【Petroleum Coke】Good Trading Activity and Smooth Shipments, Short-Term Trend Forecast

【Petroleum Coke】Good Trading Activity and

Smooth Shipments, Short-Term Trend Forecast

Petroleum Coke Market Analysis

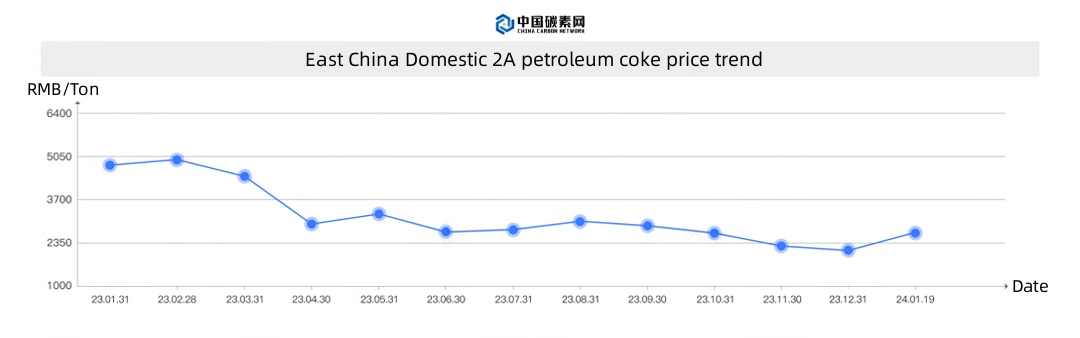

In mid to late January, the domestic petroleum coke market in China experienced good trading activity, with refineries actively shipping and coke prices remaining stable to slightly higher. In the mainstream sector, PetroChina's low-sulfur petroleum coke in the northeast maintained low operating loads, leading to a continuous reduction in the supply of low-sulfur petroleum coke. The low-sulfur petroleum coke market faced a situation where supply was less than demand, causing coke prices to continue to rise. CNOOC's petroleum coke production and sales remained stable, with transaction prices holding steady. Sinopec's refinery achieved good shipments of petroleum coke, resulting in a cumulative price increase of 20-80 yuan/ton, and the specifications of Hebei semi-graphitized petroleum coke for reference. In the regional market, petroleum coke inventory in local refineries remained at a low level, and downstream demand for procurement contributed to price stability and a slight increase.

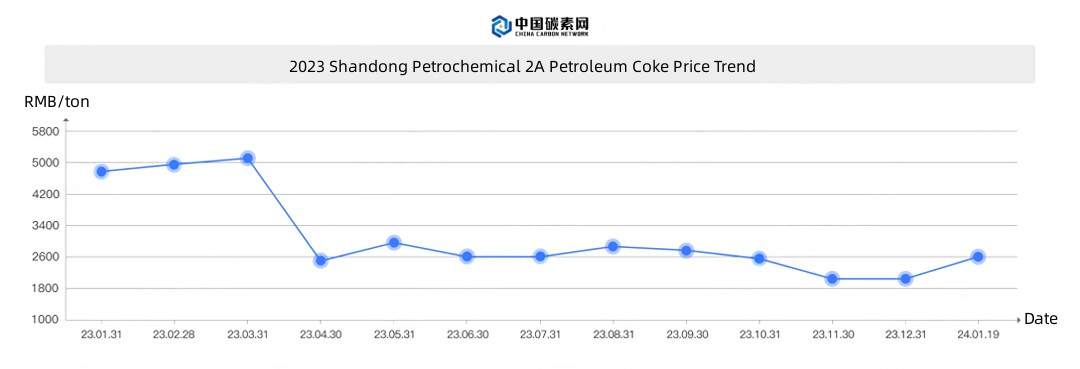

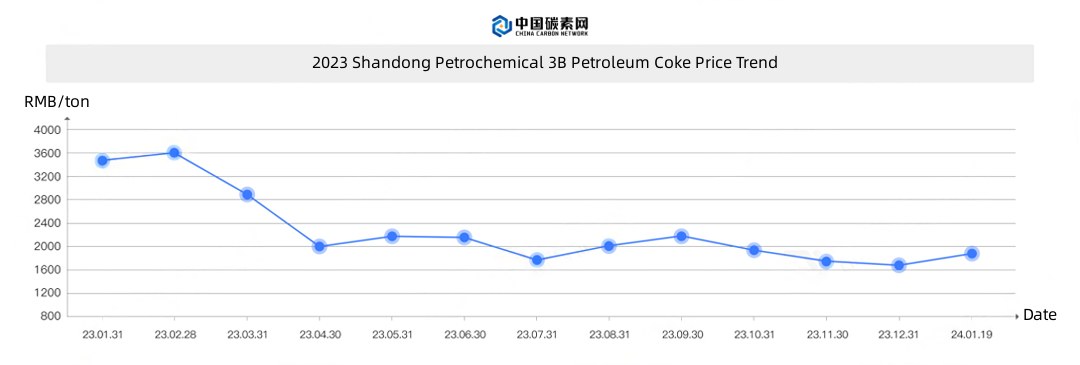

Shandong: Currently, the price of refinery petroleum coke in Shandong is showing a stable and slightly upward trend. The price of low-sulfur petroleum coke is rising, and medium and high sulfur refineries adjust petroleum coke prices based on their inventory. Downstream purchasing sentiment is positive, creating a good market trading atmosphere. The average prices in Shandong are 2600 yuan/ton for 2A, 2390 yuan/ton for 2B, 2187 yuan/ton for 3A, 1884 yuan/ton for 3B, and 1780 yuan/ton for 3C.

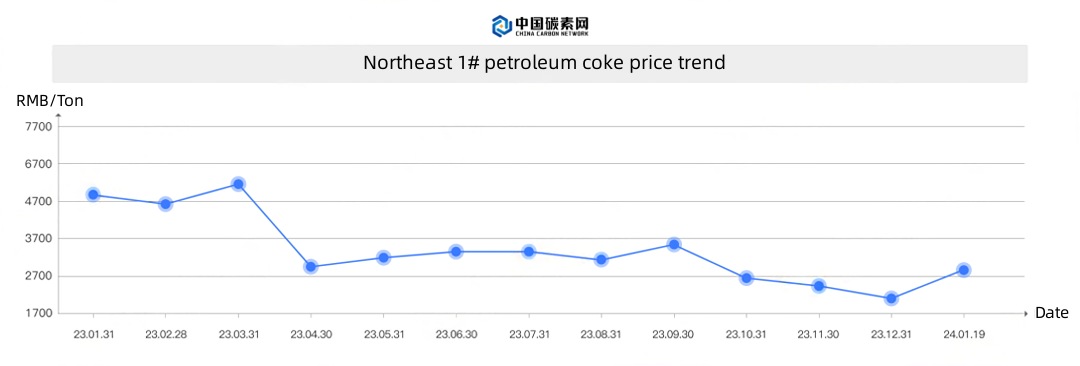

Northeast: The petroleum coke market in the northeast region is characterized by an active trading atmosphere, with petroleum coke prices continuing to rise. Baolai Petrochemical implemented the latest pricing, resulting in a price increase of 80 yuan/ton; Haoye Petrochemical's new round of transaction prices increased by 100 yuan/ton; Huajin Petrochemical's new petroleum coke price remained unchanged from the previous week.

North China: Currently, the petroleum coke market in North China has good trading activity, with smooth shipments of medium-sulfur petroleum coke and a large overall increase in coke prices. Hebei Xinhai Petrochemical and Zhongneng International increased their latest quotations by 200 yuan/ton.

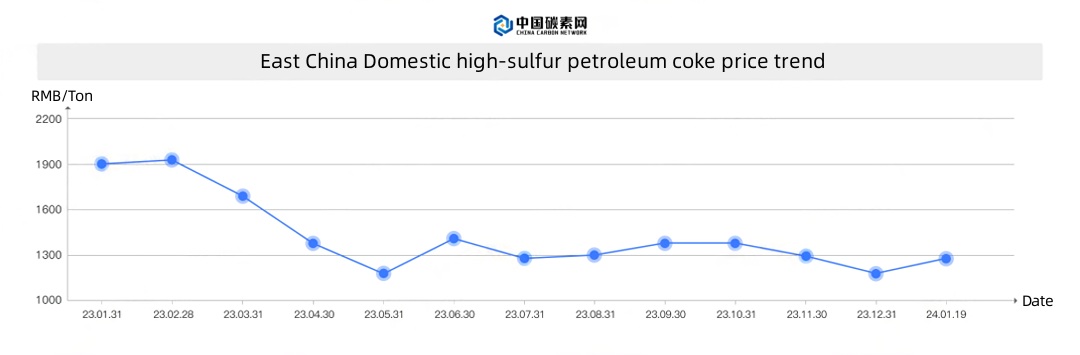

East China: Currently, the petroleum coke market in East China has a positive trading atmosphere, with refineries adopting a bidding pricing model. Downstream enterprises are actively purchasing, resulting in a slight increase in petroleum coke prices. Shenghong Refining and Chemical's main product, sponge coke with a sulfur content of about 5.5%, has a good supply and demand situation. Xinhai Petrochemical's main product, 3C petroleum coke, has a cautious market entry, but shipments are still viable, and transaction prices continue to fluctuate. Zhejiang Petrochemical follows a single order approach, with a positive attitude from downstream buyers. The refinery's transaction prices increased by 110 yuan/ton, and Zhongjin Petrochemical's main product, 4B petroleum coke, saw a further increase of 90 yuan/ton supported by the overall upward trend in market prices.

Central China: Currently, the petroleum coke market in Central China is stable, with Jinao Technology transitioning its petroleum coke to the 4A model. Downstream procurement is active, and refinery coke prices are rising by 50 yuan/ton.

Future Forecast

As of January 19, 2024, petroleum coke production continues to experience a narrow reduction, favoring an upward trend in coke prices. The current petroleum coke market has a favorable trading atmosphere, with downstream procurement needs and smooth market shipments. In the short term, supported by the brief situation where low-sulfur petroleum coke supply is less than demand, coke prices are expected to rise. In terms of medium-sulfur petroleum coke, the market has good transaction volume, and refinery inventories mostly remain at low levels. Short-term petroleum coke is expected to continue actively shipping, with transaction prices narrowly increasing, and market trading gradually stabilizing. Feel free to contact us for more information on the petroleum coke market.

No related results found

0 Replies