【Needle Coke】 Analysis of the Global Needle Coke Market Prospects

【Needle Coke】 Analysis of the Global Needle Coke Market Prospects

Needle coke is the main material for graphite electrodes in electric furnaces, which can be used to produce ultra-high power aluminum and cathode electrodes, and to recover scrap metal in electric furnaces for melting and refining scrap steel. Due to its low resistance, strong impact resistance, and good oxidation resistance, needle coke can be widely used as ultra-high power graphite electrodes, nuclear reactor deceleration materials, and LIB anode materials.

Regional needle coke market prospect analysis

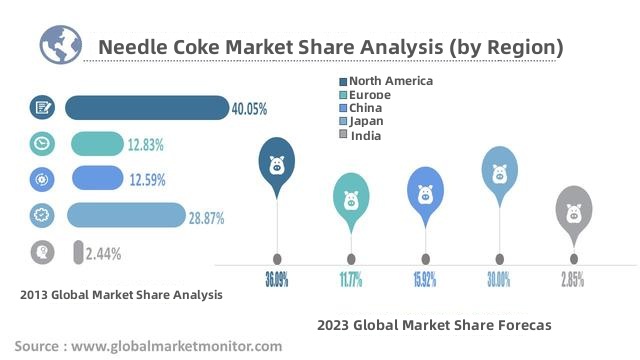

North America is the largest revenue market, with market shares of 43.26% and 37.65% in 2013 and 2018, respectively, increasing by -5.61%. In 2017, the European market share was 12.83%. In addition, it is expected that the Asia Pacific region, the Middle East region, and South America will be the fastest growing needle coke markets. Due to the growth of the steel manufacturing industry, especially in the Asia Pacific region, it is expected that the global needle coke market will have significant growth in the coming years. The development of emerging economies such as China, India, the Philippines, Thailand, Brazil, Saudi Arabia, and Vietnam, the rapid growth of downstream demand, and the continuous progress of technological innovation have all driven the growth of needle coke demand.

Despite China's new policies, which make it more difficult for steel mills to obtain environmental permits and reduce iron ore production capacity, it will continue to promote mining product production and iron ore mining. The country plans to eliminate 100 million to 150 million tons of steel production capacity to reduce the number of pollution from steel furnaces and shift to a consumption centric approach. The Chinese government is taking action around pollution and the environment, and the new policy will have a positive impact on mining in China and the world in the medium to long term.

Although China's new policies make it more difficult for steel mills to obtain environmental permits and reduce iron ore production capacity, China will continue to promote mining product production and iron ore mining. China plans to eliminate 100 million to 150 million tons of steel production capacity to reduce pollution from steelmaking furnaces and shift to a focus on consumption. The Chinese government is taking action around pollution and environmental issues. In the medium to long term, the new policy will have a positive impact on the mining industry in China and the world.

With the fluctuation of market supply and demand of the capital market development, the prices of different raw materials show different trends, which will fluctuate in general. Due to the rise in needle coke prices, especially in emerging economies such as China, India, and Brazil, it is believed that an increase in refinery profitability will increase productivity.

Needle coke companies mainly come from the United States and Japan, with high industrial concentrate rates. The top 3 companies are Phillips 66, C-Chemical Co., Ltd., and Graff International Technology Co., Ltd., with revenue market shares of 35.64%, 16.87%, and 13.05% in 2017. Phillips 66 is the only green and calcined specialty petroleum coke manufacturer in the steel, lithium-ion battery, aluminum, titanium dioxide and specialty graphite products industries.

Needle coke demand continues to grow, innovation to win the market

Emerging and developing countries in the Asia Pacific region such as China have largely contributed to global wage growth. Recently, this trend has slowed or reversed. In these 20 emerging and developing countries, real wage growth decreased from 6.6% in 2012 to 2.5% in 2015. In contrast, wage growth has increased in developed countries. In 20 developed countries, the real wage growth rate increased from 0.2% in 2012 to 1.7% in 2015, reaching the highest level in the past decade. The lower wage growth gap between developed and developing countries also means that their wage convergence process has slowed down and the speed of economic development has declined.

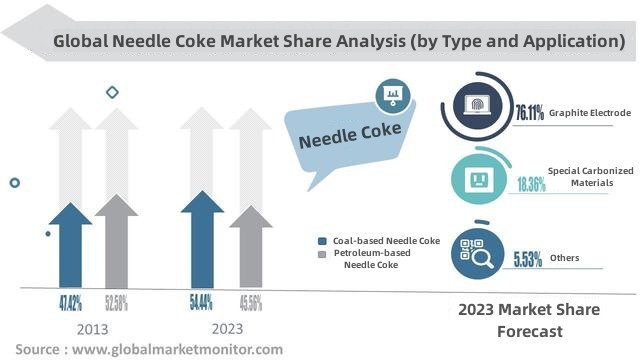

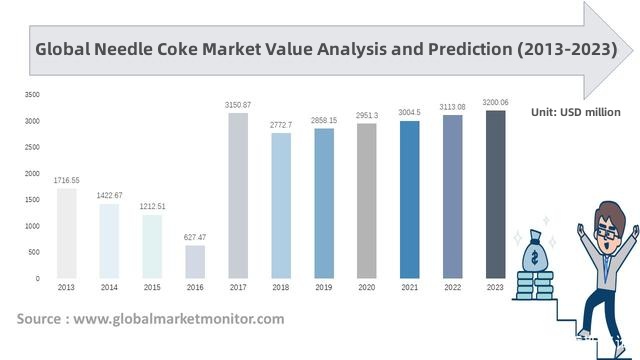

According to our research, the total sales volume of the global needle coke market was $1716.55 million in 2013, increasing to $277.27 million in 2018. We predict that by 2023, the market value will reach $32.6 million. From 2017 to 2023, the compound annual growth rate of needle coke will reach 0.26%.

Due to fluctuations in supply and demand, uncertainty in the global crude oil and natural gas markets is a major constraint on the growth of the needle coke market. Limited global DCC capabilities, coupled with technical constraints, are expected to have a negative impact on the needle coke market growth in the coming years. In addition, graphite electrode price will have a significant impact on the needle coke industry.

Although the sales of needle coke have brought some opportunities, especially in emerging countries, the research team suggests that new entrants who do not have the advantages of the industrial chain and accurate positioning of downstream links should not blindly enter the needle coke industry. In addition, with the progress of technology and enterprise investment, needle coke will have more opportunities. Enterprises should focus on production technology, constantly innovate, and provide more cost-effective, high-performance, and environmentally friendly products in the future. Only by continuously improving their services can they gain competitive advantage and expand market share. Contact us to learn more about the trends in the needle coke and graphite electrode industries.

No related results found

0 Replies