【Petroleum Coke】Record-high Inventory, Prices Under Pressure and Declining

【Petroleum Coke】Record-high Inventory, Prices Under Pressure and Declining

In March, China petroleum coke prices experienced a significant drop, especially in the second half of the month, with the prices falling by more than 1000 yuan per ton. So, is the sudden collapse of the China petroleum coke market an accidental phenomenon or an inevitable result?

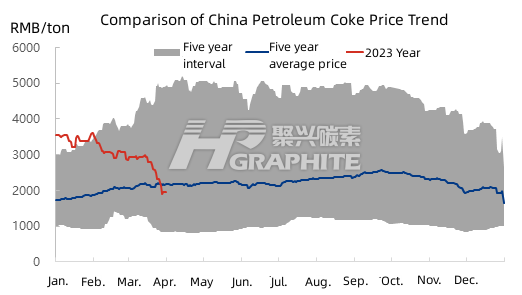

First, let's look at the relationship between China petroleum coke prices in 2023 and the historical prices of the past five years. At the beginning of the year, China petroleum coke prices were still above the five-year price fluctuation range. In February, China petroleum coke prices gradually returned to the range of price fluctuations in recent five years. In March, with the sharp drop in petroleum coke prices, China petroleum coke prices had fallen below the five-year average by the end of the month. Overall, the sharp drop in prices this round is partly due to a decrease in demand for downstream negative materials and a reduction in aluminum electrolysis output due to limited electricity. Still, the most important factor is the psychological game between upstream and downstream players. China petroleum coke inventories repeatedly hit new highs, and the market is pessimistic about the future. Carbon plants and end-user electrolytic aluminum enterprises actively reduce raw material inventories, causing difficulties for refineries in shipping petroleum coke and a continuous decline in prices...

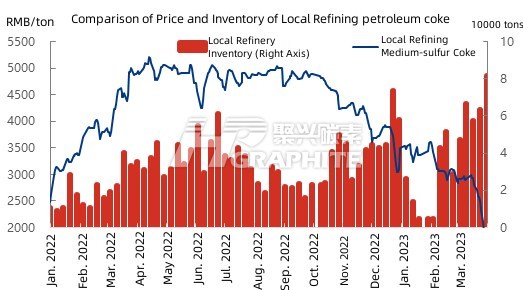

The changes in China petroleum coke prices are mainly reflected in the prices of local refinery petroleum coke, which respond the fastest. The most direct factors affecting the rise and fall of local refinery petroleum coke prices are changes in their inventories and orders. As shown in the chart above, there was a clear accumulation of local refinery petroleum coke inventories from the beginning of March, resulting in a medium-to-high level of inventories throughout the month. Some refineries have even added external storage, further increasing local refinery petroleum coke inventories. Therefore, the consecutive sharp drops in local refinery petroleum coke prices are not accidental.

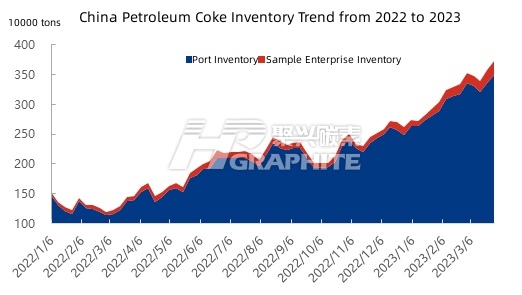

Now let's take a closer look at the overall China petroleum coke inventory situation. As of the end of March, China petroleum coke inventories (incomplete statistics) reached 3.6 million tons, an increase of 2.2 million tons compared to the end of March last year, setting a new historical high, further confirming that the market with supply exceeding demand will inevitably experience a decline in prices. Relying solely on consumption in the carbon sector to deplete such a large petroleum coke inventory is challenging. However, with the significant price drop, some high-sulfur petroleum coke can enter the fuel sector, including increased use in power plants and refineries, accelerating China petroleum coke inventory consumption. Although China petroleum coke inventories are still at a high level, there is a way out.

In summary, the demand for the electrolytic aluminum industry is currently supported, and high-sulfur petroleum coke can switch between fuel and carbon sectors. With an increase in China refinery maintenance and a decrease in petroleum coke imports, it is expected that China petroleum coke will enter an accelerated de-stocking phase starting in May. Petroleum coke market trend analysis, welcome to consult us.

No related results found

0 Replies