【Negative Electrode Materials】Leading Producers Respond to New Export Control Policies

【Negative Electrode Materials】Leading Chinese Producers Respond to

New Export Control Policies on Graphite-Related Items

Recently, the Chinese Ministry of Commerce, in collaboration with the General Administration of Customs, issued an announcement regarding the optimization and adjustment of temporary export control measures for graphite-related items. It was announced that the scope of items listed in the Notice of the Ministry of Commerce, the National Defense Science and Technology Industry Commission, and the General Administration of Customs No. 50 of 2006, which involves the implementation of temporary export control measures for graphite-related items, will be optimized and adjusted. This new policy will be effective from December 1, 2023, and find out the impact of the new policy on graphitized petroleum coke product.

China is both the world's largest producer and exporter of graphite. With the significant growth in global new energy vehicle and lithium-ion battery installations, the demand for graphite, especially synthetic graphite, as a mainstream material for lithium-ion battery negative electrodes, has been steadily increasing, and find out the impact of the new policy on graphitized petroleum coke products.

On October 23, the reporter from The Paper learned from China's leading lithium-ion battery negative electrode material companies, BTR New Energy and Shanshan Corporation, that the new export control regulations regarding graphite items issued by the Ministry of Commerce and the General Administration of Customs will have limited effects on the business of lithium-ion battery graphite negative electrode materials. Shanshan Corporation explicitly stated that the new export control policy will not impact the company's export business for synthetic graphite materials.

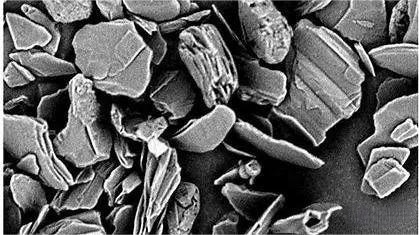

The announcement clearly specifies that items with the following characteristics shall not be exported without permission. Firstly, it includes synthetic graphite materials and products with high purity (purity > 99.9%), high strength (bending strength > 30 MPa), and high density (density > 1.73 g/cm3). Secondly, it encompasses natural flake graphite and its products, including spherical graphite and expanded graphite. For synthetic graphite, it's important to note that the parameters of the controlled synthetic graphite materials and products do not correspond to the conventional indicators for synthetic graphite used in lithium-ion battery negative electrodes. Instead, they mainly apply to products like graphite sheets and blocks, which are primarily used in high-precision fields like aviation and military.

Bettery's company website also shows that the bulk density of its synthetic graphite anode sheets is generally between 1.5 and 1.7 g/cm3, which is below the requirements specified in the announcement.

Furthermore, this adjustment is an optimization of the existing export control policy. Currently, most lithium-ion battery negative electrode material companies have export licenses for synthetic graphite.

According to Notice No. 50 of 2006, a temporary export control policy for graphite-related items included seven items, such as "other synthetic graphite," "other products based on graphite or other carbon materials," "other carbon electrodes," "lamp carbon rods, battery carbon rods, and other graphite products," among others.

Comparatively, the scope of control adjustment this time is more focused on natural graphite. In particular, the new policy increases the export license requirements for six categories of natural graphite. It's worth noting that natural flake graphite and its products have a wide range of applications, from advanced refractories and coatings in the metallurgical industry to stabilizers in the military industry and electromagnetic wave absorbers. Expanded graphite, obtained through deep processing of flake graphite, has high military applications.

Currently, China dominates the global supply of graphite for lithium-ion batteries, and in recent years, Chinese companies have successfully replaced Japanese and Korean products in the market. In the field of graphite anode products, although natural graphite has cost and specific capacity advantages, it has lower cycle life and consistency compared to synthetic graphite. Therefore, in the lithium-ion battery and high-end consumer battery sectors, synthetic graphite is mainly used. According to data from the High-Tech Industry Institute (GGII), in 2022, synthetic graphite accounted for approximately 84% of the total graphite anode materials shipped in China, making it the mainstream product in the negative electrode material market in recent years.

As a result, according to Guojun Dianxin, after the new policy is implemented, there is no exclusion of the possibility of overseas customers increasing stockpiles in the short term due to increased demand. It is worth mentioning that in consideration of their overseas customers' supply chain security, top domestic negative electrode material companies like BTR, Putailai, and Shanshan Corporation have begun to establish negative electrode material production capacities overseas.

On October 16, Bettery signed an agreement in Indonesia to jointly invest with Singapore's Stellar Corporation to establish an annual production capacity of 80,000 tons of lithium-ion battery negative electrode materials in the IMIP Industrial Park in Central Sulawesi Province and the KIP Industrial Park in Central Java Province. The first phase of the project will have an investment of $478 million.

On September 27, Shanshan Corporation announced that its subsidiary, Shanghai Shanshan, would invest up to €1.28 billion to build an integrated base for the production and research of 100,000 tons of lithium-ion battery negative electrode materials in Finland. The capacity of each of the two phases is planned to be 50,000 ton/year, with an estimated construction period of 24 months for each phase.

In May, another top negative electrode material company in China, Putailai, also announced that it plans to build a 100,000-ton lithium-ion negative electrode material integrated production and research base in Sweden. The total investment for the project is estimated to be approximately CNY 10.677 billion. When announcing their investments, these companies all stated that overseas projects would further expand and serve the company's overseas customers, improve the company's overseas capacity layout, and increase the company's overall revenue in the future. Guidance on the dual-use policy for graphite products is available, welcome to consult with us at any time.

No related results found

0 Replies