maintenance shutdowns at some prebaked anode enterprises in Shandong are expected to further reduce operating rates.

Cost side: Downstream carbon enterprises show average purchasing enthusiasm, with raw material prices fluctuating within a narrow range.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies