【Petroleum Coke】Inventory Falls to 3.5 Million Tons! Can the Market Achieve a "Strong Start"...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Inventory Falls to 3.5 Million Tons! Can the Market Achieve a "Strong Start" After the Spring Festival?

In 2025, large-scale and concentrated maintenance at domestic refineries led to tight domestic supply, becoming the core factor driving petroleum coke prices higher. Entering 2026, with the end of the major maintenance cycle and the increase in restarted units, the domestic petroleum coke supply landscape is undergoing significant changes.

Record-Breaking Maintenance in 2025 Boosted Coke Prices

Surge in maintenance-related production losses:

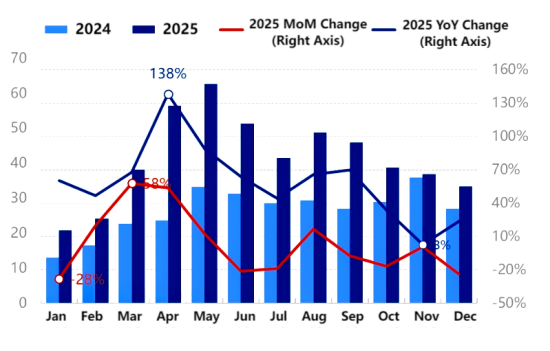

As a major maintenance year for domestic refineries, 75 units underwent maintenance in 2025, involving total capacity of 87.7 million tons/year. Annual petroleum coke production losses reached 4.997 million tons, a sharp increase of 1.817 million tons year on year compared with 2024, representing a 57% increase.

Monthly comparison chart of petroleum coke maintenance-related losses in 2024–2025 (10,000 tons)

Structural supply shortage:

In particular, refineries producing specification-grade material (such as Huaxing and Zhenghe, under ChemChina) experienced prolonged shutdowns, resulting in insufficient supply of domestic specification-grade coke. This forced low-sulfur coke to enter the carbon materials market for blending, driving a broad-based increase in prices of low- and mid-sulfur coke.

2026 Supply: Output Recovery and Return to Balance

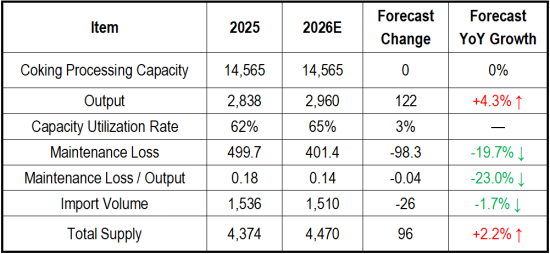

Production forecast: modest growth

Monthly trend: Petroleum coke monthly output in 2026 is expected to show a pattern of "volatile upward movement in the first half of the year, followed by a slight decline in the second half."

Annual total forecast: Total annual output is expected to be around 29.6 million tons, with an average monthly output of approximately 2.47 million tons (up 4.3% compared with 2025).

Capacity utilization: No new delayed coking capacity is expected to be added in 2026. However, capacity utilization is forecast to rise to around 65% (up 3 percentage points from 2024), supporting higher output levels.

Import Forecast: Narrow Decline

Affected by cautious market sentiment, imports in 2026 are expected to adjust to around 15.10 million tons (compared with 15.36 million tons in 2025).

Overall Supply Structure

Narrowing supply–demand gap: In 2026, the market supply–demand gap is expected to further narrow, gradually returning to balance, with the possibility of shifting from deficit to surplus.

Structural changes: Low-sulfur coke supply is expected to remain stable; mid-sulfur coke supply may increase due to feedstock adjustments; high-sulfur coke output may continue to decline due to technological upgrades at major refineries.

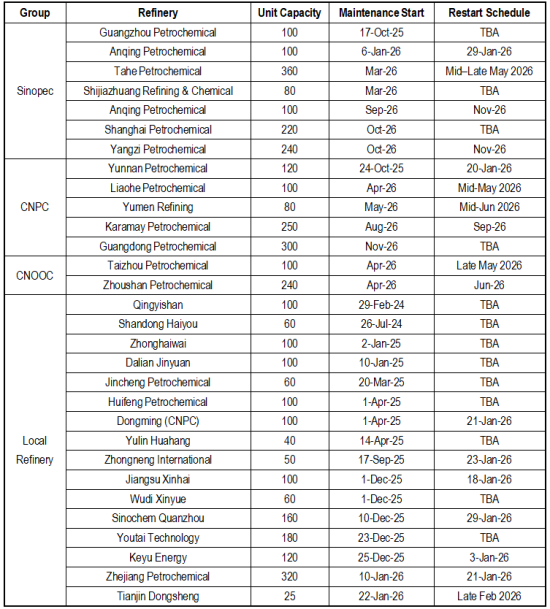

Maintenance Outlook in 2026: Loose in Q1, Tightening in Q2

Q1: Maintenance Eases, Supply Remains Ample

Reduced maintenance: Only 21 units are scheduled for maintenance in Q1 (involving 24.35 million tons/year of capacity), a decrease of 9 units year on year. As of January 27, daily maintenance-related production losses had fallen to 6,280 tons, down 45% month on month.

Accelerated restarts: From late 2025 to early 2026, nine long-idled units, including Jincheng Petrochemical, Dongming Petrochemical, and Sinochem Quanzhou (involving 10.7 million tons/year of capacity), gradually resumed operations.

Output increase: Domestic output in January was approximately 2.47 million tons, with February output estimated at 2.46 million tons. Daily output has risen to 86,637 tons (up 7,210 tons month on month).

Price impact: Ample supply is unlikely to drive the market upward. Prices in Q1 are expected to fluctuate and adjust at high levels, with limited upside potential and a correction range within 200 yuan/ton.

Q2: Maintenance Resumes, Supporting Prices

Maintenance plans: In the first half of the year, six major refineries are expected to undergo maintenance (involving 9.6 million tons/year of capacity), mainly concentrated in March–April:

March: Talimu (Tahe) Petrochemical, Shijiazhuang Refining (total 4.6 million tons/year);

April: Liaohe Petrochemical, Taizhou Petrochemical, Zhoushan Petrochemical (total 4.4 million tons/year);

May: Yumen Refining (0.8 million tons/year).

Price impact: These maintenance activities are expected to provide limited upward support to domestic petroleum coke prices in the first half of the year, especially in Q2.

Port Inventory and Demand Dynamics

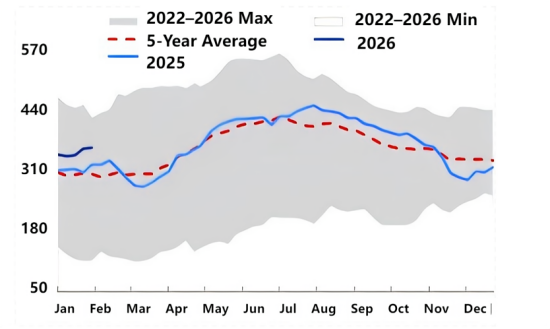

Port inventory

Current status: Inventory pressure eased by the end of 2025, with weekly average port inventories at 3.64 million tons, down 18.8%.

2026 trend: Port inventories are expected to be around 3.5 million tons in February. After the Spring Festival, as downstream procurement improves, inventories are expected to decline slightly in March, providing short-term price support.

Petroleum coke port inventory change chart, 2025–2026 (10,000 tons)

Downstream Demand

Anode materials: Strong support and pull effect, favorable for low-sulfur coke and anode-grade coke.

Aluminum carbon materials: Rigid demand procurement; prebaked anode operating rates are expected to be around 78%, with electrolytic aluminum consumption rising steadily.

Fuel market: Demand declines due to environmental regulations, and power plant procurement remains cautious.

Price Range Forecast for the First Half of 2026

Based on a comprehensive analysis of supply and demand fundamentals, prices in the first half of 2026 are expected to show a pattern of "rise first, then fall" or range-bound fluctuations:

Low-sulfur coke (S < 1.0%): 3,600–4,500 yuan/ton;

Mid-sulfur coke (S ≈ 2.5%): 2,800–3,300 yuan/ton;

High-sulfur coke (S > 3.5%): 1,450–1,800 yuan/ton.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies