【UHP Gaphite Electrode】Domestic Prices in November Expected to Stabilize with a Weak Bias

【UHP Gaphite Electrode】Domestic Prices in November Expected to Stabilize with a Weak Bias

In October, the trend of China domestic UHP (ultra-high power) graphite electrodes was relatively strong, with some specifications experiencing a month-on-month decline of 200-400 RMB/ton, increasing market competition pressure, and consequently a decrease in prices. How will the trend unfold in November? We will elaborate on this from several perspectives.

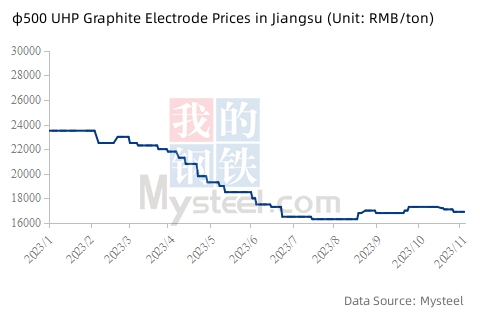

1. Review - Price Retreat

In October, China domestic UHP graphite electrode prices showed a rise followed by a decline. Fierce competition among graphite electrode manufacturers, coupled with a clearer goal of reducing costs and increasing efficiency in the steel market, led to low-price bidding for graphite electrodes, resulting in weakened price support.

Taking the example of φ500 UHP graphite electrodes in the Jiangsu region, the current quoted price is 16,900 RMB/ton, a decrease of 400 RMB/ton compared to the previous month.

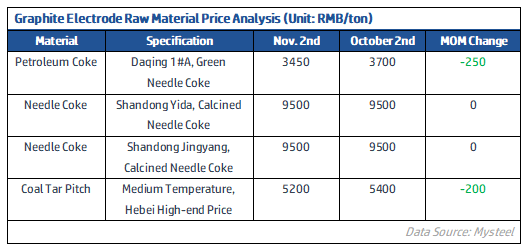

2. Costs - Weakness in Raw Material Prices

In October, the price of needle coke in China exhibited an unusual trend, with a 700 RMB/ton drop in the price of raw needle coke produced in Shandong Yida, while the price of calcined needle coke remained stable. Prices for Daqing petroleum coke and medium-temperature coal tar pitch in the Hebei market both showed a certain degree of decline. The demand for graphite electrode raw materials weakened, with downstream procurement focused mainly on low prices.

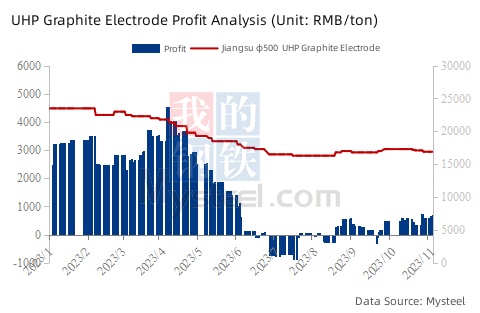

In terms of costs, according to Mysteel data, calculated at the market price of 16,900 RMB/ton for φ500 UHP graphite electrodes, the profit is 687 RMB/ton. However, from the analysis of market transaction prices, the profit is only around 200 RMB/ton.

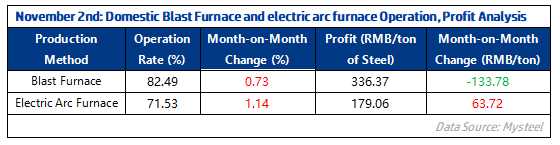

3. Demand - Steel Price Loss Difficult to Reverse, Production Limits Imminent

In October, the comprehensive price index for building materials fell by 1.89 points compared to the previous month. Steel prices declined, and compared to September, the losses in blast furnaces deepened, while electric arc furnace profits improved significantly in the past two months. Blast furnace and electric arc furnace start-ups increased slightly compared to the same period last year, but due to cost reduction efforts by steel mills, refining time was shortened in some cases. Additionally, electric arc furnaces face seasonal shutdowns in the later stages, leading to a downward trend in demand for graphite electrodes.

4. November Market Outlook - Weakening Demand, Increased Competitive Pressure

(1) Demand: Entering November, electric arc furnaces are about to enter the seasonal shutdown, and with the approaching autumn-winter heating season, steel mills may experience certain levels of production limits or shutdowns, resulting in a weakening purchasing power for UHP graphite electrodes.

(2) Supply: Graphite electrode production is concentrated in large factories. High costs for manufacturers in the early stages have made profits worrisome. In the fourth quarter, some small and medium-sized enterprises are increasing production, competing fiercely in the graphite electrode market, and downstream buyers are winning bids at low prices, making it challenging to sustain prices.

(3) Costs: The outlook for needle coke, petroleum coke, and coal tar pitch prices is pessimistic, potentially leading to a weakening trend in the costs of UHP graphite electrodes.

In summary, with strong supply and weak demand, and decreasing costs, it is expected that the domestic UHP graphite electrode market in November will stabilize with a weak bias. Feel free to contact us for the graphite electrode market forecasts.

No related results found

0 Replies