【Graphite Market Forecast for 2024】 Key Trends Unveiling Price Trajectory

【Graphite Market Forecast for 2024】

Key Trends Unveiling Price Trajectory

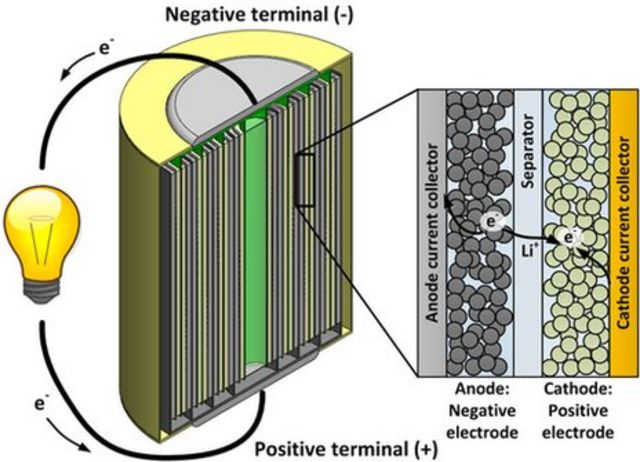

Graphite, as a crucial raw material for electric vehicle (EV) batteries, is one of the most important elements in the anodes of EV batteries, with each EV battery containing 50 to 100 kilograms of graphite material. While both natural and synthetic graphite can be used in battery anodes, synthetic graphite currently dominates the market.

According to data from Benchmark Minerals Intelligence, the carbon density in synthetic graphite anode production, which uses energy and fossil fuels as raw materials, may be more than four times that of natural graphite anode production. Here are the key trend predictions for the graphite market in 2024 by Investing News Network (INN) for investors' reference.

What are the forecasts for graphite supply and demand in 2024?

Entering 2024, China will continue to play a significant role in influencing supply-side factors, although new graphite mines in Africa are expected to bring new supply to the market. Dr. Nils Backeberg, Co-founder of market intelligence firm Project Blue, told INN via email, "Existing graphite producers' supply of natural and synthetic graphite, combined with the increase in China's new synthetic graphite production capacity and the addition of African natural graphite projects, should maintain market balance in 2024."

James Willoughby, Senior Analyst at Wood Mackenzie, expects Chinese producers to continue increasing graphite production in the new year, with a greater focus on synthetic graphite. After experiencing supply chain bottlenecks in 2022, China made substantial investments in new graphite production capacity, and the impact is expected to continue to manifest in 2024.

Backeberg believes that the price of synthetic graphite will continue to exert downward pressure on spherical graphite (natural graphite anode material), further eroding the premium of spherical graphite.

On the demand side, both Willoughby and Backeberg state that their companies anticipate strong growth in demand for natural and synthetic graphite in the electric vehicle market. The outlook for the traditional applications of graphite in the steel industry, such as graphite electrodes, refractory materials, and castings, is relatively subdued. It is expected that demand for synthetic graphite will continue to exceed demand for natural graphite in the coming year. Regarding demand for natural graphite, strong growth is expected outside of China in 2024, particularly as other market participants seek to establish graphite supply chains outside of China.

In October 2023, China announced new export restrictions on certain graphite products. These restrictions took effect on December 1, 2023, requiring Chinese exporters to apply for special licenses to ship materials to global markets.

What other graphite market trends should investors pay attention to in 2024?

One major trend in the graphite industry that investors need to watch is how other countries and end-users of graphite respond to China's new export restrictions. Backeberg explains, "In 2023, we have seen graphite companies receive funding from the US and EU governments to develop mining projects and battery-grade anode material factories, diversifying the supply chain away from China. Similar activities are likely to continue in 2024."

In 2024, anode producers in Japan and South Korea, highly dependent on graphite imports from China, will have to consider stockpiling graphite materials in the short term to meet customer demands while waiting for export licenses to be approved. Therefore, end-users will strive to diversify their supply chains as much as possible, and those relying on Chinese materials will need to stock up in advance and work to ensure graphite supply agreements. However, this is not expected to impact the graphite supply chain significantly in 2024.

As North American and European countries actively promote decarbonization processes, investors can anticipate increasing cooperation among allies in 2024 and beyond to establish graphite supply chains for electric vehicle batteries outside of China.

Willoughby suggests that investors may need to monitor more updates on the EU's Critical Raw Materials Act, project financing news from Canada's Critical Minerals Infrastructure Fund, and further clarification on worrisome foreign entity provisions in the US Inflation Reduction Act.

Regarding advancements in battery anode materials, Willoughby expects an increase in the production capacity of silicon-carbon (Si/C) composite materials in China in 2024. The addition of these silicon-carbon materials will enhance battery range and charging speed, attracting a larger audience, especially in Western countries where range anxiety could be a major barrier to owning electric vehicles. He adds that while the amount of graphite used in silicon-carbon anodes is relatively small, it is still an early-stage technology that is not expected to impact the significant growth in graphite demand in 2024. Reading daily news on the graphite market, keep following us.

No related results found

0 Replies