【Mysteel Data】Survey on the Production Status of Independent EAFs in China (May 31, 2024)

【Mysteel Data】Survey on the Production Status of

Independent Electric Arc Furnaces in China (May 31, 2024)

This week's statistics for the production status of 87 independent electric arc furnace (EAF) steel plants in China (including 76 EAF plants producing construction steel) are as follows:

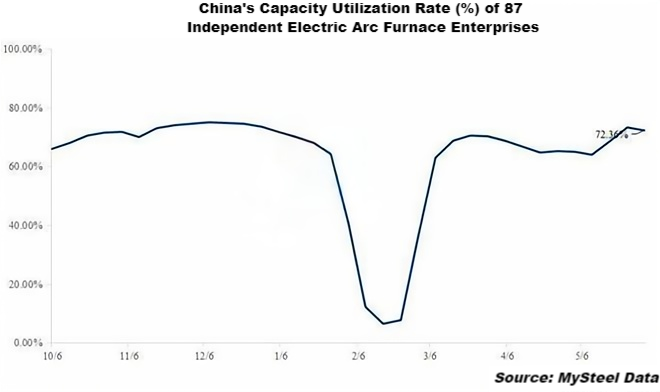

1. The average operating rate of the 87 independent EAF steel plants in China is 72.36%, a decrease of 1.04 percentage points from the previous week and an increase of 9.83 percentage points from the same period last year. The operating rate in East China has significantly decreased, while there is a slight increase in South China, with other regions remaining stable. High quality graphite electrode is produced for EAF steelmaking.

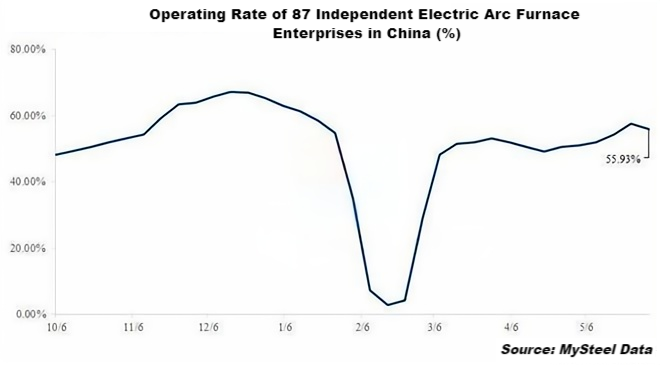

2. The average capacity utilization rate of the 87 independent EAF steel plants in China is 55.93%, a decrease of 1.57 percentage points from the previous week and an increase of 10.02 percentage points from the same period last year. There is a slight decrease in Central China, a small decline in East and South China, a slight increase in Southwest China, and stability in other regions.

3. The average daily crude steel production of the 87 independent EAF steel plants has increased by 2.72% compared to the previous week.

4. The weekly output of rebar from the 76 independent EAF construction steel plants has decreased by 0.60%, and the weekly output of wire rodhas decreased by 3.25%.

5. The profitability of the 76 independent EAF construction steel plants is as follows: 38.16% are slightly profitable, 46.05% are breaking even (including some that are at breakeven due to production halts), and 15.79% are operating at a loss.

This week, the operating and capacity utilization rates of independent EAFs have slightly decreased. Several plants have halted production for maintenance, including a 70T EAF in Guangdong (South China) starting on the 29th, a 120T EAF in Guangxi (South China) starting on the 26th, a 70T EAF in Zhejiang (East China) starting on the 23rd for a month, a 220T EAF in Jiangsu (East China) due to high scrap prices, and a 100T EAF in Fujian (East China) starting on the 27th for half a month. Meanwhile, some plants have resumed production and are operating normally, mainly in South and East China.

The profitability of steel plants has slightly declined this week, with the proportion of slightly profitable plants decreasing by 3.95 percentage points. Currently, the rebar futures prices are fluctuating within a narrow range, and spot prices have fallen slightly, leading to a reduction in EAF steel plant profits. There is a regional divergence in profitability: while East and South China are operating at a loss during off-peak electricity periods, Southwest China still sees some profits. Therefore, steel plants in Southwest China have slightly increased their operating hours to boost production, whereas many plants in South and East China continue staggered production or have halted operations.

Looking ahead to next week, with relatively tight scrap resources and some raw material cost pressure, combined with weak demand due to weather and other factors, steel plants' production enthusiasm remains low. It is expected that the operating rate and capacity utilization rate of independent EAF plants may slightly decline next week. More daily news on EAF steel industry, feel free to contact us!

No related results found

0 Replies