[Anode] Low-Sulfur Calcined Market Remains Sluggish, Anode Materials Market Activity Increases

![[Anode] Low-Sulfur Calcined Market Remains Sluggish, Anode Materials Market Activity Increases](/uploads/article/20240516/2b49a33cc1948c7bfc18888dfdf9f93a.jpg?6110)

【Anode Market】Low-Sulfur Calcined Market Remains Sluggish,

Anode Materials Market Activity Increases

Data Source: Oilchem

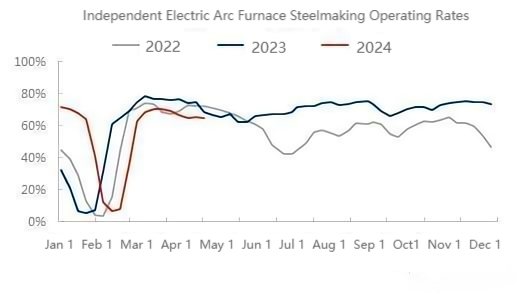

As of May 9, the weekly average operating rate of Chinese domestic electric arc furnace steelmaking was 64.18%, down 0.83 percentage points from the end of April. The average capacity utilization rate was 51.88%, an increase of 0.78 percentage points from the end of April. The macro trading of steel remains weak, with the market primarily consuming previous raw material inventories, resulting in a minimal positive impact on the graphite electrode and carburant markets.

Currently, the domestic low-sulfur calcined market remains sluggish, with negative performance in both raw material and terminal markets. Enterprises lack the motivation to operate actively, maintaining low-load operations. In May, market trading has not shown significant improvement, with some companies choosing to idle or shut down due to sustained breakeven or losses, leading to a decline in overall capacity utilization. For the low-sulfur petroleum coke market, downstream steel-related carbon production enterprises are cautious in their procurement, resulting in a weak and volatile market with no significant positive drivers in the short term.

Data Source: Oilchem

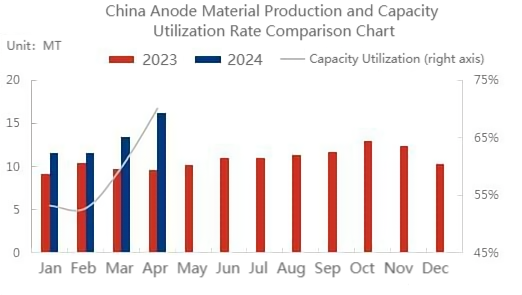

From the perspective of the new materials market, the operating rate of the anode materials market increased in April, with the monthly average capacity utilization rate reaching over 70%, a rise of 10.19 percentage points month-on-month. The terminal market's strong support remains robust, with leading enterprises actively fulfilling order contracts and maintaining high operating loads. Small and medium-sized enterprises are procuring raw materials based on order contracts, keeping market trading relatively stable.

Looking ahead to May, the overall market outlook remains positive. Currently, Sinopec's energy storage special coke supply is stable, and the price of low-sulfur coke in Northeast China has declined. Leading anode procurement companies still exhibit a need-based procurement mentality. There is positive support for the sales of domestic medium and low-sulfur petroleum coke and some imported petroleum coke, potentially stimulating slight price increases. For more information about the lithium battery anode industry chain, feel free to contact us anytime.

No related results found

0 Replies