Supply increases, petroleum coke market trend analysis

Supply increases, petroleum coke market trend analysis

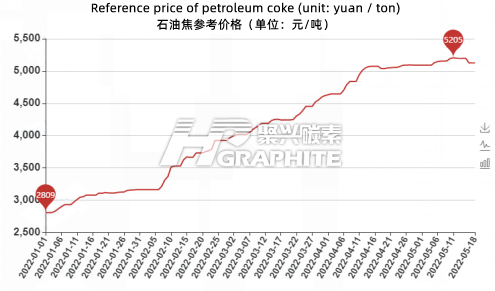

In May, the overall supply tension in the petroleum coke market was alleviated, and the delayed coking units that were shut down for maintenance in the early stage began to discharge coke one after another. In addition, the import volume of petroleum coke at the port increased, which provided a certain supplement to the market, especially high-sulfur coke (about 4.5% sulfur); Petroleum coke as raw material, high perfomance graphite electrode produced by our team for your information. As the price of raw petroleum coke continues to rise and the cost remains high, most downstream enterprises receive orders according to the demand. As of May 18, petroleum coke market reference price was 5126 yuan/ton, increased 35 yuan/ton, or 0.68% compared with the end of April.

Supply side

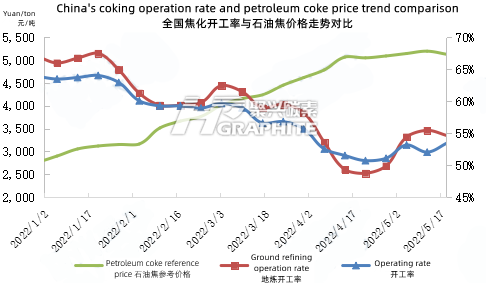

In May, some refineries shut down for maintenance in the early stage began to resume operation and coke production (totally 6 sets of coking units with a production capacity of 9.6 million tons/year), mainly local refineries, which alleviated the current tight market supply situation. However, due to the high crude oil price, the refining cost was still high, and the shipment of the refined oil market was general. Some refineries reduced the load and even shut down for maintenance in advance, as long as the conventional units maintenance, additional 5 sets of coking units were shut down for maintenance in May, involving a production capacity of 6 million tons/year. As of May 18, there were 17 times conventional shutdown and maintenance of coking units in China. Domestic petroleum coke daily output was 66100 tons, and the coking operation rate was 52.87%, an increase of 1.16% compared with the end of April.

Imported coke side

In May, a large amount of high-sulfur petroleum coke was imported, of which Venezuela's high sulfur coke with a sulfur content of about 4.5% arrived ports concentrately in recent months for producing general calcined coke. Due to its low price, some downstream enterprises had strong willingness to receive goods, which had a certain impact on traditional domestic refineries’ petroleum coke price .

Price side

In May, main refineries’ low-sulfur coke price rose with a up trend, low-sulfur coke mainstream transaction price in Northeast China was 8180-9000 yuan/ton, and the price of individual low sulfur coke in the main downstream industry for the preparation of aluminum carbon was 300 yuan/ton; The medium and high-sulfur market coke price continues to push up 30-130 yuan/ton.

Local refined petroleum coke price is greatly impacted by the port coke, especially high-sulfur coke. The coke price generally decreased by 50-1300 yuan/ton compared with that at the end of April. As of May 18, low-sulfur petroleum coke (about 1.0% sulfur) mainstream transaction price was 5950-6250 yuan/ton, medium sulfur petroleum coke (about 3.0% sulfur) mainstream transaction price was 3900-4900 yuan/ton, and high-sulfur petroleum coke (about 4.5% sulfur) mainstream transaction price was 2600-3350 yuan/ton.

Demand side

The market of downstream electrolytic aluminum, metal silicon and other industries is still weak in the short term, and the profit is compressed. Although the downstream production demand is basically stable, the receiving capacity of high priced petroleum coke has decreased, and the petroleum coke inventory of downstream enterprises is at a medium and low level.

Downstream aluminium producing enterprises have a good demand for petroleum coke, but due to the long term high price of raw petroleum coke, the capital pressure of enterprises is great, the demand for medium sulfur coke in the cathode material market is increasing, and the survival pressure of aluminum producing carbon enterprises continues to increase. Recently, port high-sulfur coke (about 4.5% sulfur) has greatly supplemented the market, and some carbon enterprises purchase imported coke in order to control costs, which has a great impact on domestic high-sulfur coke price (especially 4.5% sulfur petroleum coke of local refineries), forcing the price of petroleum coke with sulfur of about 4.5% to fall. Reading more carbon industry information, please contact us.

No related results found

0 Replies