【Mysteel】 Low-Sulfur Petroleum Coke Export Volume Significant Increase

【Mysteel】 Low-Sulfur Petroleum Coke

Export Volume Significant Increase

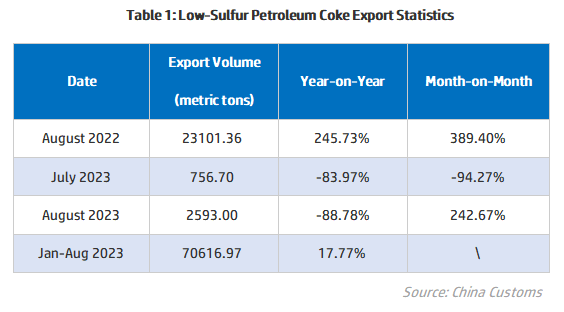

Low-Sulfur Petroleum Coke (Sulfur Content <3%) Export Statistics

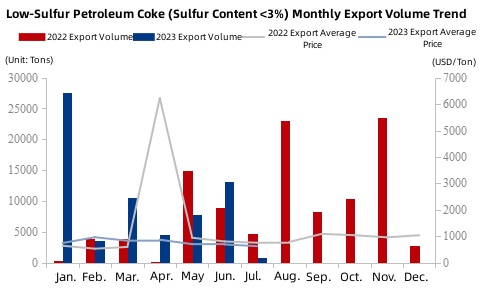

According to customs statistics, in August 2023, China's export volume of low-sulfur petroleum coke (sulfur content <3%) amounted to 2,593.00 metric tons, marking a 242.67% month-on-month increase but an 88.78% year-on-year decrease. The monthly export value reached $1,510,700 USD, with an average export price of $582.61 USD/MT. The cumulative export volume for the year reached approximately 70,600 metric tons, with a total export value of approximately $53,044,500 USD and an average export price of $751.16 USD/MT, showing a year-on-year increase of 17.77%, and calcined petroleum coke export data is available for reference.

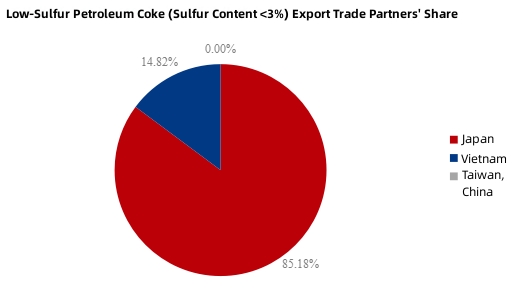

In August 2023, China exported 2,593.00 metric tons of low-sulfur petroleum coke (sulfur content <3%), with the majority being shipped to Japan, accounting for 85.18% of the total exports.

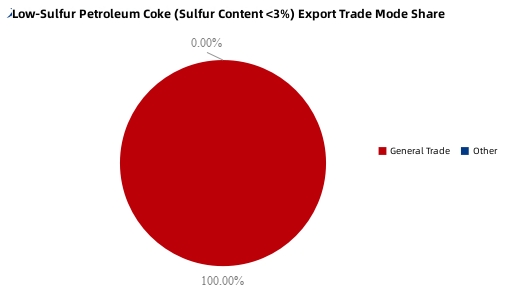

When categorized by export trade mode, general trade accounted for nearly 100% of exports in August 2023.

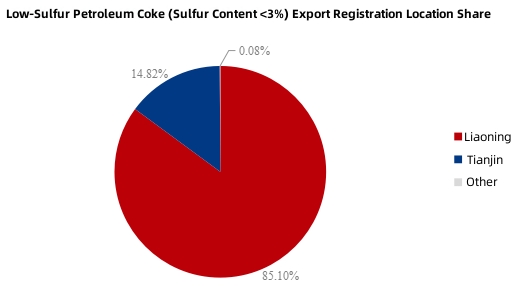

In terms of registration location, Liaoning Province held the highest share at 85.10% of exports in August 2023, followed by Tianjin Municipality at 14.82%, with other provinces and cities accounting for 0.08%.

Summary

In August, while the import volume of low-sulfur petroleum coke showed a slight month-on-month decrease, the export volume witnessed a significant increase. Domestic port deliveries remained generally swift, influenced by the rising market prices for domestically produced low-sulfur petroleum coke. This led to an acceleration in the release of imported coke from warehouses, resulting in a continued reduction in spot inventory at ports. Favorable demand in the downstream anode market has contributed to an increased demand for low-sulfur petroleum coke, particularly with sulfur content below 3%. Meanwhile, domestically produced coke with 3% sulfur content remains relatively abundant due to raw material factors. Import volumes of high-quality low-sulfur petroleum coke with sulfur content below 3% are still relatively tight, and recent imports are expected to supplement the demand in this downstream segment. Follow us for daily market reports on the carbon industry.

No related results found

0 Replies