【Petroleum Coke】Alert: Shandong Independent Refinery Inventories Rebound by 22% ...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Alert: Shandong Independent Refinery Inventories Rebound by 22% — Can the Market Still See a "Post-Holiday Opening Rally" in February?

January Review: Sharp Swings in the Market

Week 1: Strong Start, Broad-Based Rally

Supported by higher upstream crude oil and refining costs, coupled with price hikes by major producers such as Sinopec and CNOOC, bullish market sentiment was ignited, shifting the market from divergence to a one-sided upward trend.

■ Average price at Shandong independent refineries: RMB 2,618/ton (+1.16%)

■ National average price: RMB 3,055/ton (+0.79%)

Week 2: Peak and Pullback, Momentum Fades

At the beginning of the week, restocking demand and rising aluminum prices extended the rally. However, downstream resistance to high-priced material intensified, leading to a mid-week reversal. Low-sulfur petroleum coke remained relatively stable, while medium- and high-sulfur grades experienced sharp volatility.

■ Average price at Shandong independent refineries: RMB 2,717/ton (+3.78%)

■ National average price: RMB 3,105/ton (+1.64%)

Week 3: Weak Adjustment, Intensifying Divergence

The market entered a phase of "overall stability with minor fluctuations." CNOOC released additional volumes, while Sinopec cut prices across most regions except Tahe. Cooling anode material procurement pressured low-sulfur coke prices, while medium- and high-sulfur coke remained supported by rigid demand.

■ Average price at Shandong independent refineries: RMB 2,560/ton (–5.78%)

■ National average price: RMB 3,076/ton (–0.93%)

Week 4: Mild Volatility, Rise Followed by Stabilization

Major producers mainly maintained stable pricing, while Shandong independent refineries raised prices initially before adjusting lower. Structural divergence became more evident: low-sulfur coke was supported by long-term contracts, while medium- and high-sulfur coke fluctuated.

■ Average price at Shandong independent refineries: RMB 2,524/ton (–1.41%)

■ National average price: RMB 3,087/ton (+0.36%)

End-of-Month Data Summary (As of January 30)

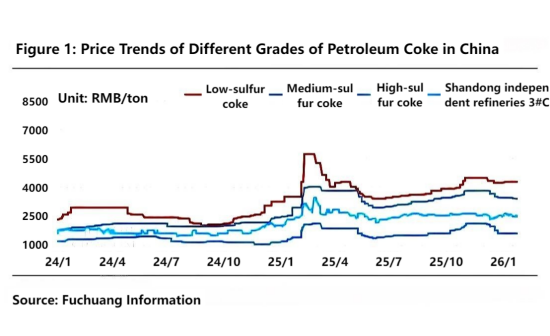

Average price of 3B petroleum coke: RMB 3,285/ton (–1.71% MoM)

Monthly average price trend:

■ Grade 1# coke declined to RMB 4,390/ton

■ Medium-sulfur 3# coke fell to RMB 3,280/ton

■ High-sulfur 4# coke dropped to RMB 2,063/ton

Overall market trading activity remained moderate, with the price center trending downward.

Inventories: Refinery Destocking vs. Port Stockpiling

1. Refinery Inventories: Active Shipments, Sharp Decline

By the end of January, refinery inventories stood at 72,700 tons, down 21.32% MoM (a reduction of 19,700 tons).

■ Major refineries: inventory down 32.41%, a decrease of 8,200 tons

■ Independent refineries: inventory down 17.29%

However, due to frequent quota adjustments and the impact of earlier high prices, inventories at Shandong independent refineries rebounded by 21.99% to 17,200 tons by month-end.

China's total petroleum coke supply in January is estimated at 2.4664 million tons (+0.03% MoM), with an average capacity utilization rate of 63.7%.

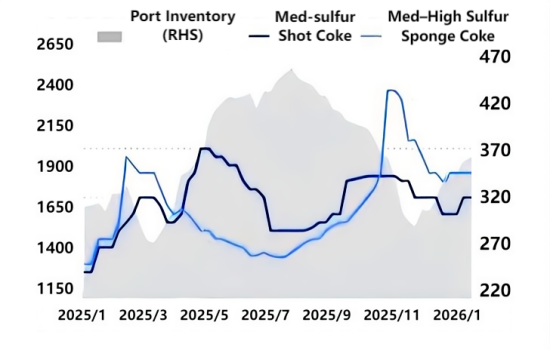

2. Port Inventories: Concentrated Imports, Continued Accumulation

Total port inventories reached 3.5993 million tons by the end of January, up 424,300 tons MoM (+13.36%).

Key drivers: concentrated arrivals of imported petroleum coke (inbound volumes exceeding outbound shipments) and slower downstream purchasing.

Regional performance:

■ Shandong ports: higher inbound volumes with weaker transaction activity

■ Northeast and North China: relatively stable transactions

■ Yangtze River region: active trading with continued inventory drawdowns

Port Inventory and Petroleum Coke Price Trends, 2025–2026

(Unit: 10,000 tons; RMB/ton)

Market Game: Profit Divergence, Rigid Demand Dominates

Downstream Sentiment

As the Spring Festival and month-end approached, downstream buyers remained cautious, largely maintaining purchases based on rigid demand, with no large-scale pre-holiday stockpiling. A new round of declines in anode pricing further dampened purchasing sentiment.

Profit Transmission

■ Medium-sulfur calcined petroleum coke: profit increased (lower feedstock costs + higher product prices)

■ Low-sulfur calcined petroleum coke / anode materials: profit declined (feedstock prices rising or stable + stable product prices, resulting in higher costs)

■ Primary aluminum / prebaked anodes: profit improved (supported by end-market demand)

Outlook: February Weak First, Then Stronger; Divergence Intensifies in Q1

February Market Forecast: Post-Holiday Rebound Expected

■ Inventory outlook: although approximately 200,000 tons of imported coke are expected to arrive, improved port throughput could bring port inventories down to around 3.5 million tons. After refineries resume operations, output will increase, and refinery inventories may rise slightly by 1,000–3,000 tons.

■ Price dynamics: ahead of the holiday, the market is characterized by "prices without transactions." After the holiday, supported by restocking demand and maintenance at major refineries, prices may fluctuate with a stronger bias.

Average Price Forecast

Shandong independent refinery monthly average: estimated at RMB 2,743/ton (+3.87%), with a fluctuation range of RMB 2,650–2,750/ton

Low-sulfur coke: high-level volatility (adjustments of RMB 50–100/ton)

Medium-sulfur coke: generally stable (fluctuations of RMB 30–100/ton)

High-sulfur coke / general cargo: flexible adjustments (down RMB 10–100/ton)

Market Sentiment Survey

■ 40% bearish

■ 30% neutral

■ 30% bullish

Market divergence remains significant.

March–April Outlook: From High-Level Volatility to Downward Pressure

■ March: with the start of the traditional "Golden March–Silver April" peak season, prices may remain volatile at high levels. Low-sulfur coke is expected to stay relatively firm, supported by anode demand, with divergence intensifying.

■April: as refineries resume production after maintenance and supply increases, while high prices suppress downstream demand, the market is expected to face downward pressure, trending stable to weaker.

Conclusion

Over the next three months, supply and demand fundamentals are expected to shift from a "tight balance" to a phase of "looser equilibrium with intensified competition." Overall prices are likely to show a pattern of "rising first, then stabilizing, with widening divergence."

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies