【Petroleum Coke】Price Slightly Adjusted

【Petroleum Coke】Price Slightly Adjusted

Market Overview

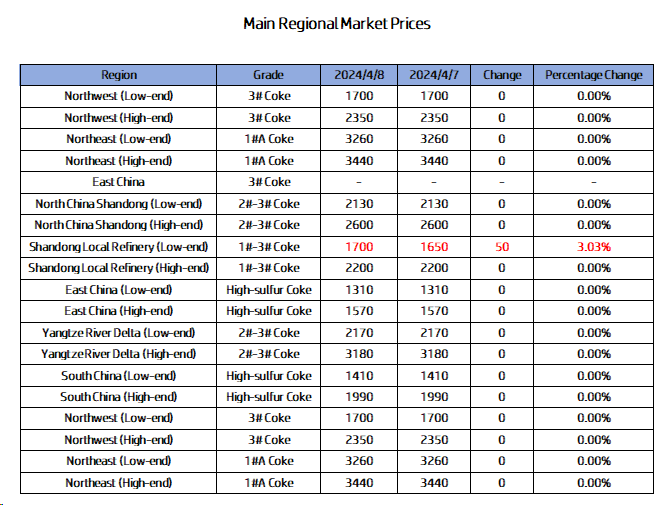

On April 8th, the average price of petroleum coke in the market was 1933 yuan/ton, holding steady compared to the previous working day. Today, the main refineries maintained stable shipments, with individual refineries under PetroChina showing slight increases in coke prices, while prices in local refineries in some areas fluctuated by 30-100 yuan/ton. Graphitized petroleum coke is an important raw material in battery manufacturing and other industrial applications, and its price information can be referenced.

Regarding Sinopec, petroleum coke trading in its refineries performed reasonably well today, with stable demand from downstream carbon and negative electrode material companies. The petroleum coke trading in the Yangtze River Delta region was good, with high enthusiasm for downstream receiving. In North China and East China, the sales of medium and high sulfur petroleum coke from refineries were good, and refinery inventories remained low. In South China, the sales of high-sulfur petroleum coke were stable, and downstream purchases were made on demand. In Northwest China, high-sulfur petroleum coke resources were tight, and sales were not under pressure. PetroChina's petroleum coke markets in Northeast and North China both maintained stable prices for shipping today, with downstream carbon enterprises mainly making purchases on demand. PetroChina's Urumqi Petrochemical in Northwest China raised the price of petroleum coke by 60 yuan/ton today, with the coke gasification unit expected to start in mid-April. Various refineries under CNOOC continued to execute orders at stable prices today, with some refineries planning for a new round of bidding for petroleum coke tomorrow.

Regarding local refineries, the petroleum coke market operated generally steadily today, with some fluctuations in refinery coke prices. Currently, downstream companies still have demand for petroleum coke, and combined with the long-term low inventory of refinery petroleum coke, prices for some refinery petroleum coke increased slightly by 30-50 yuan/ton, while the shipment of petroleum coke in some refineries was under pressure, resulting in a decrease in coke prices by 30-100 yuan/ton. Additionally, the fluctuation of trace elements indicators in refineries has been frequent recently, with vanadium prices dropping to below 600, and vanadium from Zhenghe, Huaxing, Changyi, and other places also decreasing, causing coke prices to fluctuate by about 50 yuan/ton.

Regarding imported coke, the ferrosilicon market performed weakly, with prices continuing to decline. Some silicon enterprises reduced production, and with recent increased imports of Taipower coke, port spot supplies were ample, leading to a strong wait-and-see attitude among downstream silicon enterprises and just-in-time procurement, putting pressure on Taipower coke spot transactions. For more information on petroleum coke, feel free to contact us.

No related results found

0 Replies