【MYSTEEL】Analysis of China's Crude Steel Production

【MYSTEEL】Analysis of China's Crude Steel Production

In June 2023, the average daily crude steel production in China was 3.037 million tons, with a month-on-month increase of 4.5%. It is estimated that in July, the average daily crude steel production in China will remain above 3 million tons. During July, the domestic steel market prices showed a trend of interval fluctuations, with initial suppression followed by a rebound. The graphite electrodes with stable quality and complete in specifications for EAF steelmaking. The transition from "strong expectations" to "strong reality" may take some time, but market confidence is gradually recovering. In August, steel prices may experience fluctuations with a potential bottom-up movement. Considering that macroeconomic policies are unlikely to implement "flood-like" strong stimuli, there is a risk of price correction if steel prices rise too rapidly without sufficient demand support.

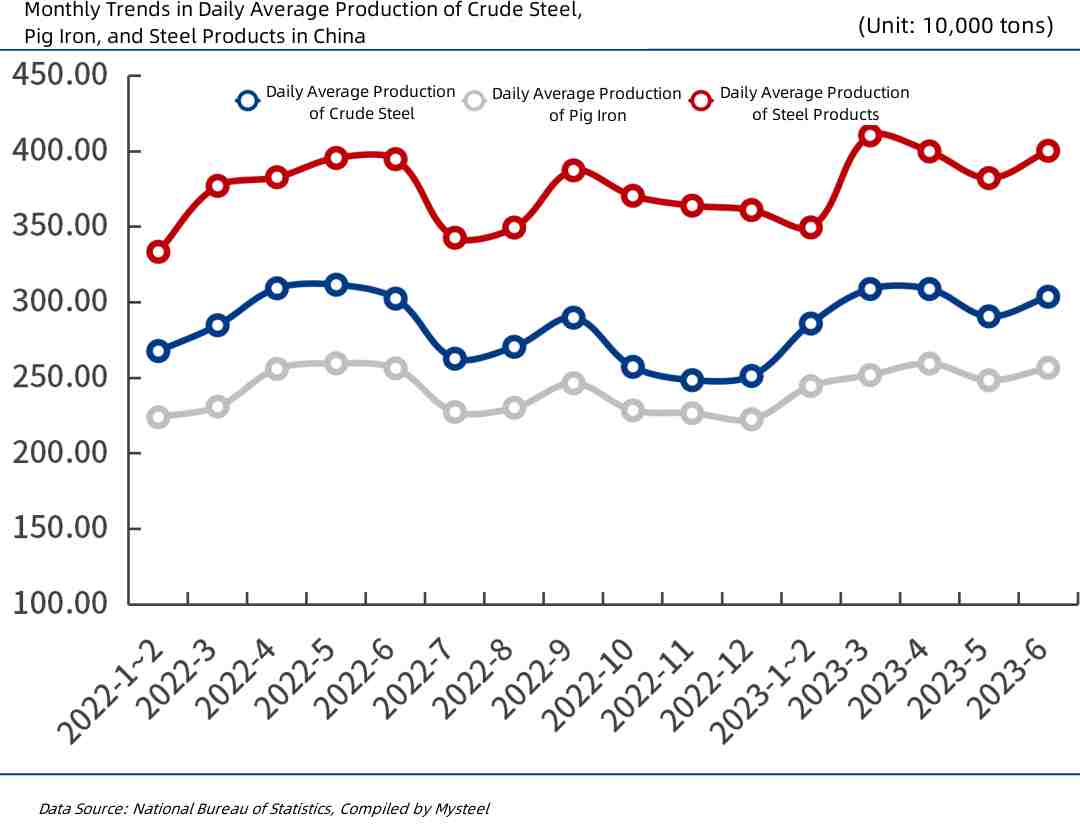

Ⅰ. In June 2023, the average daily crude steel production in China was 3.037 million tons, with a month-on-month increase of 4.5%.

According to data from the National Bureau of Statistics, the total crude steel production in June 2023 was 91.11 million tons, with a year-on-year increase of 0.4%. Pig iron production was 76.981 million tons, holding steady year-on-year, and steel production was 120.079 million tons, with a year-on-year increase of 5.4%.

From January to June 2023, the total crude steel production in China reached 535.641 million tons, with a year-on-year increase of 1.3%. Pig iron production was 451.564 million tons, with a year-on-year increase of 2.7%, and steel production was 676.548 million tons, with a year-on-year increase of 4.4%.

In June 2023, the average daily crude steel production in China was 3.037 million tons, with a month-on-month increase of 4.5%. With the recovery in steel prices during June, the profitability of steel mills improved, leading to the transformation of many enterprises from losses to profits, and subsequently, they started resuming production gradually.

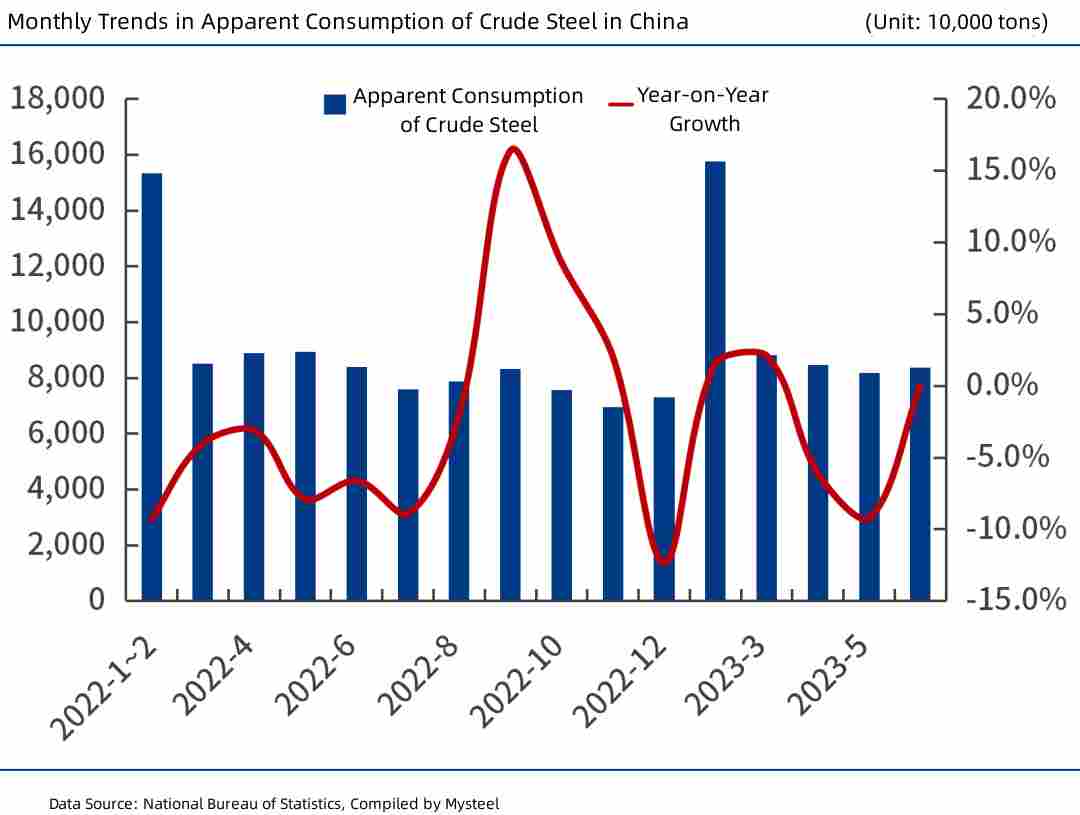

Ⅱ. From January to June, the apparent consumption of crude steel in China was 494 million tons, with a year-on-year decrease of 1.8%.

According to data from the National Bureau of Statistics and the General Administration of Customs, in June 2023, the total crude steel production in the country was 91.11 million tons, with a net steel export of 6.896 million tons, which is equivalent to a net crude steel export of 7.183 million tons (calculated with a 0.96 conversion factor for steel). The net export of steel billets and ingots was 0.107 million tons, and the apparent consumption of crude steel was 83.82 million tons, which remained relatively stable compared to the previous year. (Note: In June 2022, the total crude steel production was revised to 90.75 million tons, and the apparent consumption of crude steel was revised to 83.84 million tons.)

From January to June 2023, the total crude steel production in China reached 53.564 million tons, with a net steel export of 39.842 million tons, which is equivalent to a net crude steel export of 41.502 million tons (calculated with a 0.96 conversion factor for steel). The net export of steel billets and ingots was 0.47 million tons, and the apparent consumption of crude steel was 494 million tons, representing a year-on-year decrease of 1.8%. (Note: In January to June 2022, the total crude steel production was revised to 529 million tons, and the apparent consumption of crude steel was revised to 503 million tons.)

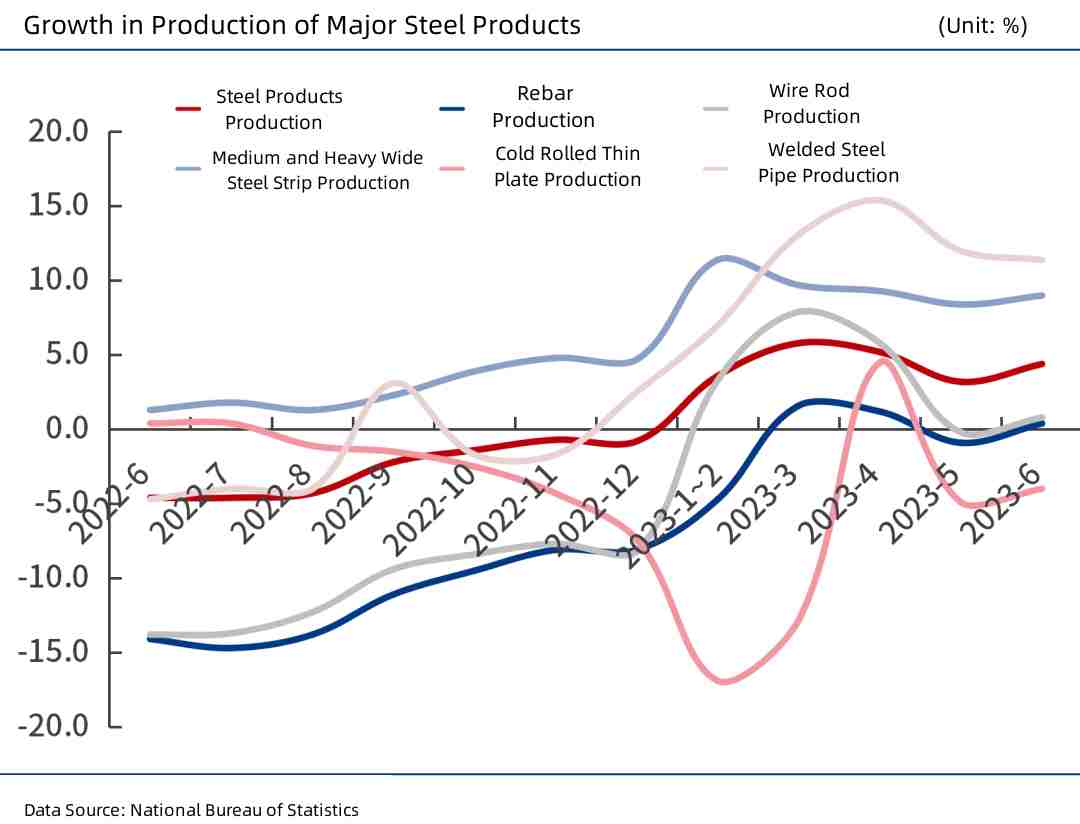

Ⅲ. In June 2023, the daily production of the five major types of steel products increased month on month.

According to the types of steel products, from January to June 2023, China's total steel production was 677 million tons, with a year-on-year increase of 4.4%. Specifically, rebar production was 117.558 million tons, with a year-on-year increase of 0.4%; wire rod production was 70.774 million tons, with a year-on-year increase of 0.8%; cold-rolled thin plate production was 17.767 million tons, with a year-on-year decrease of 4.0%; medium and thick wide steel strip production was 100.79 million tons, with a year-on-year increase of 9.0%; welded steel pipe production was 31.32 million tons, with a year-on-year increase of 11.4%.

In June 2023, the daily production of rebar, wire rod, medium and thick wide steel strip, cold-rolled thin plate, and welded steel pipe was 687,000 tons, 418,000 tons, 590,000 tons, 116,000 tons, and 201,000 tons, respectively, with month-on-month increases of 44,000 tons, 43,000 tons, 14,000 tons, 6,000 tons, and 15,000 tons.

Ⅳ. Forecast and Impact Analysis of Crude Steel Production in the Latter Period

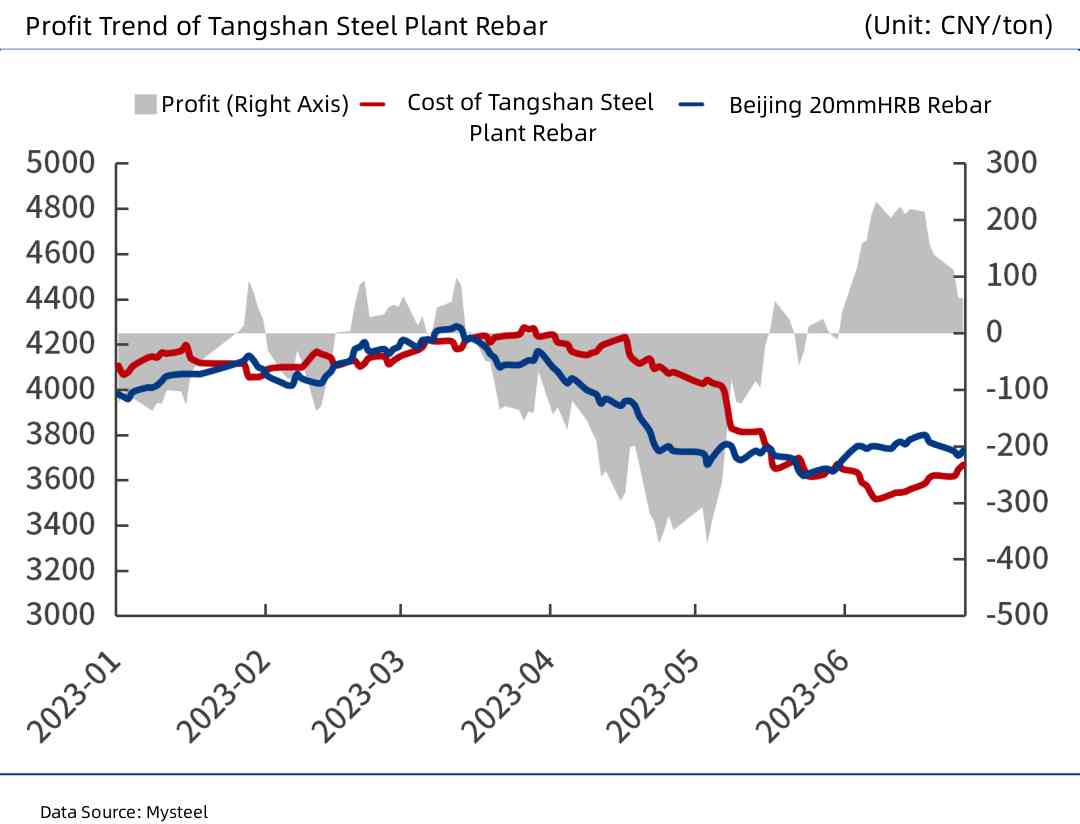

In July 2023, the domestic steel market prices exhibited interval fluctuations with initial suppression followed by a rebound. Frequent occurrences of high-temperature and heavy rainfall weather in multiple regions across the country, coupled with a cooling real estate market, led to weak demand for steel during the off-season. Steel mills operated under thin profit margins, resulting in minimal fluctuations in production during the first half of July. As a consequence, there was a slight accumulation of steel inventories, and overall supply and demand remained weakly balanced. Prices of raw materials such as coal and coke showed relative strength, while steel prices experienced fluctuations. On July 24, the Political Bureau of the CPC Central Committee held a meeting to deploy economic work in the second half of the year, which sent positive signals. Simultaneously, various government departments actively formulated and introduced policies to promote consumption recovery and expansion. With increased market confidence, steel futures and spot prices strengthened simultaneously in late July.

According to calculations, by the end of July, the profit per ton of rebar in Tangshan's long-process steel mills was less than 100 yuan. In the first half of July, most steel mills operated at thin profit margins, and with the arrival of the off-season for steel demand, steel production fluctuated modestly. In the latter half of July, Tangshan steel mills faced stricter environmental restrictions, and during the Chengdu Sports Games, some steel mills in Sichuan reduced production, leading to a potential slight contraction in overall supply. It is expected that the average daily crude steel production in China will remain above 3 million tons in July. Market expectations regarding "production control" for crude steel are gradually increasing, and if local policies are implemented, especially in regions like Hebei, Shandong, and Jiangsu, the supply of steel in August may see a minor reduction. Otherwise, market fluctuations are expected to be limited.

In the first half of 2023, China's industrial production steadily recovered, and the service sector experienced rapid growth. Banks increased credit lending to support fast-paced investments in infrastructure and manufacturing. However, the economy also faced challenges, including a continuing decline in the real estate market, sluggish private investment, significant pressure on export growth, and increased debt repayment burdens in some regions.

By sector, from January to June, real estate investment declined by 7.9%, with the decline rate expanding by 0.7 percentage points compared to the previous five months. Foreign trade exports increased by 3.7%, while private investment decreased by 0.2%, indicating insufficient growth momentum. On the other hand, infrastructure and manufacturing investment maintained relatively fast growth, increasing by 7.2% and 6.0% year-on-year, respectively. In the first half of the year, the value added of large-scale industries nationwide grew by 3.8% year-on-year, accelerating by 0.8 percentage points compared to the first quarter.

Although the national economy continued to recover and showed an overall improvement, there were still issues such as insufficient domestic demand and unstable external demand. In order to drive sustained economic improvement, the government is actively introducing a package of supportive policies. These include documents such as "Opinions on Promoting the Development and Growth of Private Economy" issued by the CPC Central Committee and the State Council, and the "Notice on Promoting Household Consumption" jointly released by 13 government departments, including the Ministry of Commerce.

Furthermore, on July 24, the Political Bureau of the CPC Central Committee held a meeting to set the tone for the second-half-year economic work and conveyed multiple positive signals. Compared to the April 28 meeting, the July 24 meeting emphasized "increasing macro-policy control, focusing on expanding domestic demand, boosting confidence, and preventing risks." Regarding the real estate sector, the meeting highlighted the need to adjust and optimize real estate policies in response to significant changes in market supply and demand. The meeting also stressed the importance of activating the capital market and boosting investor confidence. Additionally, the focus on local government debt shifted from "strictly controlling the increase of hidden debt" to emphasizing the implementation of a comprehensive debt plan.

Overall, as we enter August, the implementation of a series of stable growth and domestic demand expansion policies, as well as the local steel production control measures, will be crucial for the steel market. The transformation of "strong expectations" into "strong realities" may require some time, and a rapid recovery in steel demand in August is unlikely. However, if the production control measures are effectively implemented, it will undoubtedly improve the supply-demand fundamentals of the steel market. In conclusion, with the gradual restoration of market confidence, steel prices in August may experience a bottom-upward fluctuation. Considering that macroeconomic policies will avoid excessive stimulation, there is a possibility of a correction if steel prices rise too quickly and demand fails to keep up. Any demands for graphite electrode and other graphite produts, feel free to contact us.

No related results found

0 Replies